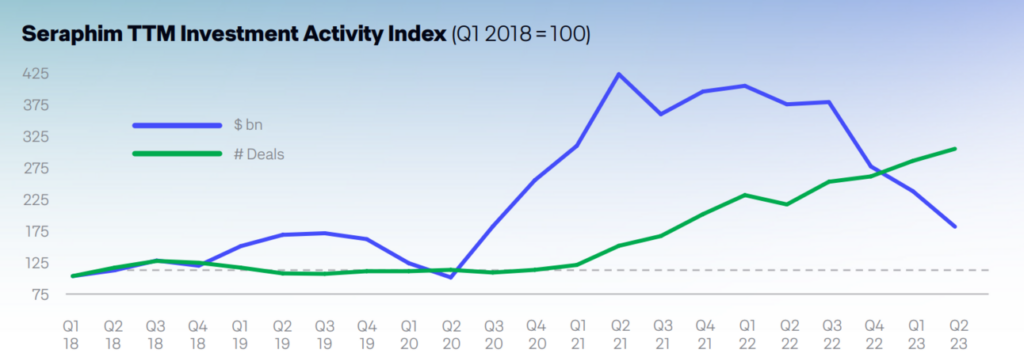

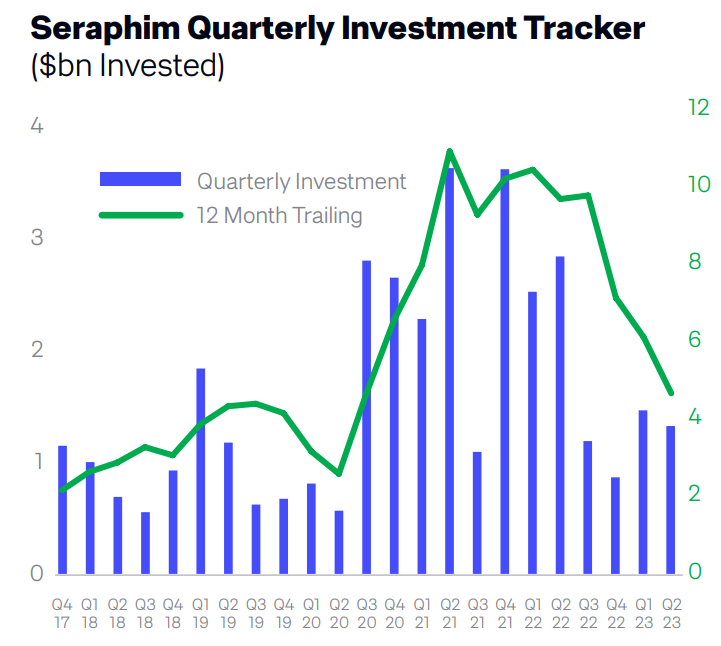

Seraphim, a leading space VC firm HQ’d in the UK, has released its yearly index on funding and acquisition activity across the space industry. Seraphim’s tracking data shows signs that investment activity is bouncing back from the economic woes and restrained capital markets of last year.

Deals, deals, deals: The trailing twelve months (TTM) analysis of the number of investments dropped in the most recent period compared to the period before, but the average size of those deals was greater, Seraphim’s analysts wrote.

“What we are seeing is a greater concentration of capital this quarter, with the same amount of capital deployed in fewer, larger growth stage deals,” the authors wrote, noting that this is “an early indicator of a recovery in the growth-stage market.”

Looking at the quarterly data yields a clearer indication that investment activity is starting to pick up steam after the dramatic lows of the second half of 2022.

- Investors injected $1.2B into the space industry in Q2 2023.

- The same quarter saw 31% fewer deals than in the previous quarter, but still higher than anything before Q4 2021.

- “Each of the last 3 quarters have set all time records for the highest total number of SpaceTech deals,” the authors wrote.

Young and hungry: There’s been a changing of the guard when it comes to the leaders of M&A activity in the space market; where most of these deals were once led by primes and “old space” corporations, now they’re performed by younger companies. The report’s authors take this as a sign that new space “has matured and is no longer such a nascent industry.”

- Seraphim tracked 28 total acquisitions over the last 12 months.

- Of these, the largest portion were led by younger space companies, such as “Planet acquiring Salo Sciences, or Slingshot acquiring Numerica.”

The M&A activity hasn’t just been left to new space, though. Seraphim also noted a trend of more private equity investors scooping up companies.

“With PE investors approaching the industry through a more profit minded lens, improved margins on products and capital efficient businesses will provide attractive targets moving forwards,” the authors wrote.

The SPAC blues: There was a certifiable boom of space tech companies entering the public markets via SPAC back in 2021, and a notable handful of stragglers taking the same approach in 2022. By and large, the past few years have not been kind to these public companies, and the rest of the industry has taken note.

- There have been very few new SPAC mergers in the last 12 months (with the notable exceptions of Intuitive Machines and SatixFy).

- World View, a stratospheric balloon tourism company, has a SPAC planned in the near future.