Ed. note: This is Payload Research analysis. You can sign up for our Research newsletter here.

The first three months of 2024 was another busy quarter for the space industry, underscored by continued growth in SpaceX’s launch cadence and a solid VC funding environment. Below are the four charts defining the quarter.

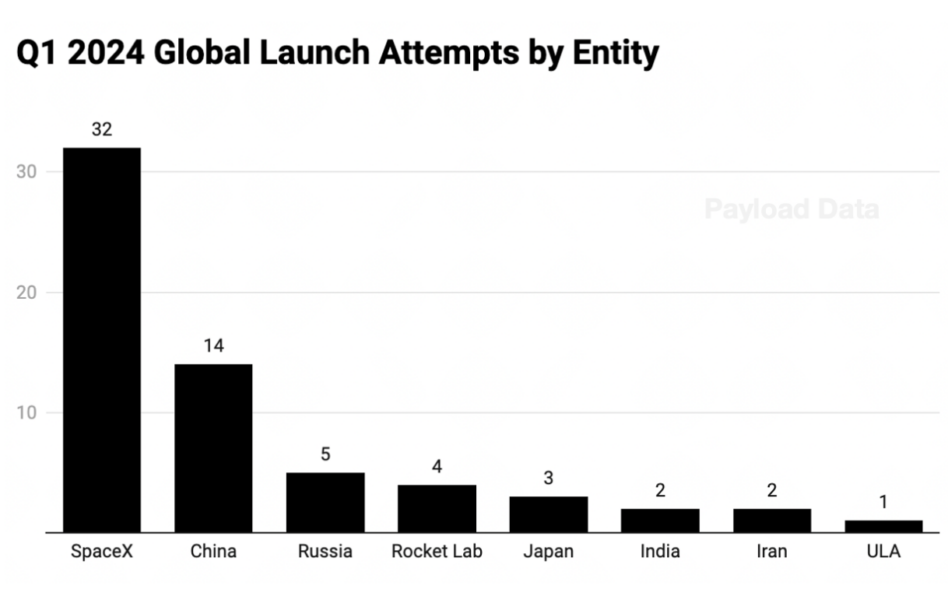

The total number of global orbital launch attempts in Q1 increased by 10 missions in 2024, a 19% year-over-year increase. The growth can be attributed to SpaceX, which saw an increase of 11 launches in Q1 2024 vs. Q1 2023.

More capacity is on the horizon with Vulcan, Starship, New Glenn, and a host of Chinese launch startups set to increase launch cadence over the next year.

Key takeaways:

- With a gap between Ariane 5’s retirement and Ariane 6’s debut, Europe registered zero launches last quarter.

- Iran launched two rockets in Q1 compared to one in 2022 and two in 2023.

- Rocket Lab launched four times in Q1 as it looks to build off the nine missions in FY23.

- SpaceX’s launch count includes 31 Falcon 9 launches and one Starship launch in 2024.

SpaceX launched 31 Falcon 9 missions in Q1, matching the total number of launches the company recorded in 2021.

The pace of launch is increasing month over month, with SpaceX hitting 12 Falcon launches in March.

Falcon launches by month:

- January: 10

- February: 9

- March: 12

Still, based on its Q1 pace, the launch giant is ~15% behind its goal of 148 Falcon launches. To hit that target, SpaceX will need to average 13 Falcon launches per month for the rest of the year.

The Q1 payload breakdown:

- 1 DoD: SpaceX launched USSF-124, which included four SDA Tranche 0 tracking layer birds and 2 HBTSS. Falcon 9 also delivered two Starshield satellites as a secondary payload on a Starlink flight.

- 1 Transporter mission: Falcon 9 hosted 53 customer payloads on Transporter-10.

- 2 science: SpaceX’s Q1 science missions include NASA’s PACE ocean monitoring bird and Intuitive Machines’ IM-1 lunar landing mission.

- 3 customer satcom: SpaceX launched Telkomsat’s Merah Putih 2 satellite, Eutelsat 36D, and Ovzon-3.

- 4 ISS missions: SpaceX launched four missions to the ISS last quarter. Crew-8, Ax-3 private crewed mission, a Northrop Grumman Cygnus cargo resupply mission, and a Dragon resupply mission.

- 20 Starlink missions: Starlink continues to dominate Falcon launches as SpaceX looks to rapidly deploy its constellation and boost capacity. This year’s Starlink-dedicated launch cadence is similar to the trend we saw last year.

Key takeaways:

- Half the deals listed are international fundraises, including the four largest.

- Shanghai Spacecom Satellite Technology’s $943M monster raise will support its planned ~12,000 LEO G60 constellation, which is China’s response to SpaceX’s Starlink network. The group plans to launch its first 108 satellites this year.

- The list features two data analysis startups and two SSA businesses, underscoring VC interest in the data and services sectors.

- US launch and spaceflight had a quiet quarter compared to the substantial attention it has received in past years.