New York-based launch startup iRocket signed a letter of intent to merge with BPGC Acquisition Corp.—a blank-check company sponsored by former Commerce Department chief Wilbur Ross—as part of an effort to take the company public.

If completed, the merger will bring iRocket onto the Nasdaq with an expected valuation of approximately $400M. In return, Ross will join the iRocket’s board of directors to advise the launch company on how best to position its technology to win future national security contracts.

SPAC is back: Several private space companies went public via SPACs at the beginning of the decade, and the results were a mixed bag to say the least.

For launchers in particular, the SPAC often meant the beginning of the end.

- Virgin Galactic ($SPCE) hit the NYSE in October 2019. The company has since lost nearly all of its market value compared to a 2021 peak.

- Virgin Orbit went public via SPAC in 2021, and filed for Chapter 11 bankruptcy within two-years’ time.

- Astra, which also used a SPAC to go public in 2021, was taken private in 2024 after its stock price fell below $1—and the Nasdaq threatened to delist the company.

Rocket Lab ($RKLB) seems to be the only launcher of the SPAC pack to survive, and thrive. Rocket Lab went public in 2021—and its trading value has doubled since.

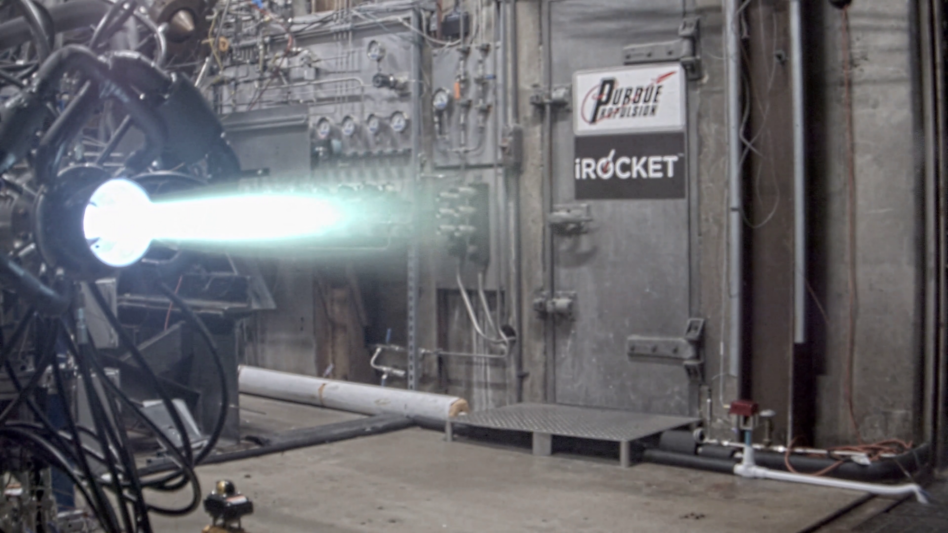

So you’re saying there’s a chance: iRocket’s plan to keep retail investors happy in the years before the 2027 launch of its first rocket—Shockwave—is unclear. The company is developing its reusable rocket, designed for quick turnaround launches, through an $18M CRADA agreement with the Air Force Research Lab.

iRocket received a $1.5M SBIR in 2020 and $1.8M TACFI contract from SSC in 2023 to develop its reusable methalox engine, but it hasn’t publicly announced any other sources of revenue since—public or private.