Euroconsult has put together the first edition of Space Logistic Markets, an extensive report on the growth of the in-orbit satellite services sector. The market research firm projects that these services will generate $4.4B in revenue by 2031, as the nascent technologies are proven and productized.

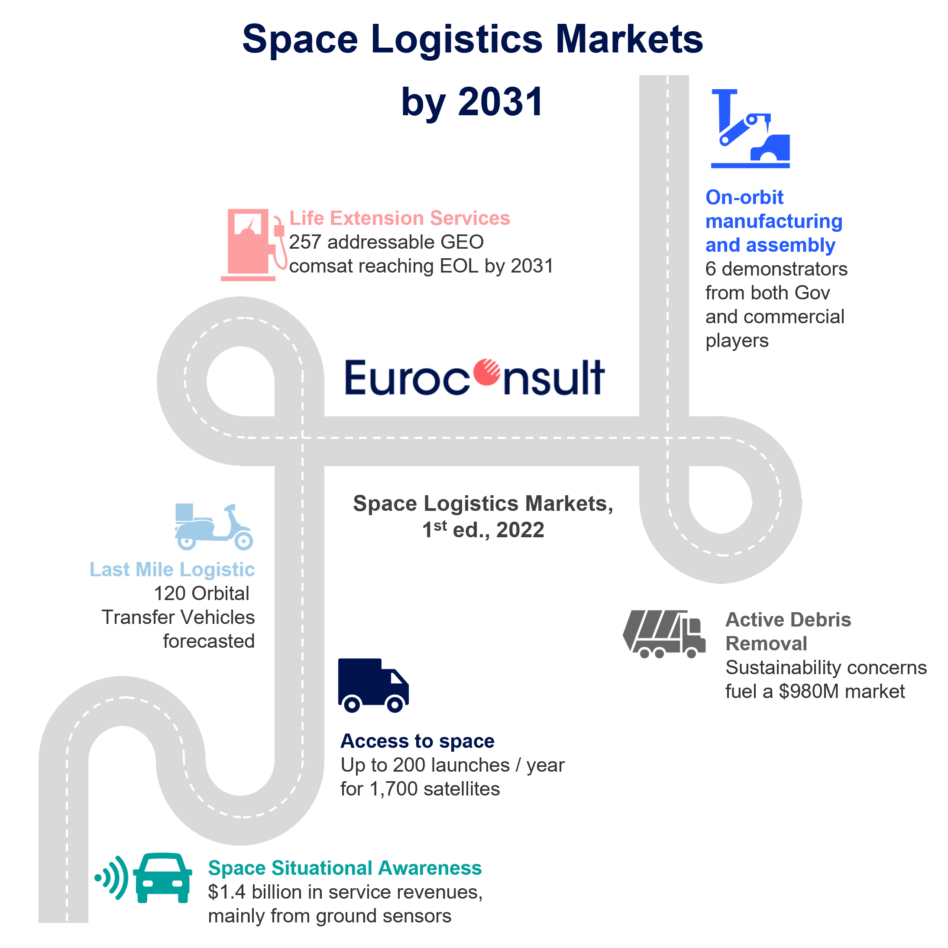

The report identifies six markets::

- Access to space

- Last-mile logistics (LML)

- Life extension services

- Active debris removal (ADR)

- Space situational awareness (SSA)

- On-orbit assembly and manufacturing

These sectors are at vastly different stages of development and maturity. Many companies have already brought functional SSA platforms to market, for example, while ADR services and on-orbit assembly/manufacturing are further from commercialization.

Funneling funding: Investors have taken interest in on-orbit services, seeing their potential to make space more profitable, sustainable, and accessible. In the last five years, investors have pumped $715M into 18 space logistics companies over 34 deals.

All eyes on space

At a projected market value of $1.4B over the next ten years, space situational awareness tech is the most mature and largest market for space logistics services.

“From a revenue point of view, safety of satellite operations and increasing risk of collision are driving demand for domain awareness from both governments and commercial customers,” Maxime Puteaux, principal advisor at Euroconsult, told Payload.

As space becomes more and more crowded, satellite operators are looking for more accurate warnings about how close their assets are to other active satellites and to orbital debris. There’s a big opportunity for SSA companies who can provide accurate data and timely communication between operators and government agencies.

Live long and prosper

Life extension services are the second largest market in the space logistics services sector, Euroconsult estimated. The report finds that there are currently 630 GEO communications satellites compatible with planned services approaching end of life by 2045, and that these alone could generate as much as $210M a year in revenue for life extension services.

- Life extension services are still new, but more mature than some other, more nascent technologies within the sector.

- Northrop Grumman is already providing Intelsat with life extension services, and NASA and DARPA are planning to launch a refueling demo mission in the next three years.

Keeping it clean

As we wrote recently, LEO is getting crowded, and a higher density of satellites and debris in space means a higher likelihood of collisions all around.

- There’s not much financial incentive for individual companies to invest in ADR at present, per Euroconsult. Instead, governments will be the buyers.

- “We see growing concern from both sides of the Atlantic and in Japan, which could trigger demand,” Puteaux said.

Closing thoughts: “At the end of the day, adoption of in-orbit services is all about added value for the end customers and how much it helps the satellite operators’ business model, assessed either financially, in time, flexibility, or safety,” said Puteaux.

The full report will be available tomorrow on Euroconsult’s website.