Denver-based Voyager Space has a new deal in the works. Yesterday, the holding company said it intends to buy a majority stake in Space Micro, a San Diego-based satellite subsystem maker. The wheeling and dealing is becoming routine—Space Micro is Voyager’s sixth acquisition since it spun up in Oct. 2019.

How’s that for flight heritage? Space Micro, started in 2002, has 100+ space electronics subsystems in orbit and 2.7M+ hours of spaceflight on the books. The company’s space electronics offerings include radiation-hardened radios, mission-data transmitters, image processing devices, and laser comms systems.

“The satellite constellation market stands at the tipping point of explosive expansion,” Space Micro Cofounder and Chairman David Strobel said in a press release. “With the Voyager team and operational functions by our side, we will be prepared to scale our technologies to meet these market needs.”

The rest of Voyager’s stable? Let’s walk down (short-term) memory lane and look at the last ~two years of deal-making. Announcement date in parentheses.

- Valley Tech Systems, a solid-fueled propulsion developer (Oct. ‘21)

- XO Markets, parent of Nanoracks, which integrated the first privately built airlock with the ISS (Dec. ‘20)

- Pioneer Astronautics, a deep space exploration R&D firm (July ‘20)

- The Launch Company, which provides launch services, hardware, and operations support (Nov. ‘20)

- Altius Space Machines, a robotic satellite servicer (Oct. ‘19)

The endgame: Rolling up space companies under one metaphorical roof, in theory, could enable cross-selling, back-office streamlining, and vertically integrating. Voyager can use revenue-generating product lines to cross-subsidize initiatives that are further from commercialization.

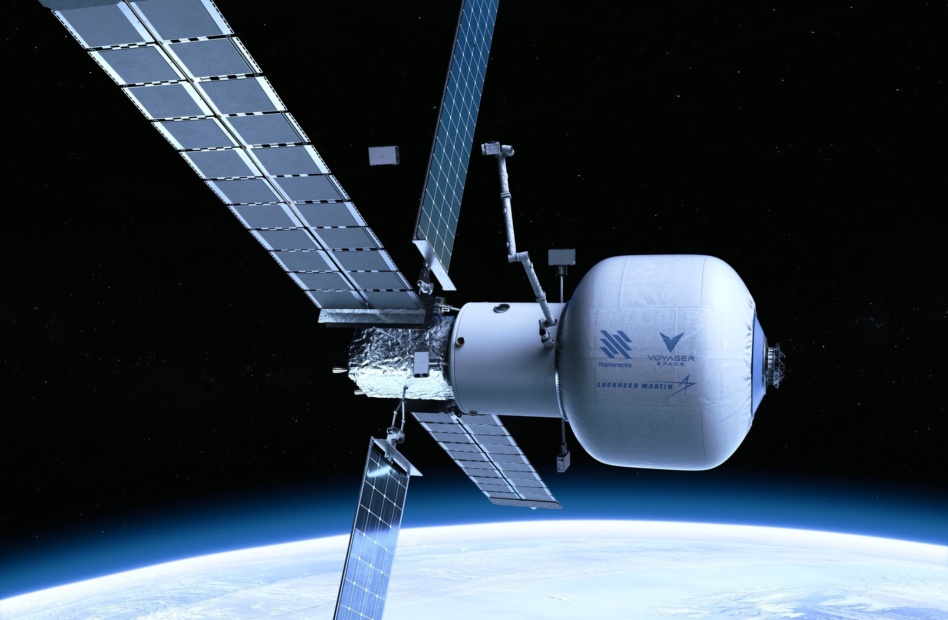

Voyager’s space portfolio—and acqui-hired teams—can also support the buildout of Starlab. Planned for 2027 initial operations, the free-flying LEO station is a joint effort between the holding company, subsidiary Nanoracks, and Lockheed Martin.

Closer on the horizon…An IPO. Voyager hopes to take the traditional route to the public markets in early 2022, Bloomberg reported in August.