Last week, we took a look at Credit Suisse’s initiation of aerospace & defense (A&D) industry coverage. In complementary equity commentary published earlier this month and seen by Payload, analysts break down their generally bearish position on the aerospace sector.

As a refresher…

…here’s one quote from Credit Suisse we published on Friday: “The space industry is one that largely consists of capital-intensive companies operating in a competitive arena with challenged unit economics, high technical and operational risks, unsupportive base rates, and a resistance toward consolidation.”

Moreover, the analysts highlight a few key risks endemic to the space industry:

- Tendency toward speculative bubbles driven by consistently overestimating potential revenue and underestimating costs

- Best opportunities locked up by the primes and SpaceX

- Unique exposure to tightening macro headwinds

- High cash burn rates and shortening runways

- Heavy exposure to valuation reflexivity (“lower public/private valuations → lower capex/opex budgets → less revenue”)

Examining each rating

- Outperforms = Avoid the risks outlined above and offer a differentiated product with long-term value proposition (e.g., government focused earth observation and niche hardware suppliers)

- Neutrals = Equity dilution and unfavorable acquisitions

- Underperforms = Less supportive valuations, tighter margins, higher technical/operational risk, and higher exposure to reflexivity

The launch risk

Credit Suisse believes that launch companies rely too much on LEO megaconstellation deployments to close the business case. Analysts are also skeptical of the LEO broadband opportunity due to continued fiber and fixed wireless access deployments, data consumption trends, and the underlying economics of fixed capacity networks.

Credit Suisse initiated coverage on five pure-play space companies—we’ll walk through each one below.

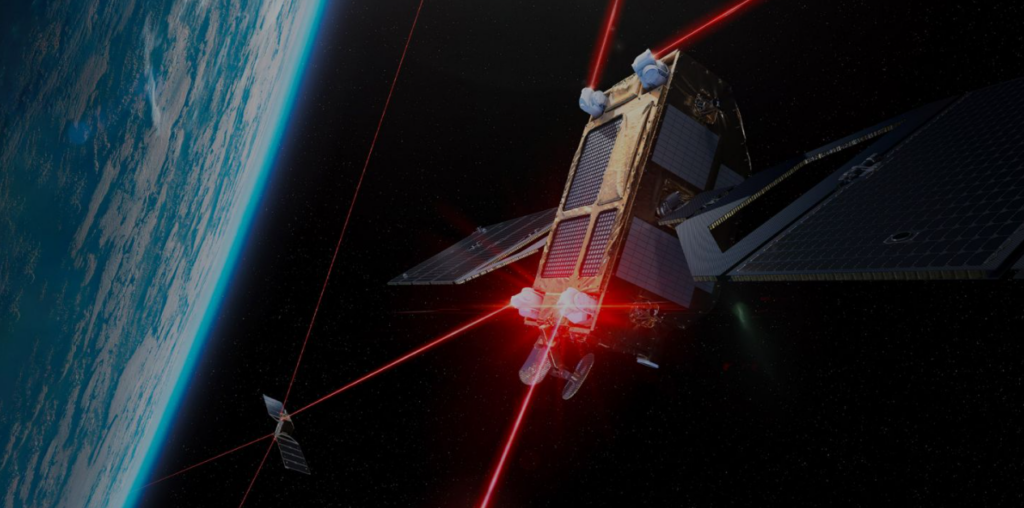

Outperform: Mynaric ($MYNA) @ $10 PT

- The laser communication developer has strong demand signals (including $6.6B in funding for an optical inter-satellite link) from military and commercial satellite operators.

- Starlink’s adoption of optical inter-satellite links (OISLs), though vertically integrated, will lead to demand from other broadband constellation developers.

- Businesses with similar business models—i.e., merchant suppliers of electronics systems like L3Harris, HEICO, and Ciena—generate attractive gross margins in the 40%+ range.

- Laser comms could benefit from network effects, and Mynaric is one of the few space laser developers focused on multi-domain development (space and air for now, with sea and land down the line).

- Downsides flagged by the analysts include increased competition, length of sales cycles, and technical risk.

Outperform: BlackSky ($BKSY) @ $3 PT

- BlackSky’s continued growth momentum is driven by government demand (a nod to the EOCL contract from earlier this year); 99% of sales are from government customers, meaning less exposure to macro headwinds.

- The company has attractive unit economics driven by minimized upfront fixed costs. Credit Suisse thinks this should support a move toward positive EBITDA by 2024E.

- Fed tightening and higher cost of equity should help BlackSky against competitors.

- Downside risks include increased competition and higher-than-expected capex.

Neutral: Spire ($SPIR) @ $2 PT

The Good:

- Credit Suisse gives Spire a strong growth outlook due to increased demand from global weather agencies, momentum in maritime, new product launches, and expansion into new geographies.

- The bank sees a scalable, capex-light business model, i.e., a single stream of data can be sold to multiple customers.

- Limited competition from its focus on RF, which is seen as a less competitive market than electro-optical imagery or synthetic-aperture radar imagery. RF also leaves room for more value-added services. For example, any EO satellite can locate a storm, but RF data can show where it’s going and what it’s like.

The Bad:

- After its share price declined 92.5%, Spire struck an $85M ATM equity distribution agreement, which could cause substantial dilution and increase share count by as much as ~57%.

- Spire’s acquisition of exactEarth raised concerns about management’s capital allocation process and signals strained liquidity.

- The Spire Space Services business unit is more exposed to the other space companies and creates reflexivity risk.

Underperform: Rocket Lab ($RKLB) @ $3 PT

“While we believe RKLB is best in class relative to its peers in many respects—track record, engineering excellence, opex discipline, liquidity—we are concerned about several risks and do not believe the current valuation sufficiently compensates for those risks.”

- Starship could potentially undermine Neutron’s long-term opportunity.

- There is risk in Neutron’s switch to an oxygen-rich closed cycle engine from the company’s traditionally used electric pump engines. It is a more complex engine design choice: Blue Origin’s similar BE-4 engine has been in development for almost eight years.

- Rocket Lab’s Space Systems business unit is playing in a highly competitive market.

- Lower valuations across the industry may reduce total launch spend.

- Upside risks include strong bookings activity, Electron reusability, and gross margin improvement.

Virgin Orbit ($VORB) @ $1 PT

“One of the areas where we see the best product/market fit for LauncherOne is in offering a sovereign launch capability to foreign governments—something that ground-launched competitors are unable to do in many jurisdictions owing to geographic constraints.”

- Virgin Orbit is in the negative when it comes to gross margins, and Credit Suisse thinks it will remain there until 2024E. Revenue is low-volume, non-recurring, lumpy, and benefits from limited to no lock-in.

- High cash burn and limited liquidity are a risk. If Virgin has to raise additional financing because of this, it won’t come cheap in the current market environment.

- Virgin Orbit’s shift toward more commercial customers in 2023 creates reflexivity exposure.

- Upside risks include large contract awards, successful execution of the upcoming Cornwall launch, and improvements in cost of goods sold.

A shared risk: On a $/kg basis, Credit Suisse deems both Virgin Orbit and Rocket Lab uncompetitive. Both providers’ $/kg is higher than Astra’s (discontinued) Rocket 3 and SpaceX’s signature Falcon 9.

As for the primes…Apart from pure-play space players, the bank issued underperform ratings on Boeing ($BA) at $98 PT and Lockheed Martin ($LMT) at $375 PT.

Payload’s takeaway: Reading between the lines of the coverage initiation, in general, the less reliant a company is on other space companies for revenue, the better.