Maxar is getting ready to start pumping out 300 series buses for the Space Development Agency’s tracking mission, but a company exec says he sees a long future for the spacecraft with both commercial and national security customers beyond the military constellation.

“There are a lot of studies and demo-type contracts within the LEO sphere that could lead to larger constellations and distributed assets in LEO,” Chris Johnson, Maxar’s SVP of space programs, told Payload. “All of our traditional commercial customers as well as non-traditional commercial customers are asking about the benefits of LEO.”

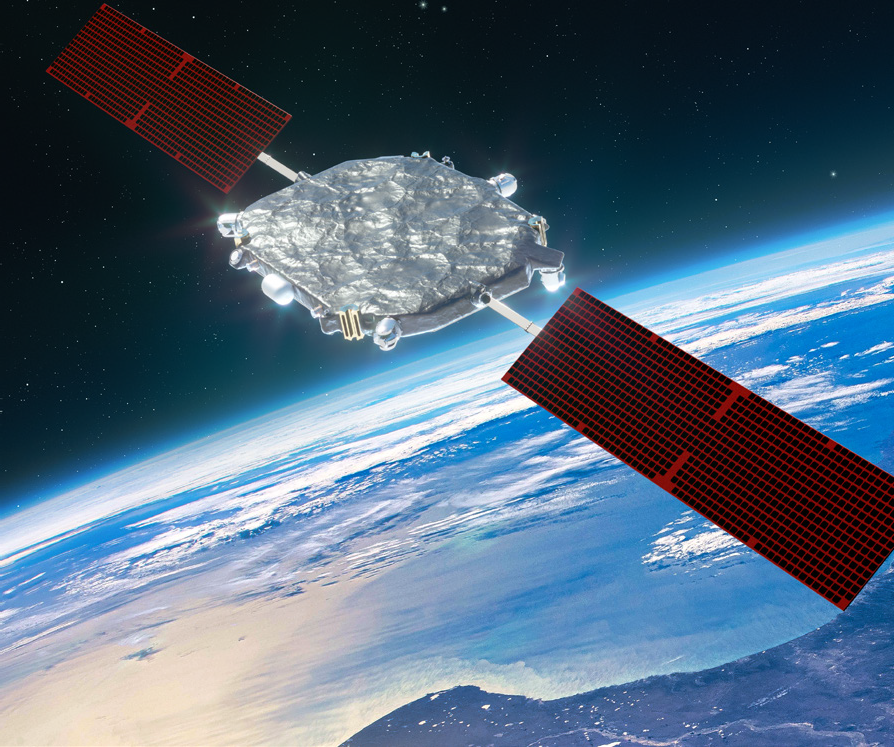

Inaugural line: Maxar’s new 300 series bus, which is the company’s smallest bus at about the width of an oven, can carry at least eight satellites to LEO for missions ranging from comms to EO to space domain awareness.

Maxar is building 16 of the buses for L3Harris Technologies to support the SDA’s Tranche 1 tracking layer, which will provide missile warning and tracking capabilities. The platform completed its first critical design review last month.

Chris Johnson 101: Johnson joined Maxar in 2021 after serving as the head of Boeing Satellite Systems International. During a recent conversation, Johnson also chatted with Payload about Maxar’s push into the national security business, the government’s approach to going fast, and what’s next for the 300 bus.

This transcript has been edited for length and clarity.

How are you preparing for upcoming milestones on the SDA Tranche 1 tracking layer (T1TRK)?

We’re through the critical design review phase, so now it’s all about production. We’re preparing a portion of the factory that’s specifically designed for Maxar 300 production. The rate and scale we’re talking about for SDA is a little bit more than traditional GeoCom, but we’re prepared to get that line up and going. We’ll do the first deliveries to that platform to L3Harris at the beginning of next year. T1TRK is the first use of the new Maxar 300 series bus, so the production line is inaugural for T1TRK.

Is Maxar looking to push more into the national security sphere?

That’s certainly our goal. We think that kind of know-how and headspace around going fast and bringing capability to bear is right in line with a lot of the messaging we’re hearing out of the Space Force. We think there’s a really big growth opportunity for us bringing to bear a different mindset around going fast and having the reliability we’ve demonstrated.

Do you get any pushback from the government on that go-fast mindset?

I’m seeing a lot of positive change on the government side compared to 20+ years ago. There are still missions that just do take longer, but I think the understanding from the national security space community about not only the capabilities of our adversaries, but the kind of capabilities and missions we need to bring to bear on a rapid timeline has increased.

There are pockets where [our] wanting to go fast is a challenge, and we’ll evaluate opportunities and evaluate customers we’re going to deal with. There are times that it’s not a fit. I do see sea change, but I don’t think it will replace the need for longer-cycle, higher price point opportunities for critical national assets.

What’s next for the 300 bus after T1TRK?

We see significant growth on that side, not only within SDA tranche 2, 3, and 4, but also within the national security space. There are a lot of studies and demo type contracts within the LEO sphere that could lead to larger constellations and distributed assets in LEO. All of our traditional commercial customers as well as non-traditional commercial customers are asking about the benefits of LEO.