It’s not that kind of prime day. Earnings season is in full swing and today, we’re diving into coverage of three primes, including L3Harris’ acquisition of Aerojet Rocketdyne, Boeing’s Starliner drag, and Northrop’s growing space division.

L3Harris 🤝 Aerojet Rocketdyne

$LHX announced it will close its $4.7B Aerojet Rocketdyne acquisition as soon as today.

“We were advised today that the FTC will not block our acquisition of Aerojet Rocketdyne; therefore, we are moving forward to close the transaction on or about July 28,” said L3Harris chief Christopher E. Kubasik.

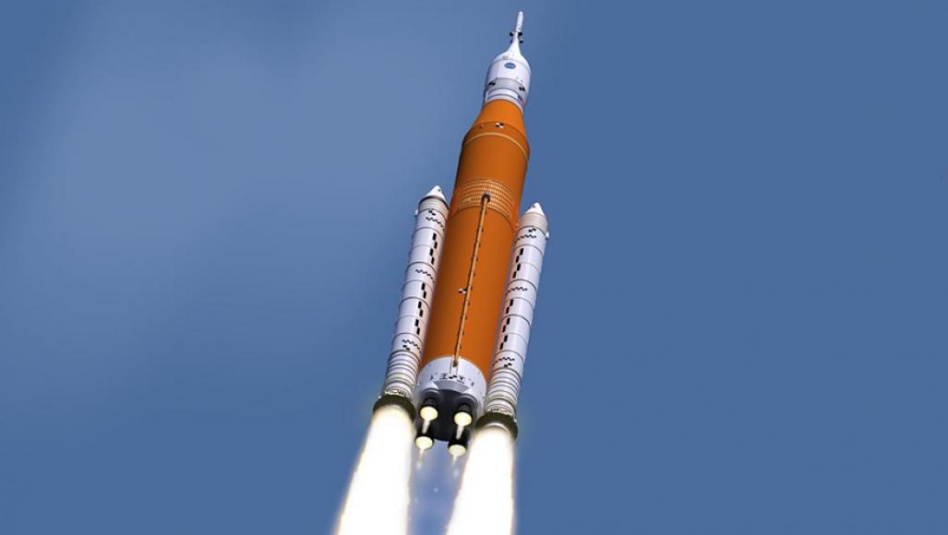

The regulatory green light comes two years after the FTC halted a $4.4B sale to Lockheed Martin over monopoly concerns, followed by months of pressure from lawmakers to nix the L3Harris deal as well. Aerojet is a key independent rocket engine manufacturer, specializing in building the SLS RS-25 engines for NASA, plus missile and hypersonic propulsion systems for the Pentagon.

Turning to financials: $LHX revenue increased by 13% YoY in Q2. The company also bumped up its full-year revenue guidance by ~$500M, driven by strong demand and new programs in the space domain.

Despite the strong demand, $LHX traded down ~7% due to narrowing profit margins.

Boeing’s Starliner Losses Pile Up

Boeing ($BA) stock surged Wednesday after its Q2 earnings beat expectations. The one glaring exception? Its space and defense division.

- The division piled up $527M in losses, including $257M attributed to its commercial crew Starliner program.

- The losses stem from Boeing’s recent announcement of yet another Starliner launch delay due to issues with its parachute and flammable tape.

Boeing’s Starliner cost overruns have now totaled $1.5B. But, hey, compared to Meta blowing $3.7B on the metaverse in Q2, maybe it’s not all that bad. Boeing was mute on when the Starliner will finally ferry astronauts to the ISS.

Moving on to ($NOC)

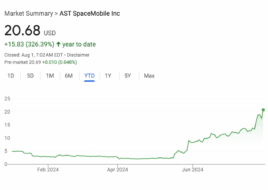

Northrop’s Q2 sales increased 9% YoY to $9.6B, and the company raised full-year guidance by $400M.

Northrop’s space systems was its fastest-growing division, with sales increasing 17% YoY to $3.5B. The division contributed $283M to operating income.

- Space systems includes SLS, SDA sats, and HALO Lunar Gateway contracts.

- The division clocked in $11.3B in funded backlog and $27B of yet-to-be-appropriated backlog.

The company made an unfavorable $36M accounting adjustment to its HALO program, citing an evolving architecture and macroeconomic headwinds.

+ Market reaction: At end of day Thursday, $NOR traded down 2.6%.