Airbus ($AIR) reported its H1 2022 earnings yesterday. Supply chain issues led the European aerospace giant to cut commercial aircraft estimates, but Airbus expects little short-term impact as it maintains its free cash flow targets.

The overall numbers:

- Revenue = €24.8B ($25.3B), a 1% YoY increase

- Free cash flow = €2.0B ($2.0B)

- Adj. EBIT = €2.6B ($2.67B)

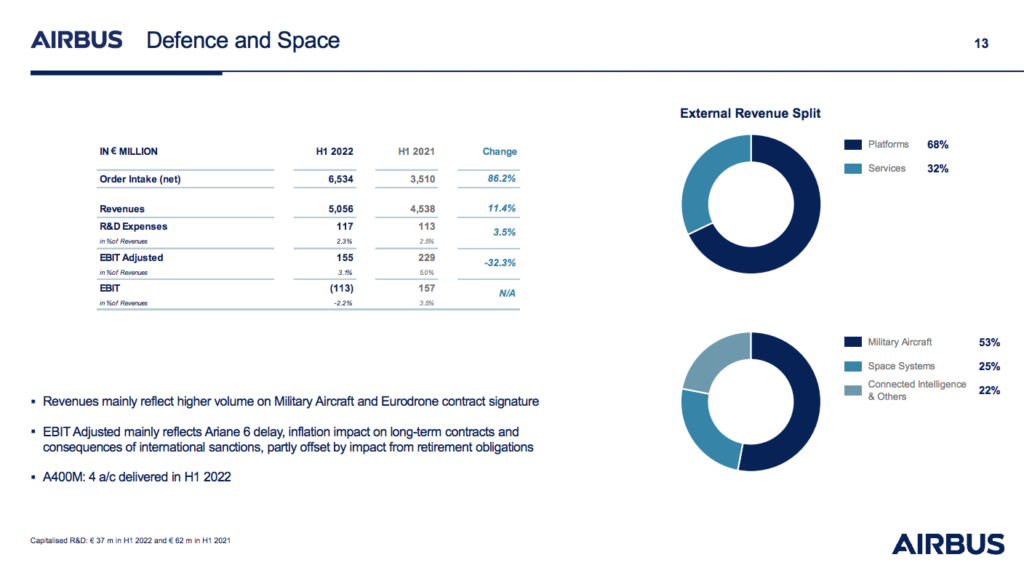

Breaking out space:

- Revenue = €5.1B ($5.2B), an 11% YoY increase

- Order intake = €6.5B ($6.6B)

- Adj. EBIT = €155B (158M)

While space systems account for roughly 25% of Airbus’ Defense and Space division, the jump in revenue mainly grew from Airbus’ military aircraft biz and its Eurodrone contract. The sale of 20 Eurofighter jets to the Spanish Air Force also boosted Q2 with a 7% revenue increase over Q1.

Delays and inflation come for everyone, and aerospace contractors are no exception to this rule. Airbus attributed the 32% decrease in Adj. EBIT to the Ariane 6 delay, the impact of rising inflation on long-term contracts, and fallout from Western sanctions on Russia. Airbus’ joint venture with Safran, ArianeGroup, is the lead contractor for Ariane 5 and Ariane 6.

“Airbus delivered a solid H1 2022 financial performance in a complex operating environment, with the geopolitical and economic situation creating further uncertainties for the industry,” said Airbus CEO Guillaume Faury.