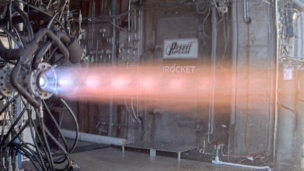

Image via Astra. Note: This slide was pulled from Astra’s Dec. ’21 investor deck, not IR materials presented Thursday.

Astra (Nasdaq:ASTR) recorded a net loss of $257.8M in 2021, the company said Thursday. That’s a 278% annual increase, but to be fair, Astra was making and launching more rockets last year than it was in 2020.

On Astra’s quarterly call, CEO Chris Kemp touted the two successful orbital launches that took place since he last got on the horn with analysts. Kemp also pointed to Astra’s first commercial trip to orbit. On March 15, Astra launched and deployed 22 satellites for paying customers.

Finally, the company is emphasizing its increased sales to shareholders. “Our customers continue to value Astra’s launch services as our backlog increased to $160 million during 2021,” CFO Kelyn Brannon said in prepared remarks.

Astra’s Q4 21, by the numbers

- GAAP net loss was $51.3M

- Adj. net loss and EBITDA loss were $37.5M and $36.1M

- CapEx totaled $19.6M.

- Cash and cash equivalents stood at $325M on Dec. 31, 2021.

For Q1 2022, Astra guided Adj. EBITDA loss to $44M–$48M and CapEx to $10M–$15M. The company says its next three missions are for NASA, with TROPICS payloads on the manifest. They’ll be launching from Florida.

+ Market data: At press time, $ASTR had a market cap of just about $1B. The stock is down ~44% YTD but ended March up ~$14%. On Thursday, the stock traded down 6.8%.