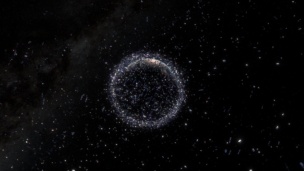

Astroscale’s IPO proves there’s value in junk stocks—space junk stocks, that is.

The Japanese startup on a mission to clean up debris left in orbit saw its share price balloon during its first day of trading in Tokyo’s growth market on Wednesday. It’s the second Japanese space company to go public this year, after lunar lander company ispace began trading in April.

The IPO: Demand for Astroscale shares far surpassed available supply, pushing the company’s stock to finish the day trading at ¥1,375 ($8.81), far above their IPO price of ¥850 ($5.44).

Optimistic investors believe the company can turn the ever-growing catalog of space junk into solid gold, and government agencies are fueling this vision.

- Astroscale has partnered with both JAXA and the UK Space Agency on missions to observe and remove defunct spacecraft from orbit.

- The company also recently won a Space Force contract to develop an on-orbit refueling vehicle.

Together these projects have the potential to add $100+M to Astroscale’s balance sheet.

License and registration: Astroscale plans to keep the orbital highways free from dangerous debris and defunct spacecraft in a couple different ways, including disposing of satellites at the end of their missions, extending how long satellites can operate in orbit, and grappling debris that’s been coasting through space for years (or decades).

The company is preparing to tackle the latter mission after JAXA recently awarded Astroscale a contract for the second phase of an effort to remove a Japanese upper stage rocket body from space. The startup already completed the first phase of the program—its ADRAS-J spacecraft came within a few hundred meters of a spent Japanese rocket this April.

Proof of concept: Governments and companies have broadly bought into the idea of space sustainability, since leaving junk in orbit represents a threat that could derail the promise of a burgeoning (and lucrative) space economy. However, Astroscale’s financial statements show a steep path to profitability. In Q3 2023, the company posted a net income of -¥2.89B(-$18.5M), and there is some skepticism among experts that cleaning up space junk can turn a profit.

“It’s just not cost-feasible,” John Crassidis, professor of aerospace engineering at the University at Buffalo, told Payload. “Do you want to build a multi-million dollar satellite to only take out one or two other satellites or debris objects?”