Benchmark has agreed to acquire plasma thruster technology from AASC, the two announced this morning.

- Benchmark is short for Benchmark Space Systems, a chemical propulsion provider based in Burlington, VT. Benchmark’s Starling and Halcyon satellite propulsion systems are its bread and butter.

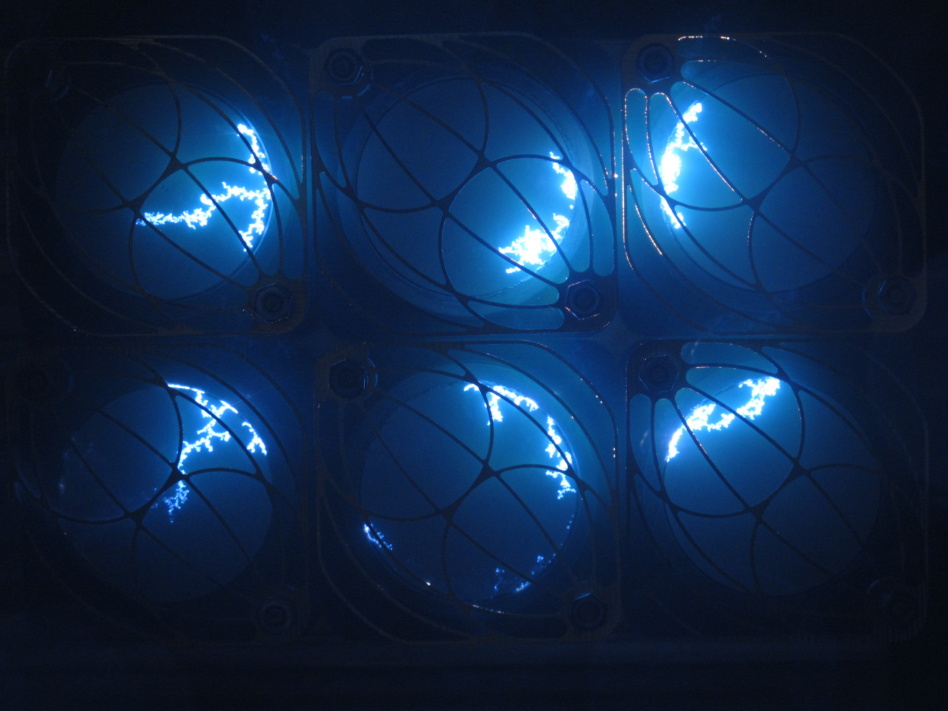

- AASC is short for Alameda Applied Sciences Corporation. The Oakland-based entity keeps a low profile, but what we do know is that AASC develops metal plasma thrusters that don’t have moving parts and run on solid metal propellants.

Like PB&J… AASC’s electric propulsion (EP) systems are ideal for “high-endurance, cruise control” ops, president Mahadevan Krishnan told Payload. At the most abstract level, you can think of the system as a microcontroller telling its thruster to “fire for the next two hours,” for example. Under the hood, it “sends signals to pucks.” Slow and steady wins the race.

Benchmark’s play is to pair this endurance with higher-thrust, larger chemprop technology. “When you put a hybrid package together…you find that you can sell the customer a package that’s less mass, less volume, which is obviously of great interest to most satellite makers,” Krishnan said.

“We’re not aware of anyone else that offers this,” Benchmark EVP Chris Carella told Payload. He estimates that fewer than 1% of active satellites utilize this kind of “hybrid” propulsion technology, and that the lion’s share of those that do are in GEO (and are thus very large and expensive assets).

The thought process: With the hybrid system, a satellite can get into a “revenue-generating orbit” quickly and then just chill out thanks to EP. If it needs to raise its orbit or rapidly maneuver to avoid a possible on-orbit collision, then the satellite can switch to chemprop.

The GTM plan: Benchmark will target the hybrid operators building satellites in the 50-250kg weight class. Common use cases in this class range from EO to connectivity, including both broadband and IoT.

Customers could pay anywhere from zero to a 50% premium upfront for the hardware, per Carella, but he said they’ll make that back very quickly.

Benchmark will sell the hybrid thrusters as pre-integrated, plug-and-play packages with “all the bells and whistles,” Carella said, including the company’s SmartAim guidance, navigation, and control (GNC) software layer.

Startup update: Benchmark is building 150+ engines over the next 18 months. Carella said the startup’s backlog stretches past 200 units. Of that number, the share of government vs. commercial customers is split roughly evenly.