This morning, Seattle-based BlackSky (NYSE:BKSY) reported Q4 and full-year 2021 results. Q4 financial highlights:

- BlackSky recorded $11.5M in revenue, up 79% year-over-year

- Operating loss stood at $31.9M; Adj. EBITDA loss was $14.4M (more on that below).

- Going into 2022, BlackSky had $168M in cash.

- In Q4, BlackSky recorded $14.4M in capex spend.

Financial highlights for the full year:

- $34.1M in revenue, up 61% YoY

- Operating loss of $120.1M; Adj. EBITDA loss of $44.4M. The discrepancy is due to pre-merger stock awards and public company transaction costs, along with $18.4M in satellite impairment costs.

- $63.9M of capex.

A busy Q4… The geospatial analytics and satellite operator de-SPAC’d on Sep. 9 and began trading as $BKSY on the New York Stock Exchange the following day. The SPAC transaction, first announced last February, provided BlackSky with ~$283M in proceeds.

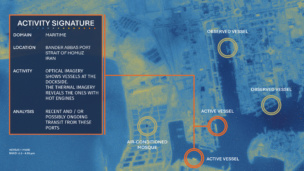

On the deployment front, BlackSky doubled the size of its constellation in Q4 from six to 12. BlackSky birds kept Rocket Lab’s Electron busy, with launches in November and December. Separately, two BlackSky satellites also launched on a Falcon 9 in early December.

- BlackSky said it was able to place newly deployed satellites “into customer-ready production” within 48 hours of launch.

- Now, BlackSky says its constellation is capable of 15 revisits per day.

A glimpse at the stock: Since going public, BlackSky has performed similarly to the wider space SPAC cohort (and growth-stage, unprofitable tech companies, for that matter). After $BKSY’s first day of trading Sep. 10, shares of the company stood at $11. That number is now $2.58.