BlackSky (NYSE:BKSY) is a geospatial intelligence and continuous monitoring company. The Herndon, VA-based space company has been in the news at fairly regular intervals in recent months, due to its role in supplying open-source imagery and intelligence related to Ukraine.

Payload sat down with BlackSky CEO Brian O’Toole at Space Symposium earlier this week to discuss Ukraine, agile space, software-driven development, expanding from government to commercial sales, and what O’Toole called space’s “internet moment.” Some context, before diving in:

- BlackSky went public via reverse merger in the fall of 2021, and like many space SPAC compadres, the company has underperformed as a publicly traded entity (-57% YTD).

- By the same token, BlackSky has been steadily expanding its constellation of Earth-observing satellites, developing its Spectra AI analytics suite, and staffing up on the sales and marketing side.

- Just last Saturday, April 2, Rocket Lab (NASDAQ:RKLB) launched two new BlackSky birds. The two have been launching satellites at a rapid clip over the last six months or so.

Find Payload’s full convo with O’Toole below. Note: This interview has been edited for length and clarity.

You just launched two birds with Rocket Lab on Saturday. In recent missions, you’ve seemed to emphasize how quickly your satellites start operating and, your words, “generating revenue.” Why?

We had imagery in about 10 or 12 hours this time around, which is amazing. From factory to imagery in customers’ hands in a matter of a few weeks. And we launched six satellites on three different rockets in our campaign this fall. All within a 20-day period.

In every case, satellites were put into revenue-generating operations in about 48 hours. This is unprecedented, right?

That’s what we’re all about: speed to insights. Agile space means we can get capacity on orbit where and when we need it and then get the data into the hands of our customers. Ultimately, we’re about giving our customers this first-to-know advantage.

We’ve designed the constellation so that’s in a unique dawn-to-dusk orbit. We can look at things dawn-to-dusk every hour, which is unique, and enable that through software. Someone could log in, task a satellite through a browser, and get imagery and analytics. All in about 90 minutes.

Are your customers only using web browsers to access this info?

They can log into our browser or online platform through a device. In other cases, they can access it through third-party platforms like Palantir. We’re making it accessible where people live. Without very much training, they can type in a location they want, point, and click. Then they get an alert that their image is ready. That’s a game-changing customer experience that didn’t exist until recently.

This is a question I’ve had for a lot of your counterparts recently. And maybe it’s a chicken-or-egg problem of sorts. How do you build the analytical layer—you know, Spectra AI—before you have a critical mass of satellites? How did you train your models and get to a production-ready level of performance?

We started 8 years ago. I founded the predecessor company, where we took a software-first approach and started building a platform that not only took in our data, but also other satellite and IoT data. Back then, we knew it was the analytics and easy-to-use accessibility [that would set us apart]. Now, we’re just layering in more AI and data sources.

So, you wrote the software before you launched all the satellites.

Most companies have not done that. They’ve focused on hardware, then figured out how to monetize it after the fact. We took it the other way around.

To me, we’re in this new commercial space age era. We went from handfuls of satellites in orbit a couple years ago to hundreds and thousands. It’s not about all those sensors, but what you do with all of that data. To me, that’s where the biggest market opportunity is.

Do you subscribe to the view at all that this type of data could become a commodity? And that it’s the analytical layer where you win?

If you stick with a business model where it’s selling pictures, I think that’s going to be challenging. We take the opposite view and focus on data and insights. People want data faster and faster. They want to move up the value chain, in terms of the level of information, right? I think that will create a flywheel effect that goes beyond commodity data.

On the Russia-Ukraine war, and BlackSky’s Business

How did Russia’s invasion of Ukraine affect BlackSky’s business and demand for your services? Did it change your strategy?

Didn’t change strategy. We were moving along at a really good growth rate and we already serve most of the most important government customers, both in the US and around the world. From a global demand perspective, I think you’ll agree this event shows the world now understands the need for this real-time GEOINT capability more than ever.

We also have a lot of commercial customers who are interested in what’s happening to the supply chain, and tracking economic impacts. We’re doing a lot to support humanitarian efforts. But fundamentally, I think our business strategy hasn’t changed.

BlackSky’s Tech Analogy

It’s been pretty remarkable to watch the degree to which all of this space imagery and data has shaped the world’s perception and understanding of the war. It feels like a coming of age moment for the industry, no?

I think space is having its internet moment right now. In the early days of the internet, all the money was going into optical networks, infrastructure to build websites, blah blah blah. Nobody envisioned the Airbnbs and Wazes of the world that came out of that.

We’re at that point in this industry. Launch infrastructure is there. Satellite production infrastructure is there. And communication networks are there.

And now, as I mentioned, we’re headed to a future with thousands of sensors [in space]. Bundle all these location-enabled IoT devices into that, and it will completely change the way we see and understand the world. We haven’t even imagined the applications that are going to come out of that over the next three, five, ten years.

I think most people believe that when you look at what’s transpired in the last 24 months with companies like ours, it shows that this is here. It works, it’s viable, and it will now power a whole new industry. That’s what we’re looking forward to, and it’s why we’ve taken a software approach. That’s the next frontier.

I like the analogy of the iPhone and the transition for 3G to 4G networks. As Apple and telcos made the upgrade, and billions were invested in infrastructure, nobody could have predicted that Uber or Snapchat were what came next.

Even think about the iPhone itself. Like many others, we have taken a vertically integrated approach. The satellite model of the old days was to start raising money and think about building these big things that would take you five to seven years.

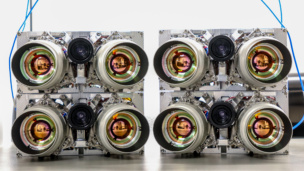

Now, we can iterate satellite technology every 24 months. We have a Gen-3 capability we’re launching in about a year. It’s the same relative size and cost, but will improve imaging resolution from a meter down to 50 centimeters with IR capability. Plus, a bunch of other features. So, that analogy of hardware married up with the app and data accessibility is totally right on.

On the upgrades and iterating…Is that a function of reaching sort of volume production or is it more from a secular trend like Moore’s Law? Is it the improving quality of sensors? Or a little bit of everything?

In our mind, three big things have happened.

#1: Access to space through affordable launch has been huge. That will get cheaper as more and more launch providers come into the market.

#2: We demonstrated the economics of small satellites. We can deliver imagery now from a satellite that’s the size of a dorm-room refrigerator, that used to be the size of a school bus.

#3: Software. All of this is enabled through software. And the data that results is affordable. I think data affordability and access will be the biggest growth drivers.

Is demand outstripping supply in any way?

It’s not a concern for us, because we don’t have a capacity-constrained model. We use software to only collect what customers want. We only take pictures of the most important strategic and economic locations. I think it’s something like 90% of the world’s GDP takes place on about less than 15% of the landmass. We don’t have a model where you paint the whole world…we only shoot those economically important locations. And we can sell that many times.

That was my next question, the one-to-many model.

We also demonstrated in the last four months that we can scale capacity with demand. We just put up eight satellites in four months, doubling our capacity. It’s a completely different ballgame now.

No capacity constraints, focusing on speed and strategically important places, and capabilities like change detection…are there other aspects of BlackSky’s model that are unique to you?

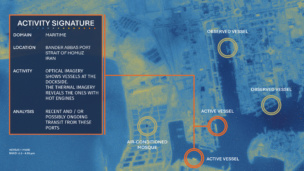

We’re combining other data already. We integrate with SAR data, for example. For customers, we’re doing 24/7, all-weather autonomous surveillance with EO and SAR, and applying analytics to that. We’ll keep adding more and more data sources and more AI.

That’s where this industry is headed. Frankly, most customers don’t want to buy pictures. What are they looking for? Change detection. Tell me when my supply chain will get disrupted, when there’s a backup at this facility, or how a certain development could affect commodity prices.

It’s the ability to anticipate what’s going to happen and then alerting on those changes that matter.

“Just give me the answer.”

What share of BlackSky’s customer base wants the underlying raw data vs. the analytics?

There’s government customers who want the raw data because they’ve already had the infrastructure to do something with it. But they’re now demanding that analytics come with it, because the volume of the data is outpacing their ability to analyze it.

There’s the data, there’s the derived data, then there’s “just give me the answer.” Most of the commercial market just wants [the latter], the report on X happening or the impact of Y on my assets. They don’t want to process pixels or fuse all that data. It’s not their business. Insurance guys just want to know: “What’s the damage to my assets?” They want to know what was damaged and where there’s routes to get people in to start doing recovery.

Has that segment been the focus of BlackSky’s sales and marketing push?

It is now. We started out in government and are a trusted provider to that market. There’s only a few of us in the world that do that. We brought in a chief commercial officer last year, so we’re really ramping that up. And we stood up an innovation center that can do rapid solution development. A lot of what you’re seeing in the media is coming from that team. They look at the data, do a quick analysis, and then get it into the hands of customers in a hurry.

Do you find that there are verticals that need something like BlackSky but aren’t even aware of it? Where do you have to educate the market, or where might the product not sell itself?

The demand is there and we have a lot of incoming interest from different industries all the time. Where they’re unaware is where, typically on a call, they’ll say “I would like to have satellite imagery to do X.” They’re asking what X is, but what they’re really trying to do is Y. [They want the “just give me the answer,” not the data or derived data.] I think companies are surprised to find out that they can get a username and password, log in, and then get imagery and analytics in 90 minutes.