BlueHalo, a young defense prime making headway in the space domain, announced yesterday that it has acquired Eqlipse, a cyber, intelligence, and advanced R&D firm working on the edge of defense applications.

A new defense prime: BlueHalo wants to do defense contracting differently. Its approach prioritizes the fast adoption of new technological advancements and aims to quickly adjust to the military’s operational needs. That includes a strong emphasis on evolving AI and ML technologies, CEO Jonathan Moneymaker told Payload.

The company’s business spans several verticals within the defense sector:

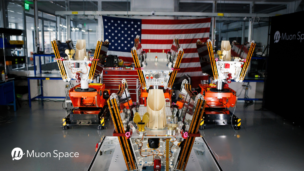

- Space. That’s why we’re here, folks—BlueHalo is building advanced RF and laser comms, among other things, to support military ops.

- Autonomous systems. Drones, tracking, and swarm tech fall under this category.

- Cyber and electronic warfare. The final third of BlueHalo’s business serves advanced cyber needs.

The company is using advanced algorithms to make all its approaches more effective. “We’re now applying that algorithmic optimization, or swarming logic, to new domains, like the maritime domain or space domain, and how that can inform and interact with new assets and new missions in those relative areas,” Moneymaker said.

Enter Eqlipse: Speed and flexibility are top of mind for BlueHalo’s defense customer approach, and Eqlipse is on the same page.

According to Moneymaker, Eqlipse “brings new specific capability across the electronic warfare portfolio that has been part of our organic strategy, and really accelerates that into new payloads, into our counter drone business, and solidly, I think, cements us in the cyber and signals intelligence domain.”

BlueHalo declined to disclose the terms of the deal.

Dream team: Together, Blue Halo and Eqlipse say they’ll bring in nearly $1B in annual revenue and manage a team of ~2,400 employees in the US.

Eqlipse will add to BlueHalo’s capabilities as it completes its $1.4B USSF contract through the Satellite Communication Augmentation Resource (SCAR) program, which is modernizing the military’s space comms infrastructure.