Brunswick, ME—bluShift Aerospace ignited its MAREVL engine this week in the company’s latest attempt to prove that hybrid rockets are as good as, if not better than, purely solid or liquid alternatives.

While bluShift is still parsing the results, early indications show that the company throttled its engine and hit thrust levels that would launch a suborbital rocket, according to CEO Sascha Deri.

The test marks the end of a $1.1M US Air Force TACFI contract, which funded bluShift’s efforts to explore how its propulsion tech could be used as boosters for medium-lift launch vehicles.

Now, the company’s future is up in the air. bluShift’s trajectory reflects the challenges of building a cost effective rocket engine in the face of shifting government priorities.

We have launch at home: As recently as October, bluShift’s path to orbit started with a single-engine suborbital rocket. Multiple engines working together would power flights to LEO. During the course of the TACFI test campaign, which saw three major hotfire tests in the last eight months, bluShift found its government customer was no longer interested.

“A year ago, we were hearing from the Space Force [that] they wanted more launch options. They were looking for ways to save money, looking for a diversity of launch…but the word has come from on high that no more launch companies are to be supported,” Deri told Payload. “They have already figured out who the launch companies will be.”

Given the private sector’s over-investment in launch start-ups and the challenge of competing with SpaceX, ULA, Rocket Lab, and Blue Origin—not to mention the likes of Stoke, Firefly and Relativity—that’s not a huge surprise.

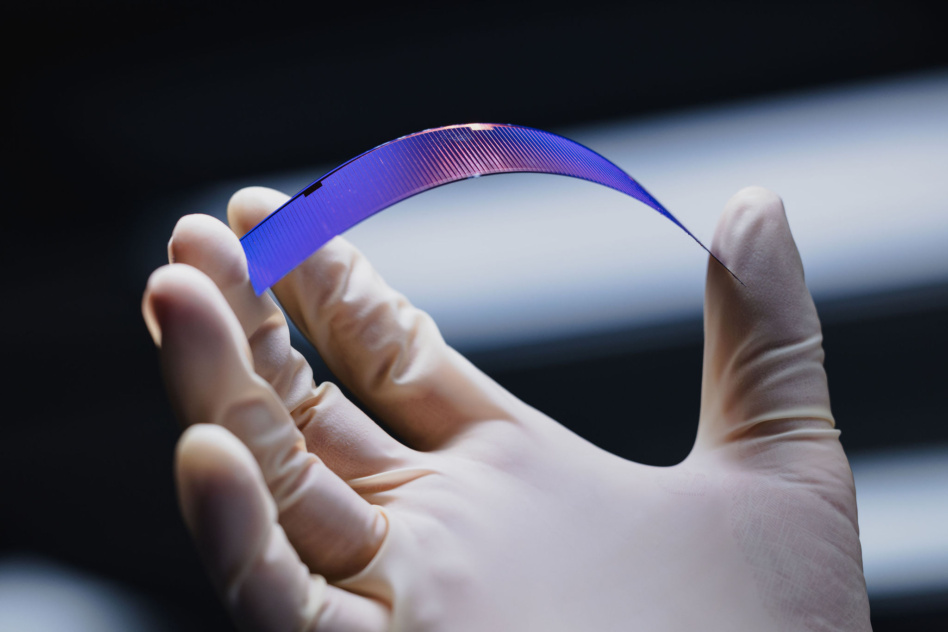

Little of this, little of that: bluShift believes that its non-toxic, storable propellants make its engine viable for the multiple applications in the defense industry—by the company’s estimate, its propulsion system is 50% cheaper than solid- or liquid-fueled alternatives.

- In the near term, bluShift is in talks with a potential commercial partner in the Northeast US to provide low-cost boosters for hypersonic tests at Mach 5 speeds.

- Longer-term, the company wants to support the US government’s new requests. It envisions repurposing its boosters for on-orbit missile intercept capabilities as part of the Golden Dome architecture, or miniaturizing its engines for on-orbit propulsion.

In for a penny: The company is in the process of raising a $1M seed round as it searches for more government contracts and locks down commercial partnerships. Deri says the company has raised $6M between private funds and government contracts since its founding in 2014. bluShift disclosed in an April SEC filing that it ended its most recent fiscal year with $3.6M in combined short- and long-term debt.

Correction: This article was updated to correct the value of bluShift’s TACFI contract.