SpaceX is dramatically outpacing the rest of the world in launch cadence and capacity. In its Q2 2023 launch trends briefing, BryceTech quantified just how much the launcher is breaking away from the competition.

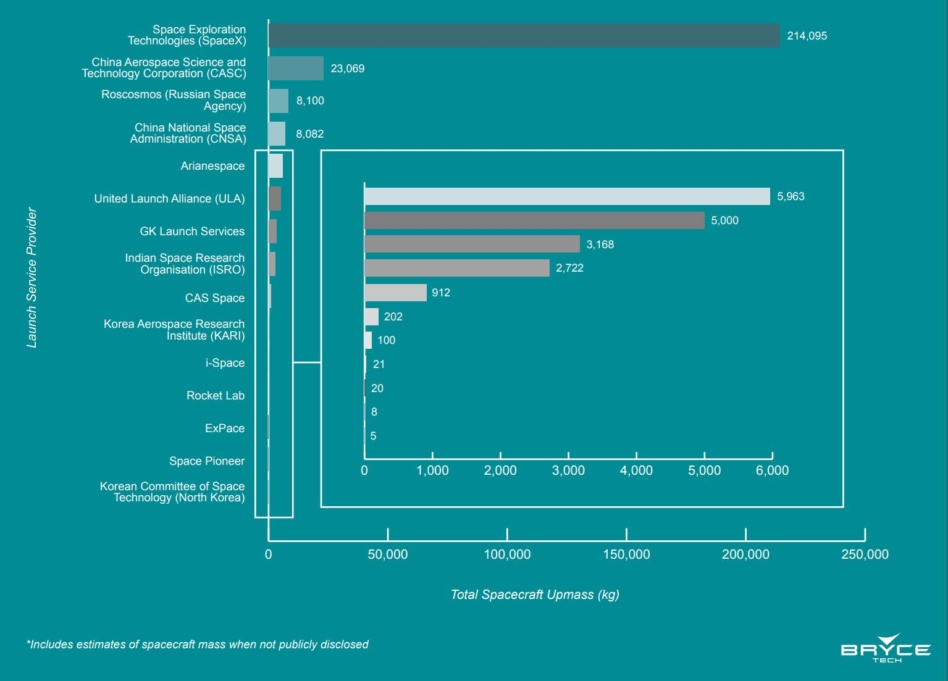

SpaceX vs. the world: On each of the launch metrics tracked by BryceTech—that is, number of launches, number of satellites launched, and mass to orbit—SpaceX led the pack in Q2.

The primary contractor for China’s space program, CASC, comes in second on each of these metrics—but it wasn’t close. SpaceX launched 22 times in the quarter, compared to CASC’s six. (Side note that SpaceX also dominated the US market, making up 88% of American launches in Q2). SpaceX also launched 648 total satellites, while CASC launched just 49.

Widening the gap: SpaceX has led the world in mass-to-orbit for the past seven quarters, according to BryceTech data. That includes quarters where the launcher didn’t lead the pack in number of launches—SpaceX tied CASC at 18 launches in Q4 2022, for example, but sent more than twice the mass to orbit. That’s a whole lot more mass per launch.

This year, SpaceX has expanded its staggering lead. In Q4 2021, SpaceX led in mass-to-orbit by a much smaller margin (63,400 kg to CASC’s 51,000 kg). In the first two quarters of 2023, however, SpaceX has sent about 10x as much mass to space as CASC, which has been its closest competition in both cases.

Spacecraft breakdown: Of the 797 spacecraft launched in Q2, the vast majority were communications satellites. Here’s how it breaks down:

- 67% comms, led by Starlink deployments

- 16% technology development

- 13% remote sensing

- 1% or less each of science, crew and cargo transport, and miscellaneous applications

Commercial satellites also far outnumbered government deployments, and 97% of satellites launched were smallsats. It’s a new world out there.