Last week, NYC-based Cloud to Street announced a partnership with Raincoat, a parametric insurance provider, and Munich Re Group, a major international reinsurer. The three are launching a flood insurance product in Colombia. The national program will make flood insurance policies available to 100,000+ Colombian farmers for the first time.

- In effect, that means that policy-holding farmers will be paid out when certain flood thresholds are triggered in the country.

- Parametric insurance provides coverage to policyholders by paying out prespecified amounts based on the magnitude of an event, rather than the losses.

- “You insure not by damage but by the presence of the event,” Cloud to Street CEO Bessie Schwarz told Payload.

Meet Cloud to Street

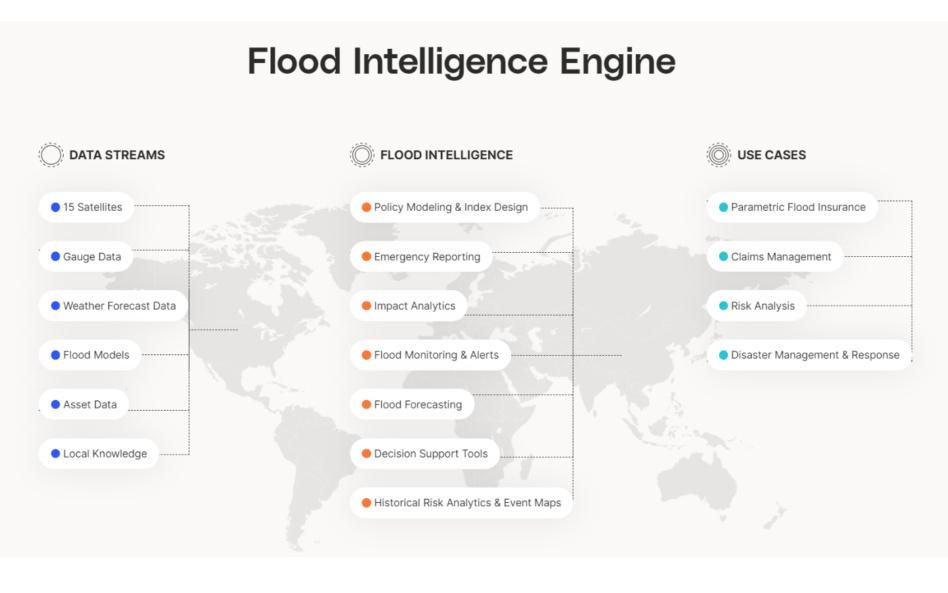

The startup operates a flood intelligence engine by collecting historical data, mapping flood zones, helping to insure and transact flood risk, and providing highly granular, rapidly updated data at a global level.

Schwarz says Cloud to Street “is the authority on tracking floods globally in near-real-time, using satellites, AI, and a variety of other types of new data.” While it may operate out of Brooklyn, Cloud to Street’s observations are global in nature. All-time stats:

- 28 governments, companies, and institutions are supported by the platform

- 169 countries are mapped on Cloud to Street

- 375M people live in areas monitored by the tool

- 7,000+ people have been relocated from at-risk areas identified using Cloud to Street.

The space angle

Cloud to Street works with 15 public and private satellites, with resolutions ranging from 250m to 30cm. The company’s archives span 35+ years of data. Cloud to Street taps public sensors from NASA and ESA. “We really love working” with commercial satellite players, Schwarz said, and “what we do today would likely not be possible without so many commercial sats coming up.”

- The power of space: If someone changes the height of a curb in Houston, for instance, Schwarz said Cloud to Street will be able to observe the change pretty frequently by detecting changes in watershed heights and water flows.

Ground truth and global data layers…The team doesn’t just use optical imagery, SAR snapshots, and EO data. Its expertise extends across remote sensing, machine learning, and hydrology. Cloud to Street tunes algorithms differently for each sensor and fuses them together into one flood map. Cloud to Street will also rely on river gauges and other local sensors to collect information on stream flow, precipitation, and the like.

Who’s looking for what?

Cloud to Street works with the UN, national governments, insurers, and reinsurers.

- In many ways, the public sector is the earliest adopter here. “The government is the insurer of last resort,” Schwarz said, so they’re willing to “adopt innovative new insurance that can give them new forms of risk transfer protection.”

- For insurers, “it’s not the maps that they care about,” Schwarz said. “It’s time-series graphs,” or charts showing flooding levels in a given city block or agricultural zone across time. Insurers weigh the probability of flooding using Cloud to Street’s data and use that to price policies.

- For FOSS lovers…Cloud to Street open-sources most of its data. “We have the largest database of flood observations in the world,” Schwarz said. Cloud to Street shares that database with the world, but maintains an even larger internal dataset that it uses for its flood intelligence engine.

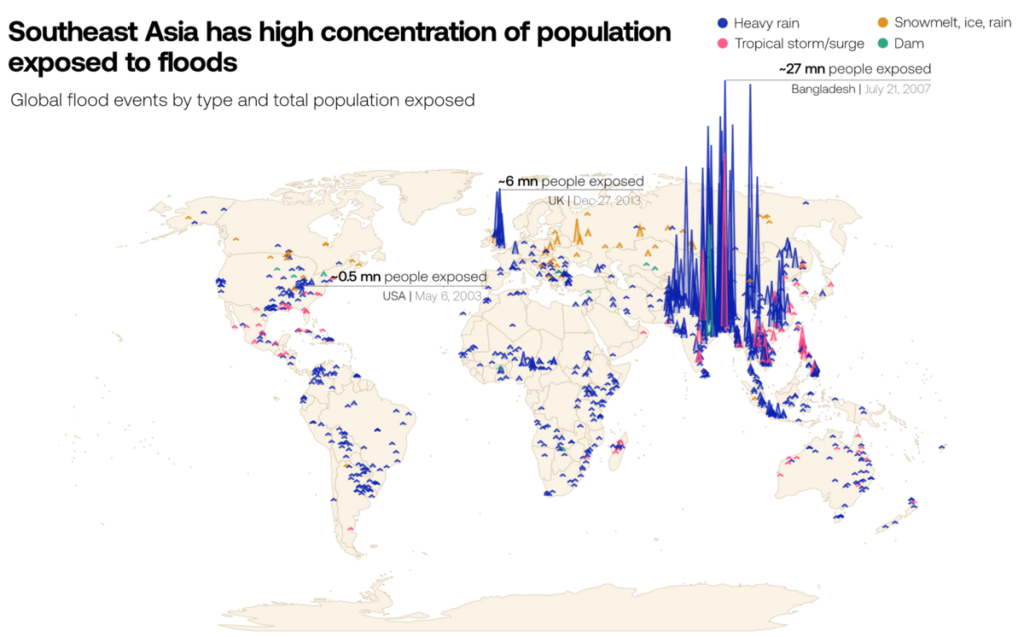

Cloud to Street’s opportunity: 75% of flood losses are uninsured, and flood vulnerability is rapidly increasing around the world. The lack of flood protection, unsurprisingly, is particularly acute in areas that are unbanked and/or underserved by financial services.