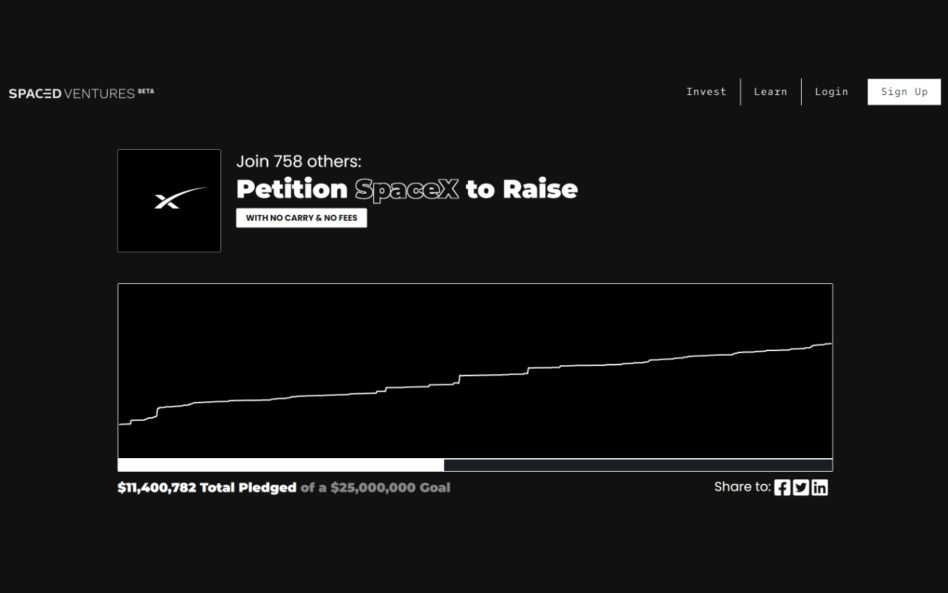

Spaced Ventures is waging a longshot bid to amass retail investors and petition SpaceX to raise a community round.

In under a week, the space crowdfunding investment platform has passed $11M in pledges from users. The tally includes pledges from both unaccredited and accredited investors. Spaced Ventures’ MO is opening up space private markets to everyday investors. The high-risk, high-reward proposition is possible thanks to Reg CF. It’s a new-ish SEC rule that lets startups raise $5M via crowdfunding offerings each year.

To be crystal-clear, SpaceX isn’t affiliated with this campaign and hasn’t endorsed it.

How it happened

Other Reg CF platforms have petitioned SpaceX to do a community raise in the past. Spaced Ventures asked users to pick the private space company they’d like to invest in most. The overwhelming majority (80+%) picked SpaceX.

How it would work

Spaced Ventures wouldn’t charge carried interest or management fees. It’s running the CF campaign on a first-come, first-serve basis. A pledge ≠ a binding commitment to invest. It’s a non-binding indication of interest. CEO Aaron Burnett told Payload that Spaced Ventures would likely set up two special purpose vehicles (SPVs).

- One SPV would be for smaller checks from unaccredited investors (Reg CF).

- The other would be for larger investments (Reg D).

For anything to materialize, SpaceX would need to take Spaced Ventures up on the offer. That’s very far from a given. SpaceX fundraises these days tend to include three commas.

Why would SpaceX ever entertain this?

There are a few reasons, Burnett told Payload:

- SpaceX could bring everyday investors (and superfans) onto its cap table without the disclosures, overhead, or short-term market pressures of being public.

- The rocket and satellite powerhouse would control the terms of the private offering. It could maintain selectivity when setting a valuation and selecting investors. SpaceX could opt to only take on, say, Starlink customers as new investors, Burnett said.

- If Spaced Ventures can aggregate enough investor interest, it could secure a warm intro to SpaceX leadership.

So, that’s the working theory…how’s it going? As of this writing, 758 individuals have pledged $11,400,782. The median check size is $1,000, Burnett said. The average is far higher, at around $15,000, as some whales have pledged larger check sizes (think $1M and up).

You’re saying there’s a chance…

To get SpaceX’s attention, let alone cap table access, Burnett thinks table stakes are $20M–$30M. His current magic number is $25M. Spaced Ventures is 45% of the way toward that goal.

Burnett hopes the stars will align and that the petition to raise could reach $50M. But even if Spaced Ventures was to hit the bullish target, SpaceX still needs to pick up the phone and hear Burnett out. And that, we can’t emphasize enough, is still a longshot.

If there’s any takeaway here, it’s that there’s loads of investor interest in backing SpaceX. Moreover, investors may not be all that price-sensitive. SpaceX was last valued at $125B pre-money, the highest for any American startup.