Ed. note: This is Payload Research analysis, authored by Mo Islam, Payload’s cofounder and Jack Kuhr, Payload’s Research Director. This is an educated best guess, not based on access to any SpaceX internal data or proprietary info!

Payload is back with our SpaceX revenue analysis. This week, we’ll estimate SpaceX’s 2023 revenue, breaking down launch and Starlink revenue. Next week, we will be dusting off our crystal ball to predict 2024 revenue. (To receive next week’s article in you inbox, you can sign up for our Research newsletter here).

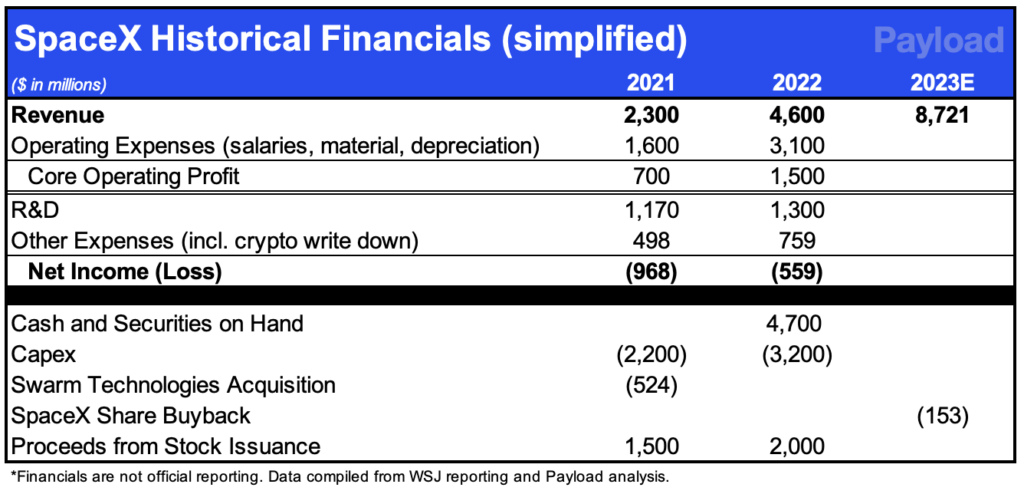

2022 bullseye: Payload’s 2022 SpaceX revenue estimates were dead on last year with our estimate of $4.597B coming within a mere $3M of the WSJ-reported actual revenue of $4.6B.

2023: We are estimating SpaceX’s 2023 revenue hit $8.7B.

To illustrate the revenue growth and profitability, we built a SpaceX three-year income statement (hat tip to WSJ for the rarely-seen historical detail).

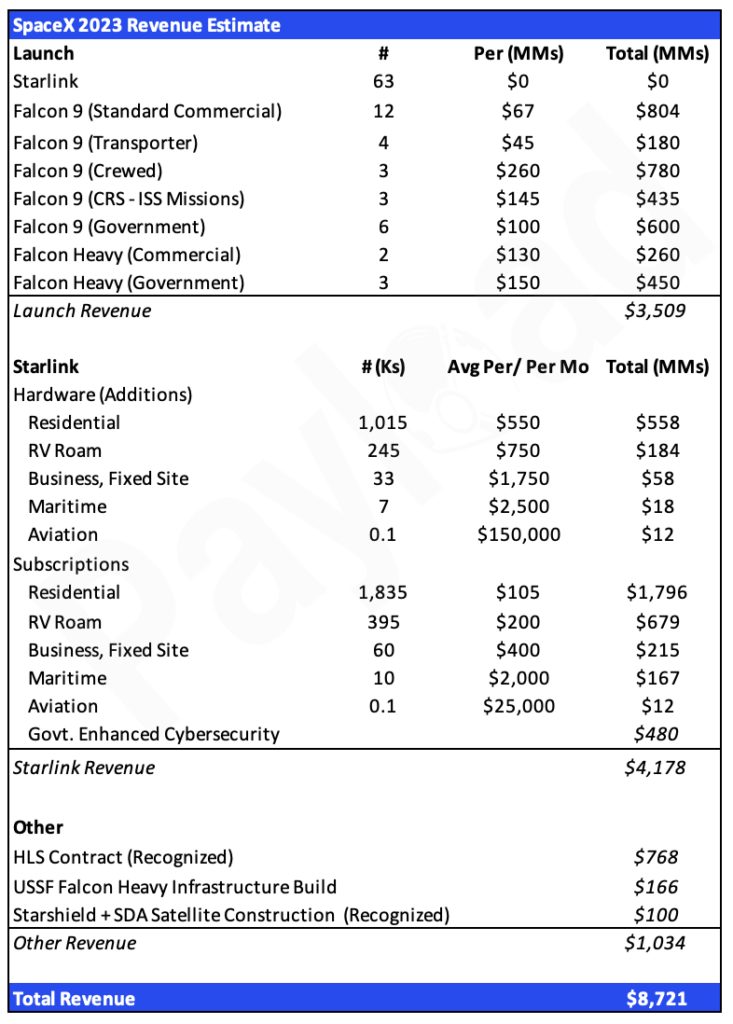

Now, let’s get more granular with 2023 revenue detail. In February, we published our 2023 SpaceX revenue prediction of $11.5B; today we are revising the number to $8.7B with complete year-end data.

2023 Revenue Detail

As you can see below, Payload’s revised 2023 estimate gets us to $8.721B of sales.

Please note: Subscription revenue isn’t a simple total subscriber x cost per month calculation. We calculated it monthly with an assumed growth rate.

Key Build Notes

In 2023, SpaceX prioritized Starlink constellation build-out over customer launches, resulting in lower revenue. Launch revenue came in $1.8B below our forecast driven by 1) fewer-than-expected commercial Falcon 9 launches and 2) two crewed missions pushed to 2024. We revised Starlink revenue down by $1.3B driven by slightly lower user numbers and less business (fixed site) subs.

Starlink…SpaceX reported 2.3M active customers at the end of the year, up from 1M last year. Our prediction at the beginning of last year 2.6M. SpaceX has switched from defining users as subscribers to customers, perhaps due to subscription pausing, sharing, and discount dynamics.

- Starlink Maritime hit 10,000 users this year, higher than we expected. Payload estimates the growth was largely driven by the introduction of a $250/mo low-bandwidth subscription offering, a significant discount to the higher bandwidth $5,000/mo pricing Starlink was exclusively selling last year.

- Starlink Roam: We estimate SpaceX had nearly 400,000 Starlink roam users at the end of the year. Starlink’s roam monthly subscription costs start at $150/mo, providing a boost to average subscription revenue per user.

- Fixed Site Business mix: By the end of 2023, Starlink had signed up 60,000 business users (just 2.6% of total users), proving Starlink is a consumer product through and through. In the absence of data in the past, we had previously assumed ~20% of subscribers were business (for reference 37% of Hughes Network subs are enterprise).

- Aviation: SpaceX rolled out Starlink aviation with hardware costing $150,000 and monthly fees of $25,000. Starlink was installed on 80 aircraft last year, well below the 750 we had previously predicted. The shortfall to our prediction was likely due to long sales cycles and many operators that are likely bound by longer-term relationships with other providers. SpaceX has 400 additional aircraft in contract.

- Government enhanced security: In 2022, Elon Musk said the Starlink service in Ukraine was losing the company $20M/mo due to unpaid enhanced security measures for cyberwar defense. We assume revenue for the service has grown to $40M/mo due to increased adoption of Starlink for military comms in Ukarine and other nations.

Launch:

- Customer vs. Starlink-dedicated launches: We originally estimated standard customer Falcon 9 launches would hit 30 this year, continuing a steady growth rate. This was not the case. Falcon 9 commercial missions was flat year-over-year as SpaceX elected to double down on its proprietary constellation.

- SpaceX launched a staggering 63 Starlink-dedicated Falcon 9 missions in 2023. Starlink launches are zero revenue missions.

- Crewed: Crewed launches to the ISS were revised down from five to three as Polaris and Ax-3 launches were shifted into 2024.

Other Calc. Assumptions

- Starlink residential pricing: US Starlink residential pricing is ~$120/mo. International monthly pricing is lower, ranging from $40 to $105.

- Global users account for 41% of total customers, with the majority from developed areas such as Japan, Europe, Canada, and Australia.

- Crewed launches: We blended per seat pricing to $65M on the Crew Dragon.

- Commercial Falcon Heavy: Reusable Falcon Heavy commercial launches are priced at ~$100M; however, in 2023, ViaSat elected to pay up for FH launch with fully expendable boosters, which likely cost ~$160M.

- As a result, in 2023, the average Falcon Heavy commercial launch came in at ~$130M each.

- Government Falcon Heavy: Government Falcon Heavy launches are priced higher than commercial, averaging ~$150M.

- Transporter: Falcon 9 Transporter missions are likely significantly lower than the $67M sticker price—we assume the average price to be $45M.

Other contracts:

- HLS: According to public records, NASA paid SpaceX $765M this year for work on HLS.

- Falcon Heavy infrastructure: The Space Force paid SpaceX a whopping $316M to launch USSF-67 at the beginning of 2023. We estimated that $166M of that contract was earmarked for FH infrastructure work.

- SDA: We are recognizing $75M in revenue from manufacturing four Tracking Layer Tranche 0 satellites. Note the full contract was worth $150M, with $75M recognized in the prior year.

Conclusion: 2023 was the year of Starlink. The focus all year was on growing both Starlink’s user base and satellite constellation. The investment paid off as SpaceX’s revenue began to scale, and the company achieved significant profitability this year.

- Launch revenue grew from $2.4B in 2022 to $3.5B in 2023

- Starlink revenue grew from $1.9B in 2022 to $4.2B in 2023

- SpaceX launched 63 Starlink-dedicated Falcon 9 launches and introduced the higher-capacity Starlink v.2 minis in 2023, significantly improving capacity and download speeds.

- The service achieved strong geographic expansion this year, and is now available in 70+ countries and everywhere in the US. The company is no longer constrained by user terminal manufacturing capabilities.

- Starlink hit cash-flow breakeven this year, a key milestone for the business model.

Predicting SpaceX’s 2024 revenue: Stay tuned for our newsletter next week (you can sign up here), where we will attempt the impossible once again and predict SpaceX’s revenue for the next 12 months.