In its flagship Space Economy Report published this morning, Paris-based Euroconsult finds that the space market grew 8% in 2022. This report is the gold standard for market intelligence on the end-to-end space economy, from upstream manufacturers to downstream service providers and end users across civil, military, and commercial space.

The space value chain…

…as Euroconsult see is, consists of:

- Government agencies, which fund R&D and operate space assets

- The space industry, which builds space subsystems, satellites, and rockets

- The ground segment, who operates hardware and software to send commands to satellites, downlink data, and more

- Satellite operators, who serve satcom, navigation, or geospatial data to end users in “packaged solutions”

- And finally, service providers use these solutions along with other value-added services

For methodological purposes, Euroconsult describes #2 and #3 as upstream players, while #4 and #5 are downstream. And #5—service providers—includes satellite user terminal suppliers.

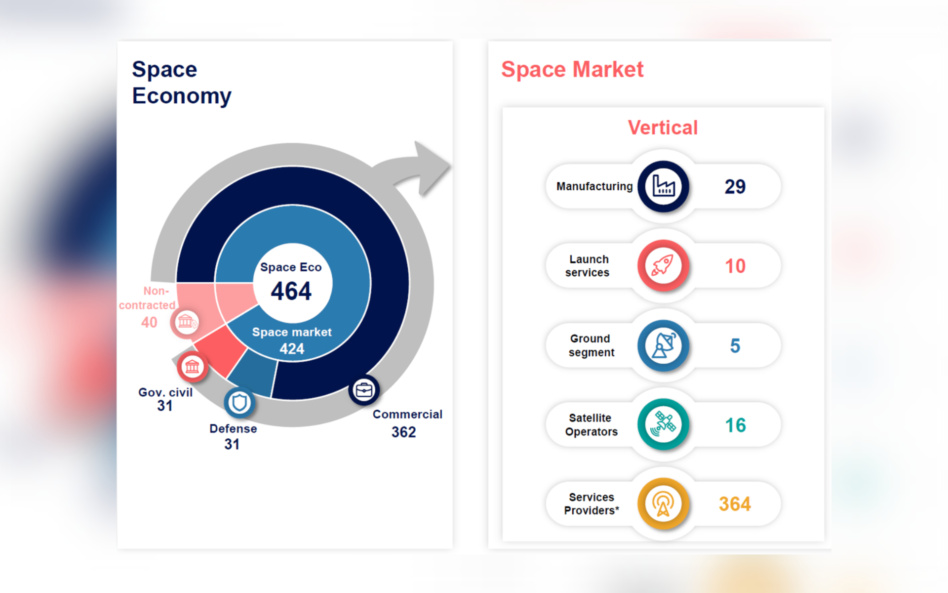

Space market + economy $$$ values

Euroconsult values the 2022 space market at $424B, an 8% year-over-year jump. The space economy—which encompasses industry contracts across civil, military, and commercial space + non-contracted government activity—sat at $464B last year, according to Euroconsult.

Breaking out the data…

- The vast majority of the space market’s value—83%—is captured by downstream players like Uber, smartphone makers, or telcos, which use space-collected data to provide services in some way, shape, or form.

- Euroconsult assesses the “core” space sector—ie, companies that make or own space assets—at $70B in 2022. That’s expected to grow to $100B in 2031.

- The market research firm valued the manufacturing segment in 2022 at $29B, with satellite operators at $16B, launch services at $10B, and ground at $5B. Those sectors are projected to grow to $30B, $30B, $11B, and $5B, respectively, by 2031.

- And 2022 government space spend totaled $103B, according to Euroconsult. That’s expected to grow to $124B in 2031.

Macro trends

Supply bottlenecks and inflationary pressures extended into 2022 and continued to negatively impact the space industry throughout the year, with Russia’s invasion of Ukraine adding new pressures and uncertainties for space operators. But the war in eastern Europe also shed new light on the value of space internet and EO services.

From the investor’s POV, Euroconsult writes that “cash is king” now. We saw tons of major M&A deals announced or completed last year, with various satellite sub-industries continuing to consolidate. Investors are looking more favorably on capital-efficient, revenue-generating companies, while rotating “away from uncertain business models and capex-intensive businesses.” And the SPAC boom, of course, became the SPAC bust.

Government space spending

86 nations invested some $103B in space last year (+9% YoY). That’s a new record and an especially notable jump, but Euroconsult expects government space expenditures to stabilize at 1%–2% annual growth starting in 2024.

Government space spend remains top-heavy, with the top five countries spending 84% of the world total. But relatively speaking, it’s not as top-heavy as it once was: In 2000, the top five government space spenders accounted for 93% of the world total.

What to watch for

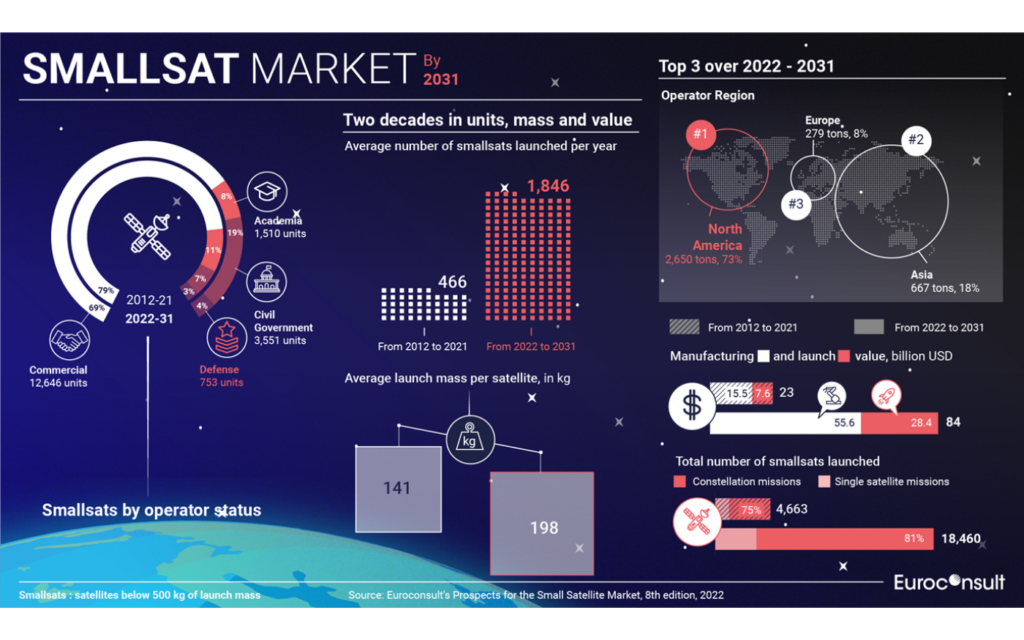

As Euroconsult first projected in mid-2022, the smallsat sector is in the midst of a hockey stick-like ramp in deployments. The next decade will see an average of 1,704 satellites launched each year from 2022 to 2031. For comparison, an average of 382 was launched annually over the previous decade).

Considering just <500kg satellites, Euroconsult’s analysts say that we’ll lift roughly one ton a day into LEO over the next decade. Let that sink in. But revenue may not scale neatly with satellite deployments or upmass, given increases in the cost of capital and a coming decade that will see intense competition between constellation operators.