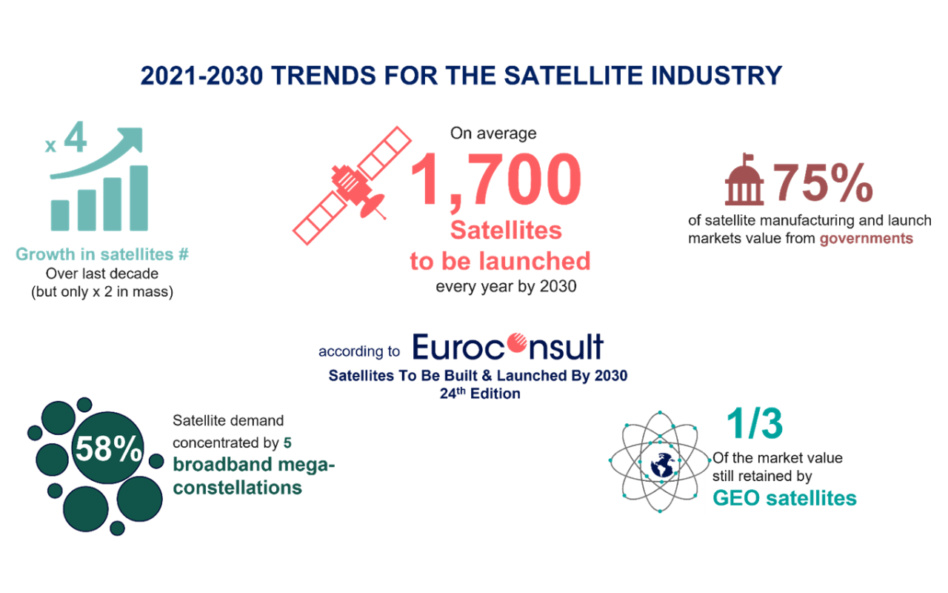

Euroconsult has published the 24th edition of “satellites to be built & launched.” The report serves as the gold standard for market intelligence on, you guessed it, building and launching satellites.

The European consultancy expects 17,000 satellites to be launched over the next decade. The migration to LEO and deployment of tiny, lightweight satellites are evident in the forecast. Though Euroconsult expects a 4X increase in the number of satellites, it expects only a 2X increase in total mass.

Mega-constellations: Commercial companies are responsible for ~65% of the 170 constellations under construction that were analyzed by Euroconsult. Five constellations—OneWeb, Starlink, Gwo Wang, Kuiper, and Lightspeed—are expected to represent 58% of the 17,000 satellites launched in the next decade.

- Due to economies of scale when making these satellites and the proverbial drop in launch costs, Euroconsult predicts that these mega-constellations will make up just 10% of satellite manufacturing/launch revenues.

- That value is still largely created by governments and captured by incumbents.

Euroconsult says the name of the game through 2030 will be tapping newly launched satellites to rapidly provide services like broadband internet and IoT connectivity. “New space is no longer the driving force in the industry,” said Maxime Puteaux, principal advisor at Euroconsult and the report’s editor. “It’s all about fast space now.” New vocab term?