Euroconsult, a space consulting firm, predicts the global EO market will grow from $4.6B in 2022 to $7.6B over the next ten years, driven by tech advancements, premium product offerings, and public investment.

North America is currently leading market share with 45%, followed by Europe coming in at 22%.

The $4.6B market in 2022 was split between B2G defense ($2B), B2G non-defense ($1.4B) and B2B commercial ($1.2B).

Headwinds: Despite forecasts expecting the market to nearly double in 10 years, the sector faces several challenges to reaching its full potential, including inflation, launch delays, and geopolitical issues limiting export opportunities.

- As a result, Euroconsult reports leading operators have looked to reduce expenses.

- AI-based tools are also being implemented to more quickly evaluate EO data and images captured in orbit, to adapt to the new market.

Funding constellations: Analysts identified 145 commercial constellation initiatives comprising 7,000+ potential satellites. However, the firm believes the sector will fall well short of that number due to funding issues, particularly in the private markets.

Still, public investment remains strong.

“Underlying drivers remain supportive, there is a realignment from private equity investment falling year-on-year for the first time in the last 10 years toward rising public investment,” said Euroconsult’s Alexis Conte.

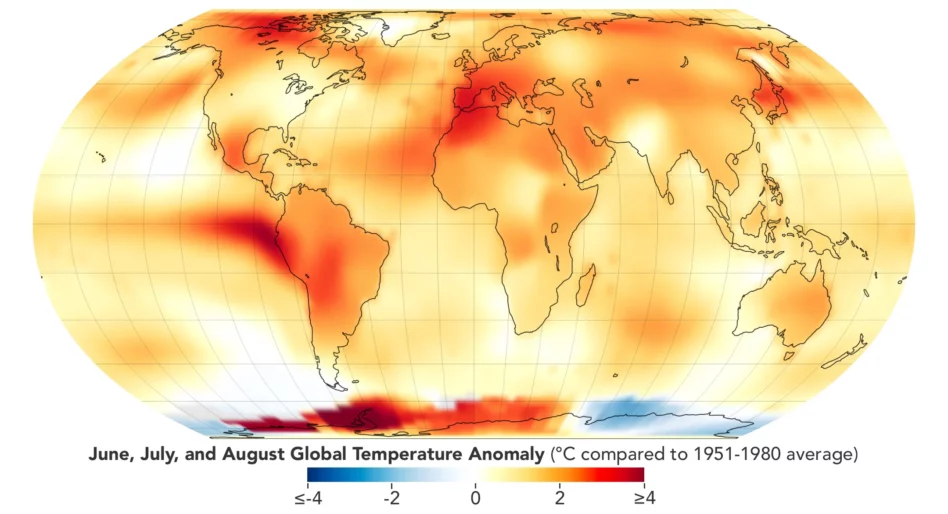

Security and sustainability initiatives are driving global public investment in the EO sector. NRO has increased support for commercial data, and Europe continues to commit significant investment in natural disaster and emission monitoring tech.