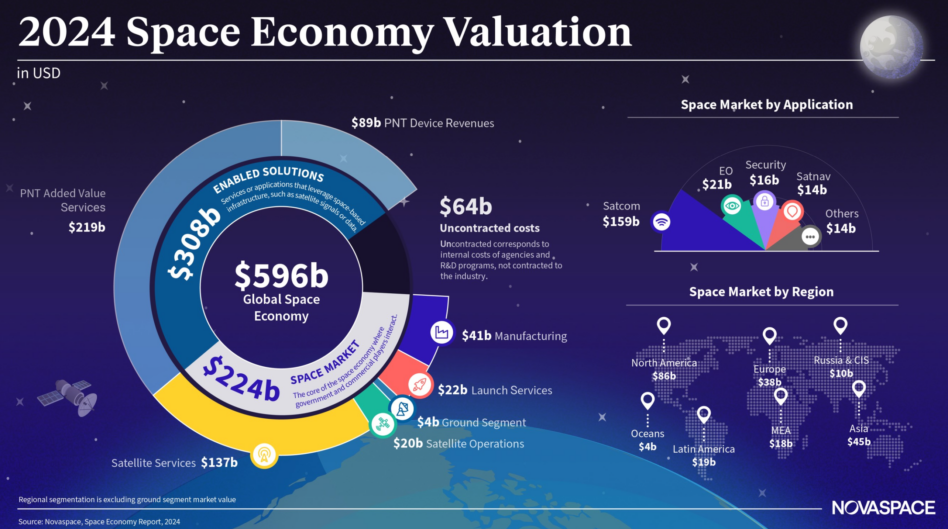

Amid major shifts in US foreign policy under President Donald Trump, European governments have unshackled budget rules and funded a five year rearmament plan, including a €800B ($905B) investment in defense technologies that will benefit space contractors.

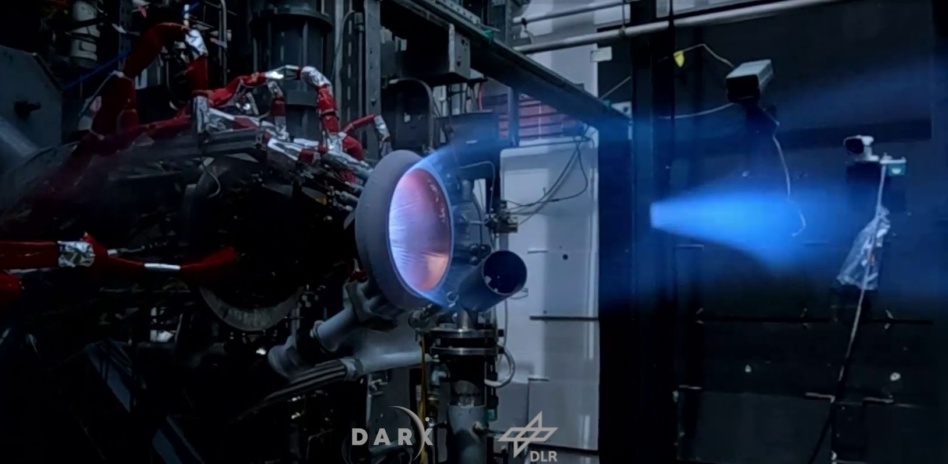

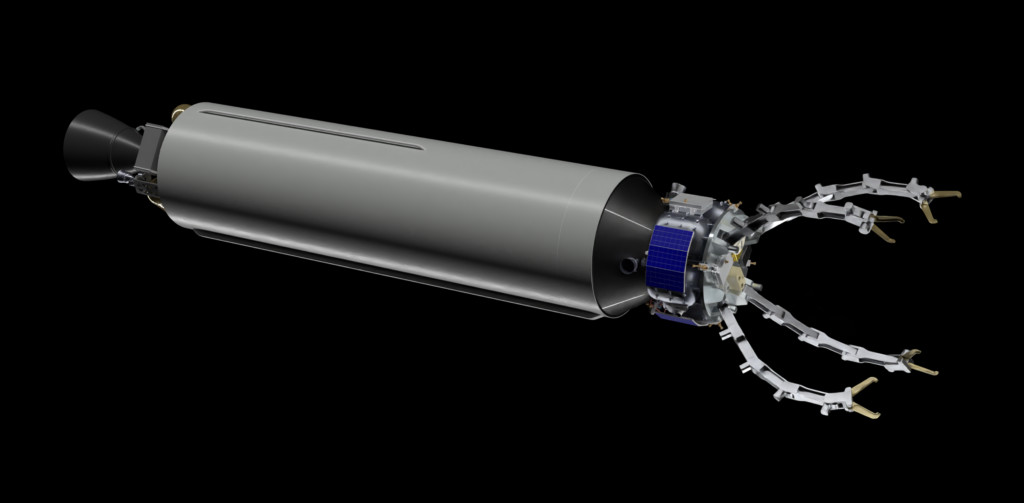

Invent it: Paris-based Dark was founded in 2022 by former defense industry engineers, CEO Clyde Laheyne and CTO Guillaume Orvain. It’s building an air launched space vehicle that can grab a “problem” satellite in LEO and actively deorbit it—in theory, a kinetic space weapon without a debris problem.

The company, which raised $11M and has development contracts with the French government, is planning a 2027 test mission to demonstrate its rendezvous capabilities.

“The change in Washington’s diplomacy has for sure supercharged defense spending in France, 100%,” Laheyne said. “Three years ago, our pitch of the company was not that common. People would say, ‘Well, we’re not going to fight each other in space.’ Today it just looks completely normal.”

It is what it is: Unlike companies with comparable technology, like Astroscale or Northrop Grumman, Dark isn’t emphasizing the potential civil applications.

“The civilian market for debris will be a product-driven market—no one will take any initiative in terms of [active debris removal] regulation if we don’t have the solution for it,” Laheyne told Payload. “In terms of defense, it’s not a product-driven market. It is threat-driven.”

Integrate it: Another approach for European companies is acting as integrators. In April, Berlin-based satellite bus builder Reflex Aerospace announced it would collaborate with the US SAR firm Umbra. The two companies will develop SAR spacecraft for military use, built with a European supply chain.

“We certainly see that sovereign capabilities are needed by all the European states,” Reflex CEO Walter Ballheimer told Payload. “We also see the context of this huge spending in Germany, which has been announced: $400B into defense capabilities. A non-negligible part of that will go towards a new space architecture.”

That is one path for US firms with valuable IP to find wins, despite the new emphasis on trade protectionism.