Momentus, the space tug company attempting to rebound from a troubled SPAC transaction in 2021, is now on the verge of bankruptcy.

Last week, it laid off 20% of its work force and canceled a planned mission on a SpaceX launch as its cash reserves dwindled. This week’s $4M cash injection from an unnamed institutional investor is unlikely to stave off the company’s fate for long.

How we got here: Things looked different in 2020, when the company announced a $1.2B plan to go public. It was a first-mover in the business of using orbital transfer vehicles to augment rideshare launches for small satellite operators, and would deploy a new, cheaper electric propulsion system fueled by water. In the future, Momentus planned to use the technology to build satellite buses or provide in-space servicing and refueling.

What went wrong: None of those aspirations came to fruition. As the company went public, a federal investigation into founder and Russian entrepreneur Mikhail Kokorich revealed that he could not legally work with Momentus’ export-controlled technology, and the SEC charged the company with misleading investors about a successful test of its novel engines.

The fall-out was costly: A $7M settlement with regulators, $50M paid to Kokorich and other early investors to divest them from the company, and $4.5M to a securities class-action lawsuit.

The company, which raised about $260M over the course of its existence, spent nearly a quarter of its total capital cleaning up that mess. Momentus (and its former board) are still facing several shareholder lawsuits.

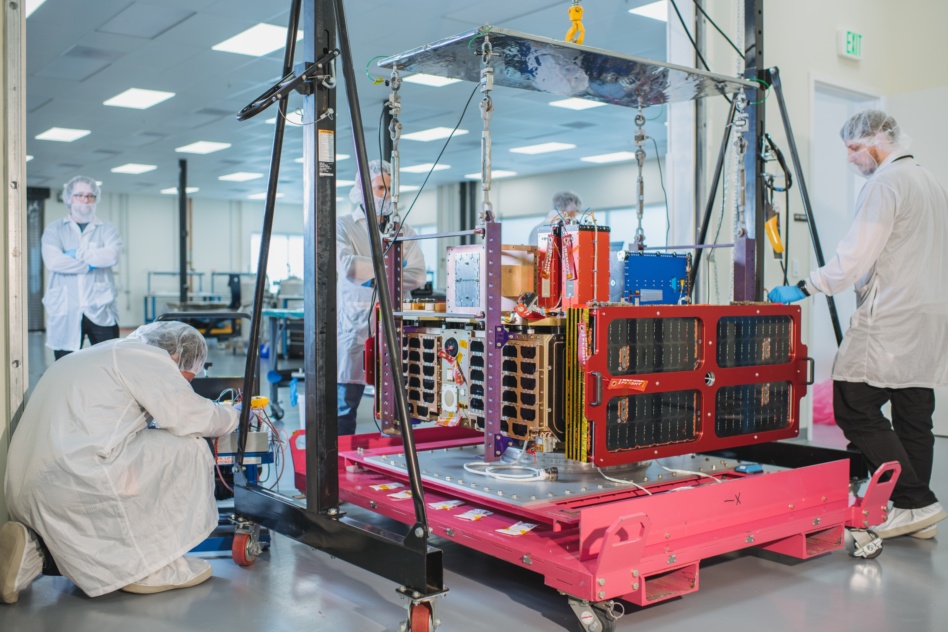

An attempt at a rebound: Starting over as a public company, led by former Defense official John Rood and having a largely new workforce, wasn’t easy. A 2022 demo mission failed to prove out the company’s propulsion tech, and in a June 2023 filing, the firm had to admit that “we have yet to confirm the unit’s ability to generate sufficient thrust for completion of deliveries.”

Investors fled next. VC fund Prime Movers Lab, the startup’s original backer, owned 20% of the company in September, then sold its entire stake. The company had just over $9M in the bank at the end of that month—and owed lenders $5.7M in the next year.

The final blows were the company’s failure to win a long-shot bid to build satellites for the SDA, and a failed mission as the satellite integrator for a November SpaceX rideshare mission. Momentus used a deployer built by the Dutch firm ISISpace, but several spacecraft failed to deploy.

Jeremiah Pate, the CEO of satellite data firm Lunasonde, lost his firm’s first spacecraft on the mission, and says it’s not clear today exactly what went wrong with the deployer. His next satellite will launch early this year—on a different rocket and with a different partner. Stressing his respect for Momentus’ engineers, Pate says “I don’t think they know their trajectory as a company at the moment.”

Momentus may not, either. The company didn’t respond to requests for comment.