NASA’s SBIR funding—particularly its Phase I & II tracks—has become a vital source of non-dilutive capital for early-stage space startups. At the same time, it has gained a reputation for coming up short in delivering on its larger Phase III programmatic contracts, leaving companies to navigate the “valley of death.”

Payload worked with NASA to pull granular phase-by-phase SBIR data and found that Phase III is a well-utilized program but can result in a limited payday.

SBIR 101: The Small Business Innovation Research (SBIR) program provides federal financial support for startup R&D projects. The program is divided into distinct phases, with a higher phase indicating a more technologically advanced project proposal and resulting in greater funding. The phases are not necessarily linear, as a company can go direct to Phase II, for example.

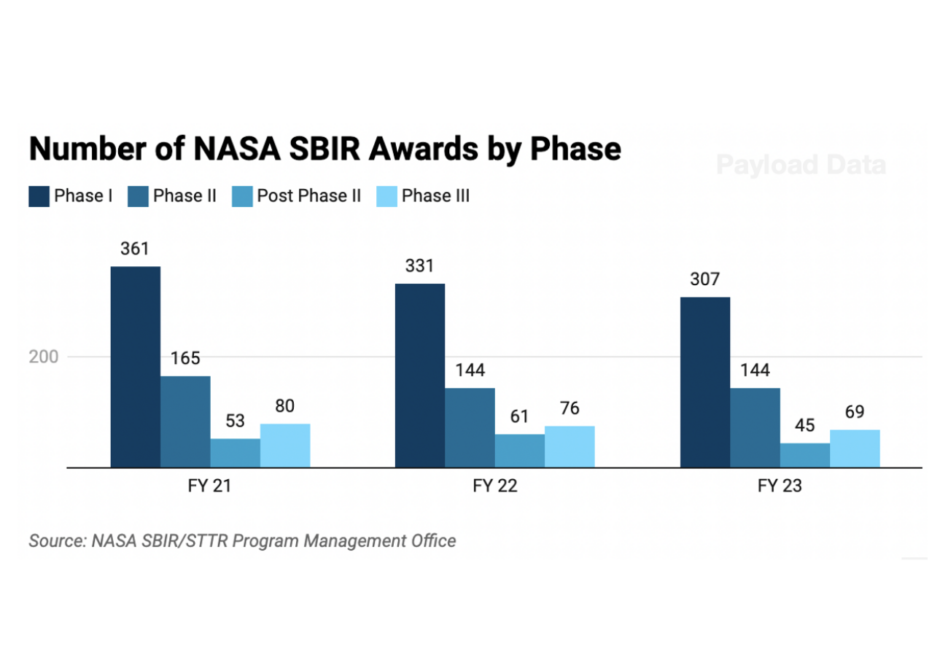

NASA’s Phase I, II, & III awards:

- Phase I: Early-stage R&D tech feasibility initiatives with awards often around $150,000.

- Phase II: R&D that is closer to the prototyping and testing phase with awards often around ~$800,000.

- Post-Phase II: In-between funding step that generally requires a match.

- Phase III: Award amounts vary widely from a couple hundred thousand dollars to $50M+ at the highest end (e.g., ICON, the Austin-based off-world construction startup was awarded $57.2M in SBIR Phase III funding in 2022). Phase III does not receive funding from the SBIR program; instead, it relies on NASA programmatic needs and their mission budgets.

- “NASA will find Phase IIIs when there is good programmatic alignment with what’s being developed in the prior phases,” NASA’s SBIR/STTR program executive Jason Kessler told Payload.

Valley of death: The “valley of death” refers to the technological and funding gap between early-stage Phase I and II R&D awards and Phase III commercialization. Industry participants have told Payload that Phase I and II funding feels fairly accessible with an element of randomness, whereas Phase III feels much more elusive.

Below is the granular phase-by-phase NASA award data for the last three years:

(Note: The graph shows the total volume of NASA awards, and is not meant to show or imply a phase-to-phase graduation rate. Phase III awards include some smaller small-dollar funds to match Post-Phase II awards, which skews the number of awards higher.)

NASA SBIR Phase I proposals have a ~30% success rate, moving on to Phase II is ~40%, NASA told Payload.

As technical readiness requirements increase, the number of awards declines—resulting in fairly consistent funding distribution.

- The number of Phase II awards is about half that of Phase I

- The number of Phase III awards is about half that of Phase II

The chart above shows that Phase III awards don’t suffer as steep a fall-off as their reputation for being impossible to achieve would suggest.

The total dollar outflow per phase introduces another side to the story.

(Note: Award funding is spread out over multiple years, and the data above is the funding portions obligated for each year. For example, NASA may only have a $3M yearly obligation on a $15M award.)

Phase III funding is generally consistent with the other tranches, except for Phase II awards, which have exceeded a total of $100M for each of the past three years (2021-2023).

Diving deeper into Phase III: Over the last three years, NASA’s Phase III program averaged 75 awards and $56M of funding outflows per year, a ratio that suggests somewhat limited funding per project. NASA says the ratio is skewed downward because its accounting includes some small-dollar Post-Phase II match funding. There have been large and heavily publicized wins (like CAPSTONE and ICON), but the broader takeaway is that not all Phase III awards result in massive windfalls.

Since Phase III contracts are often not multi-million dollar awards, they could present a more “gettable” opportunity, but a win may result in less of a boon for startups.

Other SBIR stats:

- Over half of SBIR awards are for developing tech relevant to NASA’s Moon to Mars exploration approach.

- Approximately one-third of Phase I awardees are first-time winners.

- Roughly one-quarter of awardees are from underrepresented groups.

Getting to Phase III

Phase III tech awards typically support major missions—like VIPER or CAPSTONE—with a high cost of failure for NASA.

Phase III proposals may not be selected because of:

- Insufficient readiness level

- Lack of alignment with programs

- Competitive criteria for Phase I & II not met

Importantly, startups also must master the art of good ole fashioned schmoozing.

NASA stresses the importance of developing a network with the agency’s community so that decision-makers can see the value of a technology. “It’s a lot on the firm to make sure that what they’re doing is understood and communicated to the programs,” said Kessler.

Pitfalls: For some startups, SBIR funding can be a distraction. Applying for an SBIR award could mean submitting a 15-20 page technical proposal, which can take 80+ hours to prepare and can ultimately result in a rejection or limited funding. If a startup wins an award, it may result in engineers spinning their wheels on a project that is outside of the company’s scope, and then relying on Phase III to carry the project over the finish line.

NASA clarified that the contracts should be commercially feasible and move the company’s mission forward on a product roadmap, and not be a side quest.

“If you’ve got a particular value proposition, you have to be really thoughtful around whether or not applying for this relatively close sub-topic makes sense because it might be too far removed from what your commercialization plan is,” said Kessler.

However, if a startup’s tech aligns with a NASA need, Phase III could offer a win-win—resulting in a substantial contract for a company.

(Aaron Sorenson contributed research to this piece)