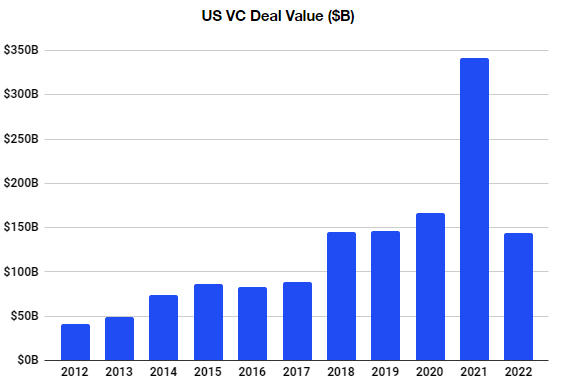

It’s been a rough start to the year for startup financing. In fact, Q2 saw the largest quarterly drop in venture funding in a decade. Higher-than-expected inflation growth, rising interest rates, and an energy crisis in Europe continue to threaten institutional capital deployment. VC-backed public listings reached a 13-year quarterly low, with eight completed this quarter as IPO liquidity has practically evaporated.

Space has largely been a mixed bag, with private investments this quarter up 32% from the previous quarter, but down 45% since last year. According to a new report by Space Capital, space infrastructure companies brought in $2.5B of private investment in Q2, largely driven by SpaceX’s $1.7B funding round (68% of the total).

Payload’s POV: “The companies that can generate real paying customers today are the ones that have the best chance of navigating the fundraising vacuum we’re in,” Payload’s Mo Islam recently told Axios. “If you fall into the 2nd or 3rd order business model and you don’t have 12-18 months of runway, government contracts to bridge the gap to commercial orders will be critical.”

Here are the top deals this quarter, ranked by size:

- SpaceX, $1.73B (Series Q)

- ExPace Technology, $237M (Series B)

- Capella Space, $97M (Series C–more here)

- Xinjinghe Laser Technology Development, $79M (Series D)

- OrienSpace, $65M (Series A)

- Apis Cor, $35M (Series A)

- Dawn Aerospace, $30M (Series A)

- X-BOW, $27M (Series A)

- Muon Space, $25M (Series A)

- Adranos Energetics, $20M (Series A)