A new remote-sensing company emerged from stealth on Wednesday with $12M in seed funding from investors including Lowercarbon Capital, Toyota Ventures, Pear, Mark Cuban, and E2MC.

Matter Intelligence is building a novel hyperspectral sensor that it plans to deploy on a satellite, Earth-1, and then across an entire constellation. The startup was founded by former JPL engineers Vishnu Sridhar and Thomas Chrien, plus former CalTech scientist Nathan Stein.

This capital will go toward the development of a spaceflight-ready sensor and software that the company will demonstrate on an aerial platform before the end of 2025, before raising another round of funding to send it into orbit.

Hype-rspectral: “Hyperspectral is such a buzz word,” CEO Sridhar told Payload, covering everything from multispectral cameras to true spectrometers.

Even as companies like Planet, Wyvern, Orbital Sidekick and Pixxel seek to put such sensors on orbit, investors clearly believe the near-magical insights gathered from spectral signatures leave opportunity for a new entrant.

Sridhar said Matter is aiming to leverage the team’s experience building bespoke sensors for Class A NASA missions to deliver unique data. It’s familiar territory for Sridhar, who led the team that developed the SuperCam for the Perseverance Mars Rover.

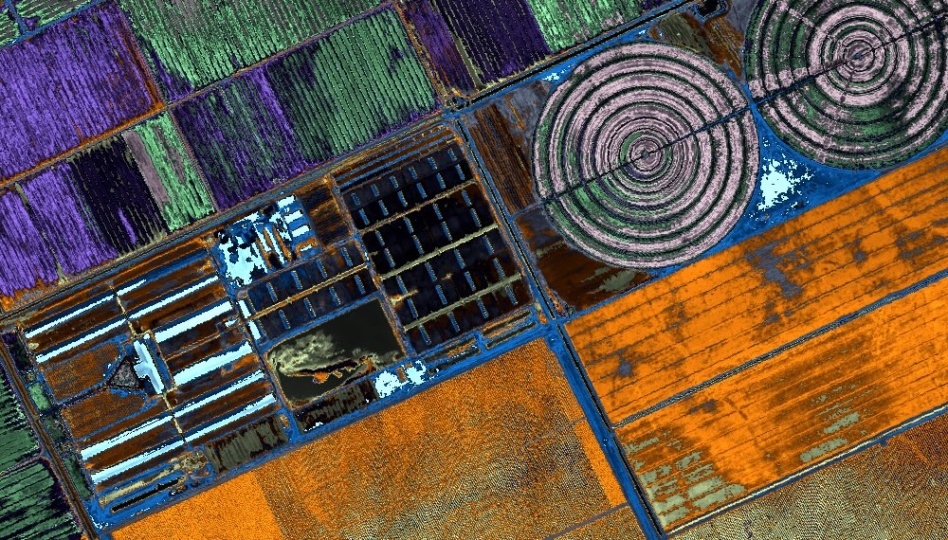

Matter’s single-aperture sensor will operate at sub-meter resolution and collect imagery across a range of spectral bands that is an “order of magnitude” higher than the JPL-built EMIT spectrometer on the ISS, which gathers data across 285 bands ranging from the visual spectrum deep into the infrared.

EO ROI: After his stint at JPL, Sridhar earned an MBA at Harvard Business School, and spent time talking to customers of commercial remote-sensing satellites.

“If you look at the ROI of all these EO companies, it’s not been net positive,” Sridhar said. “That goes back to the kind of data that they’re collecting, and people following capabilities and forcing them into use cases.”

Sridhar said customers “got tired of trying to brute force computer vision models” into data that isn’t fit to purpose, “so that’s why we’re trying to do the opposite in delivering and creating new data—that’s really going to push the boundaries of our AI models.”