Maxar booked $438M in revenue this quarter, down 7.3% YoY. Earth Intelligence revenue increased slightly YoY, while Space Infrastructure fell ~10% YoY.

The EO mainstay noted that sales within its Space Infrastructure segment dipped (or dove) by $36M, enough to put Maxar in the red. The company’s quarterly operating loss was $30M (vs. $45M YoY).

- Maxar’s backlog grew to $2.9B thanks to an increase in its Earth Intelligence segment. This dramatic increase in backlog could be good or bad for the company depending on its efficiency.

- Management maintained 2022 guidance ranges for Revenue and Adjusted EBITDA.

On segments: “Earth Intelligence continues to drive growth in high margin imagery revenue and Space Infrastructure continues to generate healthy margins. Both businesses see a solid pipeline of opportunities,” stated Biggs Porter, Chief Financial Officer.

Service vs. product: Maxar’s services business is outperforming product. Services revenue held steady with just a slight increase, while product revenue dropped nearly 19% YoY.

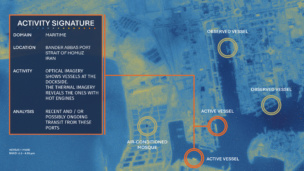

Q2 contracts: The NRO awarded Maxar a contract of up to $3.24B as part of its biggest ever EOCL allotment. If all goes as planned, Maxar will get ~$300M in years 1–4 and then $340M annually for the rest of the decade. The company announced yesterday that it was picked by L3Harris to build 14 spacecraft platforms for the Tranche 1 Tracking Layer with the SDA.

Maxar also launched the Outpost Mars Demo-1 mission, an experimental vehicle that will demonstrate metal cutting in space with Nanoracks this quarter on SpaceX’s Transporter 5.

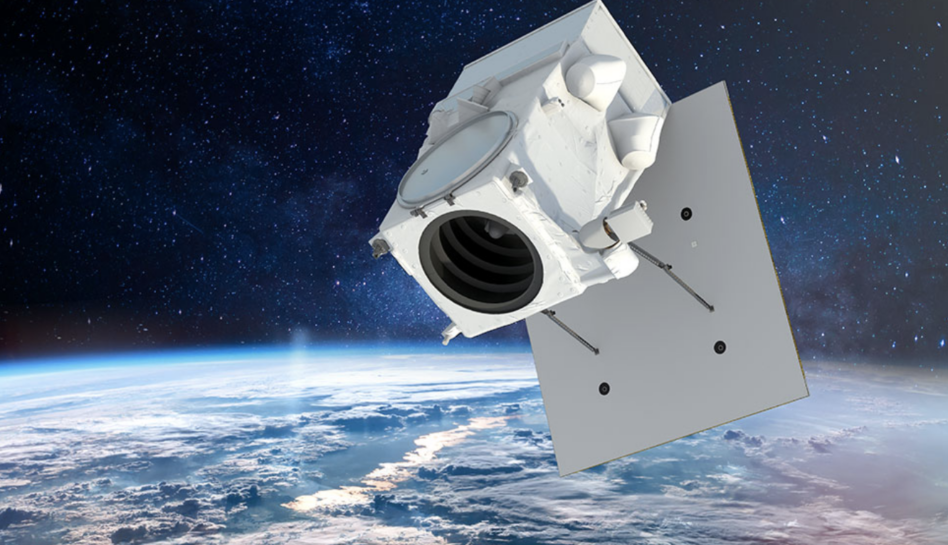

Looking ahead: Maxar delayed the first launch of its Worldview Legion. The highly-anticipated constellation will advance the company’s EO capacity.