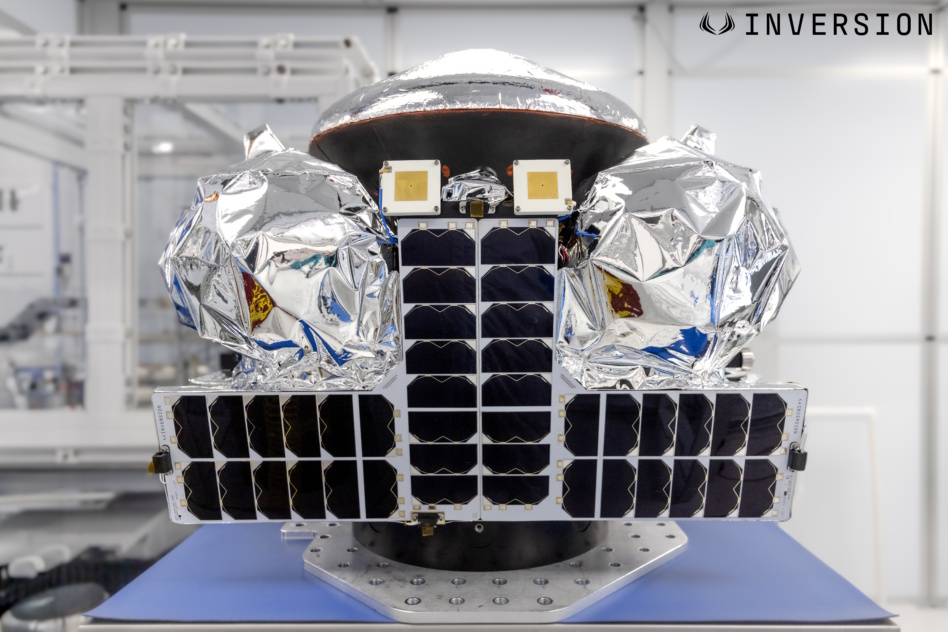

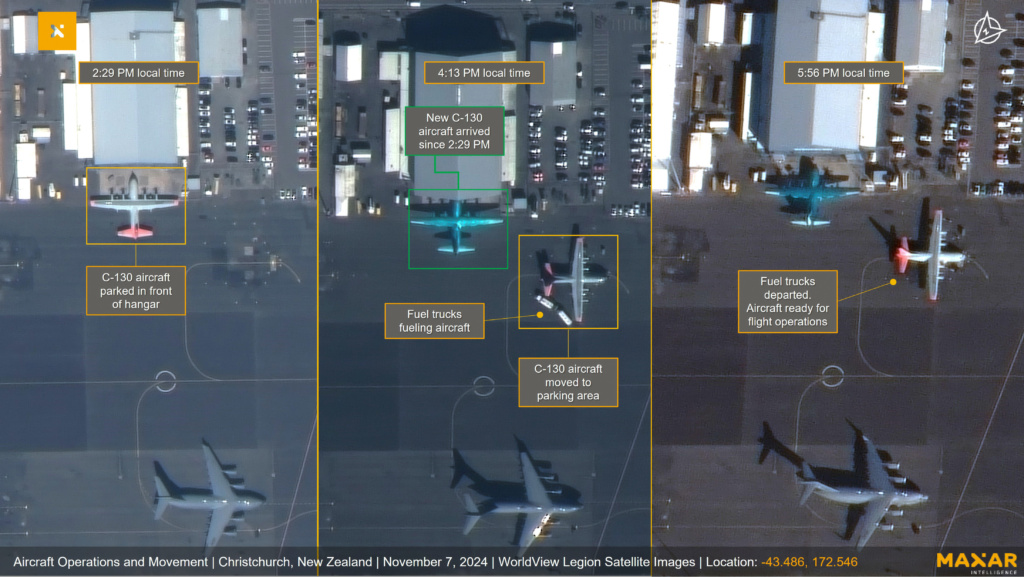

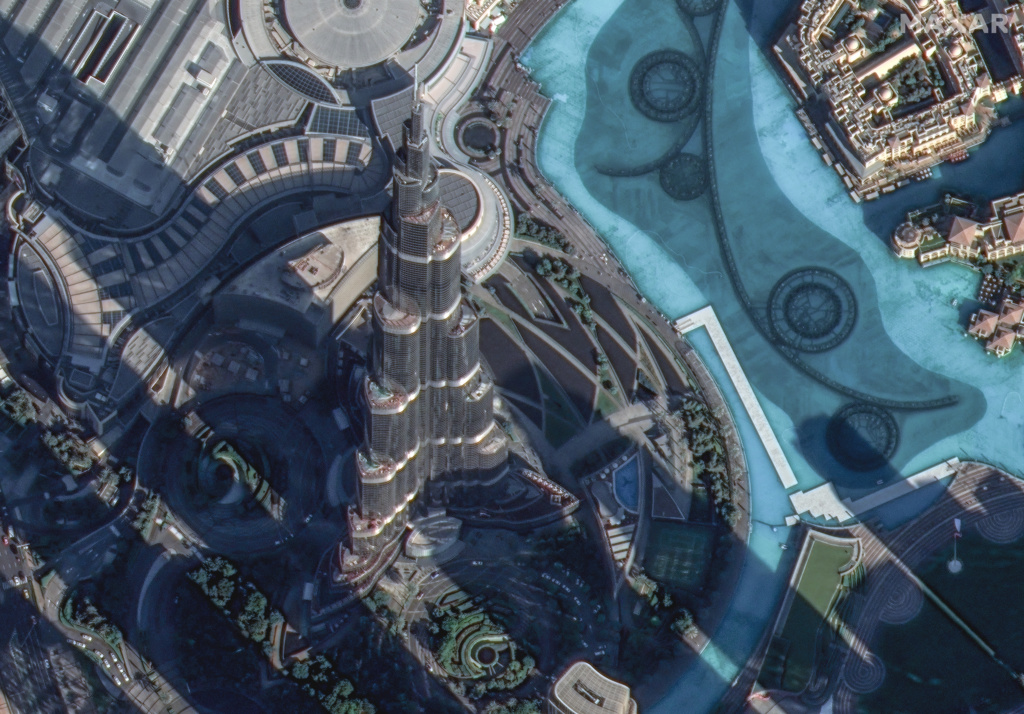

Maxar Intelligence shared the first imagery from its WorldView Legion 3 and 4 satellites this week. Payload caught up with CEO Dan Smoot about what these satellites enable and what he’s been up to during his first year leading the company.

New birds. The new satellites, launched in August, have begun delivering data to customers. Notably, these birds aren’t flying a typical sun-sync orbit, but are instead circling the globe at mid-inclination. That means they can image the most populated areas of the Earth more often and at different times, at the cost of spending more time in the dark.

“In certain regions, specifically in the AsiaPac regions, you’re going to get higher re-visits in certain areas … we’ve seen [positive] feedback from one of our customers in AsiaPac, who’s actually incorporated it into their direct access facility collection,” Smoot told Payload.

New bids? Smoot was hired for the top job at Maxar Intelligence last year, after PE firm Advent International took the company private and spun out its data business from its spacecraft manufacturing, now Maxar Space Systems.

Smoot’s team has been busy getting Legion spacecraft to the pad and commissioning them in orbit, with the final two spacecraft expected to launch in early 2025, but his focus has been getting the company in a strong financial position to invest in the future. That includes developing new analytics tools for 3D mapping and exploring potential M&A opportunities to add new capabilities.

“We are watching the market very carefully; quite candidly, we’re seeing some stress and pressure in the market,” Smoot said. “While we continue to focus on our financial strength, we will be opportunistic if there’s an opportunity to look at anybody or anything that can help our constellations and our value.”

Analytics integration: EO companies differ on how much investment they put into analysis and AI model building—some want to be pure data collectors; others want to offer more tools.

Put Maxar in the latter camp: “Customers are demanding it,” Smoot said. “If you think about the average analyst, it doesn’t matter for enterprise or government, intel or defense, making the analyst more productive and faster is one of the most important things that we’re trying to do.”

Model models. Smoot makes what he calls a “controversial” argument: The specific software capabilities are less important than delivery of relevant data at his speeds.

“We fundamentally believe that our operational infrastructure and operational capabilities to collect and distribute information is much stronger than anybody else in the industry,” Smoot told Payload. “An AI pure-play company, from an analytics perspective, is going to struggle, because they don’t have the control of the data.”

Maxar boasts a 125+ petabyte EO database collected in the previous decades, and Smoot says to look out for more partnerships with companies to leverage that data.

The Elephant in orbit. SpaceX’s defense-focused Starshield network is reportedly collecting EO data as well as acting as a communications provider, something that other EO companies are watching warily.

While he wouldn’t comment on classified discussions, Smoot said that “what SpaceX is doing in the marketplace, especially the communications networks that they’re delivering, will allow us to deal with latency challenges. I don’t see SpaceX as a competitor at this point. I actually see them as a potential collaborating partner.”