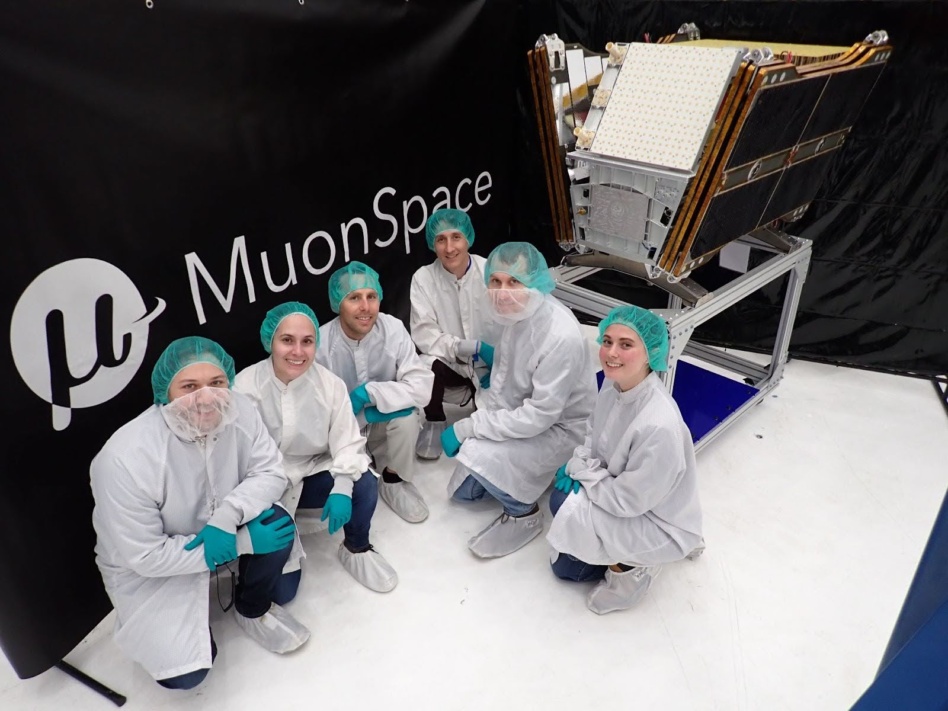

Muon Space, the California-based satellite builder and operator, said today that it won an NRO Stage II contract to expand the agency’s portfolio of commercial EO data.

The NRO’s Strategic Commercial Enhancements program chose Muon for onboarding in 2023. The new contract will allow the intelligence agency to purchase EO IR data gathered by Muon’s FireSat prototype, launched in March on SpaceX’s Transporter-13 mission.

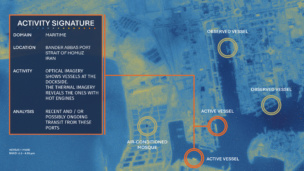

Mind the gap: These commercial enhancement contracts are designed to add unique data to the NRO’s tool chest; previous solicitations targeted hyperspectral, radar, and RF. Muon collects IR data, an area in which US commercial providers lag behind Chinese competitors.

“We are excited to be somewhat unique in the US—and especially in the new space community—having not only real customers around the IR data space, but also having developed what we think is cutting edge instrument technology,” Muon CEO Jonny Dyer told Payload.

If the NRO finds Muon’s data useful during this pilot program, Dyer hopes to build more spacecraft and secure a more permanent procurement mechanism.

You down with SCE? The other four companies in Muon’s SCE contract class didn’t respond to inquiries. One, Hydrosat, will rely on satellites built by Muon and isn’t ready to deliver data; two others, Albedo and Turion, also launched on Transporter-13 with their own spacecraft that could provide data to the NRO. It’s not clear what kind of spacecraft the final participant, Airbus US Space and Defense, plans to use to fulfill its NRO contract.

End-to-end: Muon will launch four more spacecraft this year for customers, and plans to launch 12 more in 2026, with the goal of developing capacity to support production of 100 spacecraft a year in 2027. The company has a unique approach to vertical integration. It offers customers a total package from conception to operation, rather than just a bus or a finished satellite.

“It’s not going to be, ‘Here’s the box of parts; best of luck to you,’” Dyer said. “Our goal is to operate at the scale and cost of somebody that’s just building a factory cranking out Model T buses, but in a way that actually solves an end-user need.”