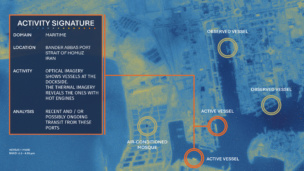

Russia’s invasion of Ukraine three years ago this week catapulted EO tech into the spotlight, providing a bird’s eye view of everything from Russia’s build up of military equipment along the border to the theft of Ukrainian grain.

Seeing the benefits of EO before and during the conflict, industry officials said other countries have been actively pursuing their own EO capabilities to make sure they could access EO data if needed during a crisis.

Zoom out: While the Gulf War in 1991 is widely seen as the first space war because of the reliance on GPS and satellite comms, the conflict in Ukraine is the first in which commercial space companies played a significant role. In the days preceding the invasion, commercial satellite imagery provided visible evidence to cut through Moscow’s denials.

“This is really the first serious ground war where you had commercial space assets being able to collect images of battle space from space,” Peter Wilczynski, the chief product officer at Maxar Intelligence, told Payload. “It made a lot of countries think… did they have the capabilities to do that, especially in Europe.”

Global reach: Since the conflict began, Planet Labs’ CEO Will Marshall told Payload that he’s seen countries making sure they have independent access to intelligence assets, such as EO, that are critical to decision making in times of conflict.

“Now more than ever, this includes guaranteeing access to space and the powerful information-gathering and decision-making EO satellites and data provide,” Marshall said via email.

The numbers back this up. Two of the biggest EO providers—Planet and Maxar—have both released a number of international deals in recent months. Since December, Maxar has announced a $14M deal with the Dutch Ministry of Defense and $35M worth of tasking contracts with two Asia-Pacific nations. And last month, Planet announced a $230M contract with Sky Perfect JSAT to boost EO data collected over the Pacific.

What’s next: Even while the war in Ukraine stretches on, industry is already trying to incorporate lessons learned to be better prepared for the inevitable next conflict.

One of the biggest takeaways? The importance of resilience and secure infrastructure, according to Dalia Bankauskaitė, a CEPA senior fellow, and Dom Milasius, a deep tech entrepreneur.

“Russia’s attempts to jam and disable satellite communications and EO assets underscored the need for hardened, redundant networks,” they said in a statement. “Governments are now rethinking procurement strategies, increasingly integrating commercial constellations into defense planning rather than relying solely on classified national assets.”