NRO’s NROL-85 launches. Image: SpaceX/NRO.

As if Wednesday wasn’t already filled to the brim with space news, the National Reconaissance Office also had to flex on us and announce its “largest-ever commercial imagery contract.” EOCL, imagery, billions of dollars…let’s break it down:

- The agency awarded Electro-Optical Commercial Layer (EOCL) contracts to BlackSky ($BSKY), Maxar ($MAXR), and Planet ($PL).

- The NRO isn’t messing around, noting that the EOCL contracts “mark a historic expansion of the NRO’s acquisition of commercial imagery to meet increasing customer demands with greater capacity than ever before.”

- The awards are worth billions of dollars and stretch across the next decade.

How many billions?

Yesterday, Maxar said its contract is worth $3.4B across 10 years with ~$300M in year #1–4 and then $340M annually for the rest of the decade (H/T Case Martin). BlackSky’s contract is worth up to $1B. We weren’t able to find any details/filings on Planet’s contract, so the company will likely hold out on sharing deets until earnings in mid-June.

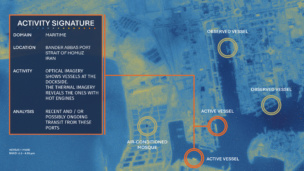

The EOCL nitty gritty, via NRO

“EOCL includes a substantial increase in requirements for foundation data, intelligence points, and non-taskable data collection; shortwave infrared, nighttime, and non-earth imaging; and direct downlink to theater-based remote ground terminals.” The spy agency said it demonstrated this “vital capability” for the Pentagon in multiple exercises across the past year.

The market’s reaction: 📈📈📈

$MAXR traded up ~18%, while $PL jumped 14% and $BSKY shares rocketed upwards by *checks notes* 96%. Adding some perspective here:

- Maxar’s market cap is $2.13B. The stock is down just 2.3% year-to-date.

- Planet’s market cap is $1.54B. The SF company is down 6.8% YTD.

- Rounding out the pack, BlackSky’s market cap is ~$281M. $BSKY shares are down 48% YTD.

Based on the numbers alone, it would seem BlackSky is punching above its weight with the EOCL contract. The company would argue, though, that it was built for precisely this. “We started out in government and are a trusted provider to that market,” BlackSky CEO Brian O’Toole told Payload earlier this year.