This week, Orbital Sidekick announced a $10M raise from a group of strategic and existing investors. Energy Innovation Capital led the round, with energy firms Williams and ONEOK participating. The University of Minnesota’s endowment fund, 11.2 Capital, Syndicate 708, and In-Q-Tel also joined the round.

Six-year-old, SF-based Orbital Sidekick is preparing to launch a six-bird hyperspectral sensing constellation this year. That fleet, known as GHOSt, will go up on three SpaceX Transporter rideshare missions throughout 2023. Each GHOSt satellite is ~100kg in size.

- GHOSt stands for “Global Hyperspectral Observation Satellite,” and has to be one of the best constellation names that we’ve heard to date.

- SIGMA, short for “Spectral Intelligence Global Monitoring Application,” ain’t bad either. SIGMA refers to Orbital Sidekick’s hyperspectral “intelligence” engine for end users.

“We think of ourselves more as an intelligence company than a satellite company,” Orbital Sidekick CEO Dan Katz told Payload, because it sells analytics (or “intelligence”) rather than raw space data.

The hyperspectral pitch

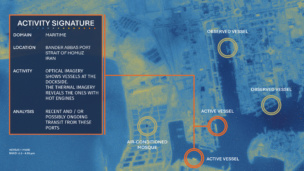

Hyperspectral sensors let us observe changes on Earth’s surface that aren’t obvious to existing satellites or the human eye. GHOSt will capture images in 500+ contiguous color bands, from visible to short-wave infrared, across the electromagnetic spectrum.

Example use case: Since the vast majority of pipelines are buried underground, a methane leak might not be easily or immediately detected. “Because we have all of these spectral channels and we’re not just looking for methane, we can look at the secondary indicators of an underground leak,” Katz said. “If methane is leaking underground, it’s gonna affect the spectral signature of the surrounding environment…the soil, the vegetation, the water. We can pick that up.”

Finding PMF

Orbital Sidekick works with the energy sector and government customers. By bringing customers on to its cap table, the startup has validated the business model, Katz argued. “This is why we’re really excited about this latest round,” he said. “It really is important with hyperspectral to provide good product-market fit (PMF). Are we actually solving a real-world tangible problem and not just supplying hyperspectral data to these end users?”

Beyond PMF, a bet on Orbital Sidekick—be it investor or customer—is a bet that vertical integration (acquisition, processing, and analytics) in Earth observation is better than picking off one part of the value chain.

What’s next? Orbital Sidekick has trained its AI models, learned from demo sensors on orbit, and received early votes of confidence. The next step is to launch GHOSt and see whether customers can detect changes in the field early and sustainably.