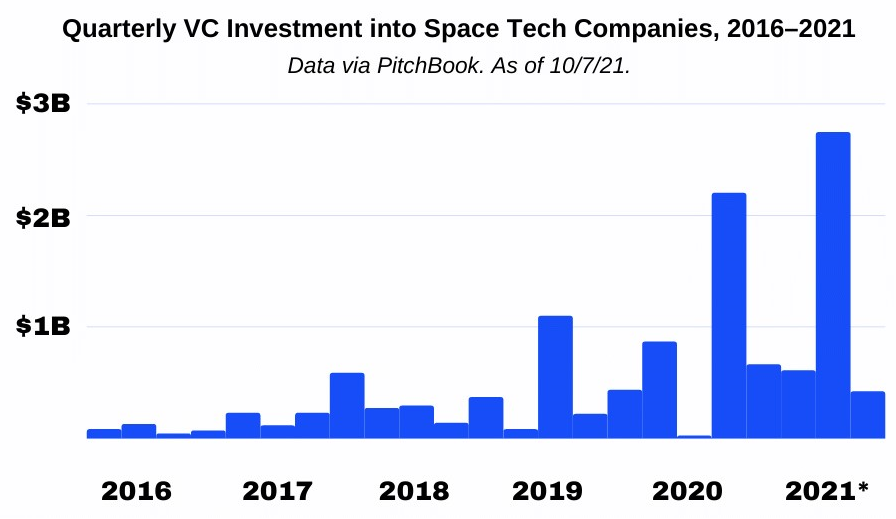

t’s already been a banner year for VCs and we still have three months to go. That’s the takeaway from the Venture Monitor report, published by PitchBook and NVCA this morning. Let’s break out the “space tech” investment data.

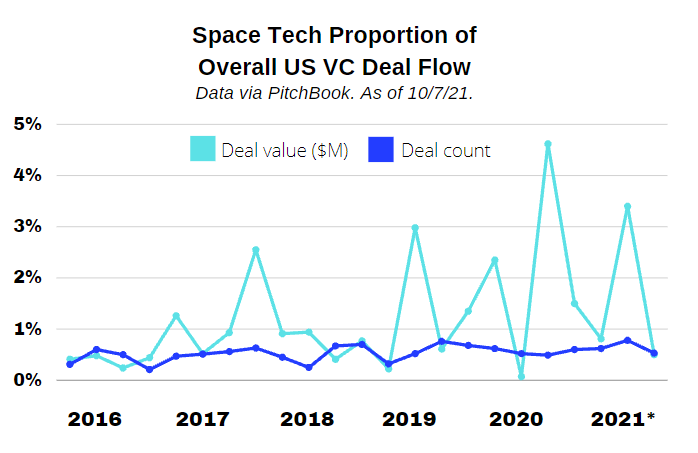

Since 2016, space tech has accounted for ~1.2% of all VC funding. That proportion jumps around in quite erratically, as you can see above, due to episodic mega-deals.

We’re unsure where to draw the line at what is and isn’t a mega-deal. We’ll leave that to you. But here are the top deals so far this year, ordered by size:

- SpaceX, ~$1.2B (April)

- Relativity Space, $650M (June)

- Astranis, $281M (April)

- ICON Technology, $207M (August)

- ABL Space Systems, $170M (March)

- Axiom Space, $130M (February)

- Climavision, $100M (June)

- Tomorrow.io, $77M (March)

- Firefly Aerospace, $75M (April)

- Orbital Insight, $73M (May)

Total quarterly investment is also heavily impacted by mega-deals. In this graph, you can also see the pandemic’s effect on space investing very clearly: