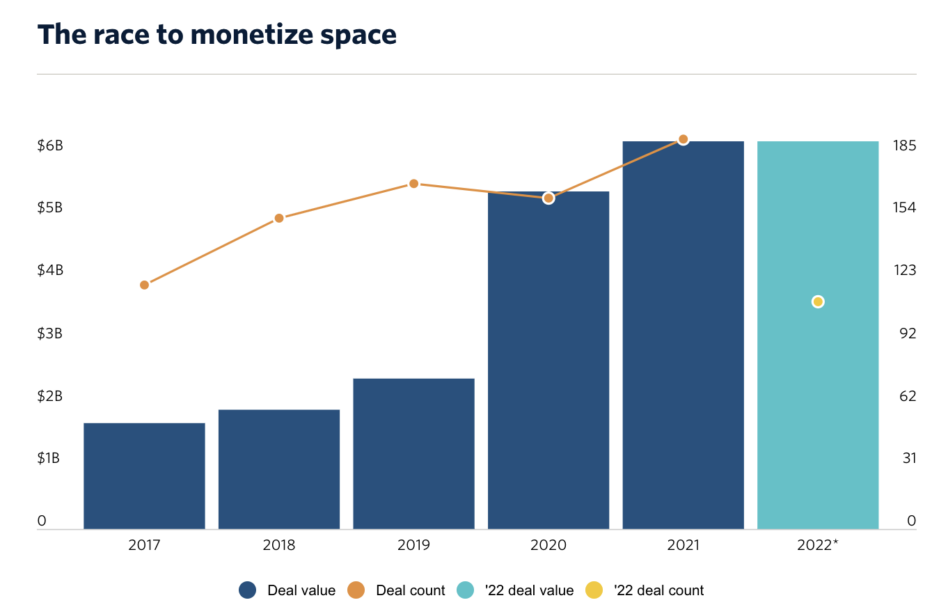

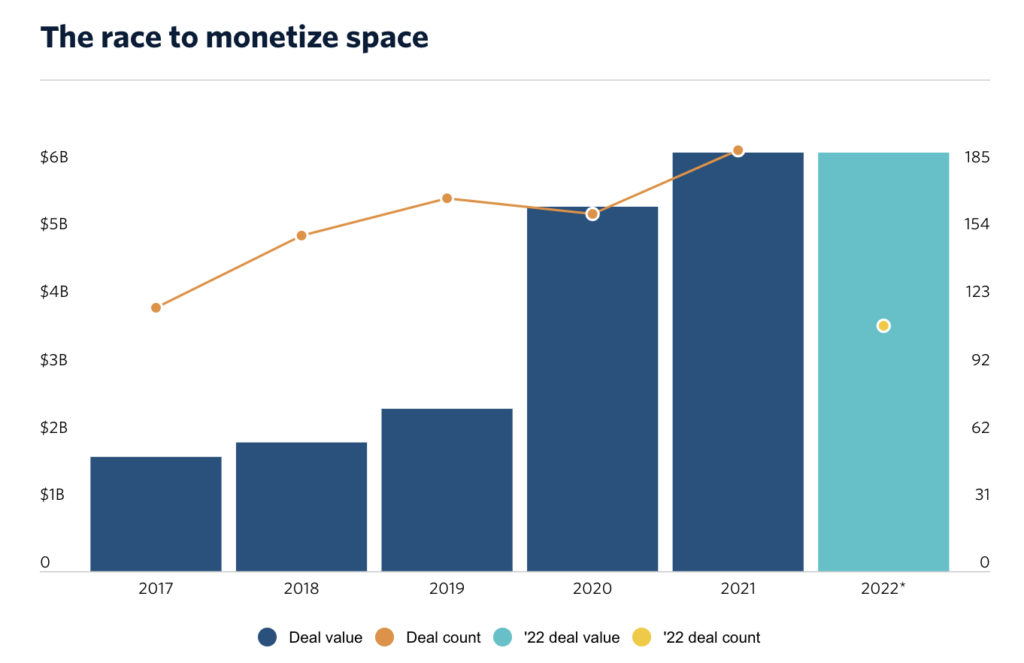

Despite deteriorating economic conditions on Earth—and plenty of reasons to be bearish on the sector—space tech is set to have a banner year in VC funding.

Global venture investment into space startups totals ~$6.2B billion this year, according to a recent PitchBook tally (the data runs through Oct. 24). That’s roughly the same amount as 2021, itself a record year, and we still have two months to go.

2021 saw 192 space deals vs. this year’s 112. Deal count is tracking to be lower this year, while deal size is set to be higher on average.

Some observations

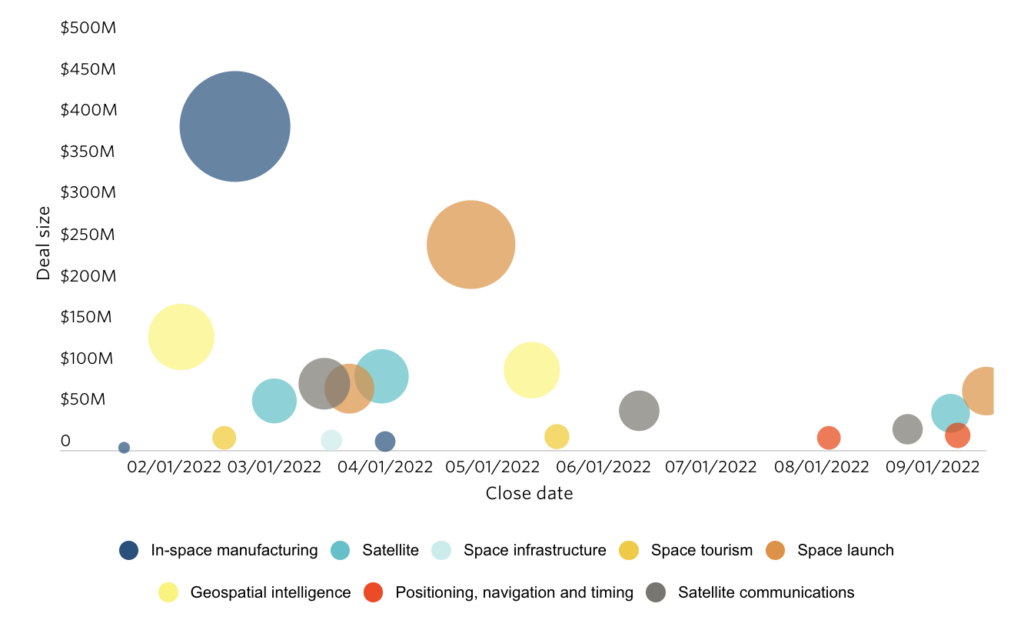

The distribution of capital is lopsided. SpaceX, the US’ most valuable startup, continues to dominate everyone else by a lead equivalent to Pluto’s distance from Earth. The launch juggernaut has raised $3.6B+ YTD. Other companies with mega-rounds that PitchBook highlighted include Iceye ($136M Series D), Hadrian ($90M), and Firefly ($75M).

The focus. While VCs spread the love across multiple space sub-sectors, they saved most of that love for EO, satellite communications, and launch.

Admittedly, for our purposes, this data is a bit skewed. ICON, a 3D-printing startup with plans for–but not a focus on–space, represents the big blue dot. Image: PitchBookWidening the aperture to aerospace & defense (A&D)

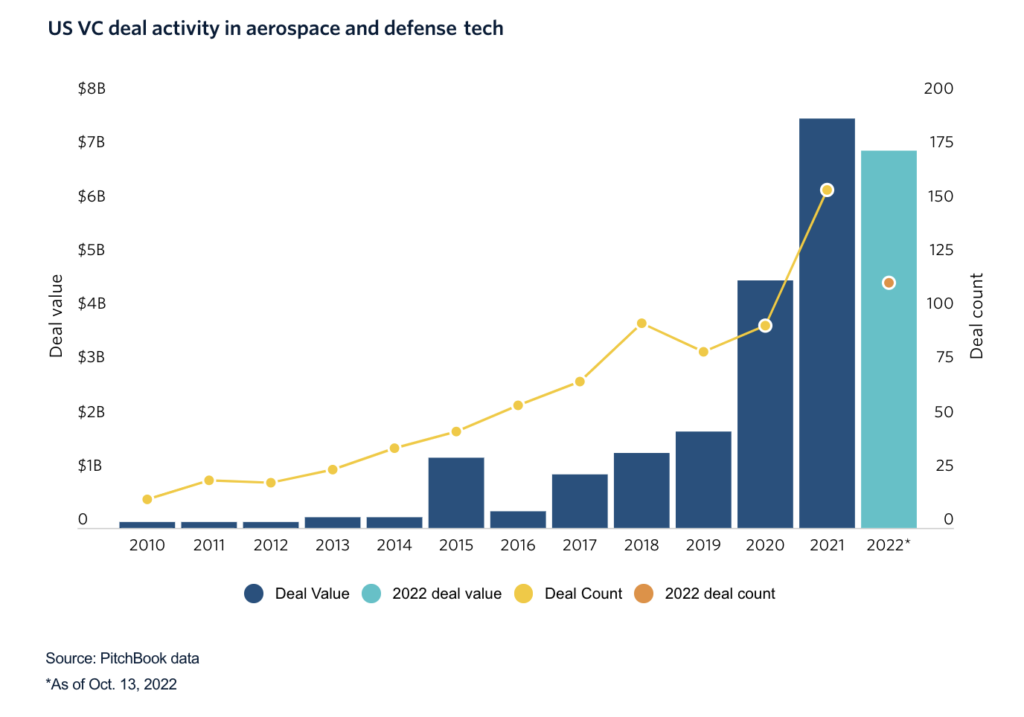

Led by Founders Fund, Lux Capital, and a16z, military- and security-related investments are once again in vogue. American A&D startups bagged $7B in venture financing through Oct. 13, per PitchBook. One theory for why deal-making in the dual-use space is more resilient than other sectors:

- Government spending is counter-cyclical.

- Russia’s invasion of Ukraine and long-simmering tensions with China have driven Western governments to boost defense budgets.

- “Companies focused on defense and security are considered recession-proof,” PitchBook asserts.

It wasn’t too long ago that venture capitalists saw defense tech as persona non grata. “Since the early 2000s, you had a movement of people that felt that [working on these technologies] was taboo,” Lux Capital’s Josh Wolfe told PitchBook.

Payload’s prediction: Dollars will keep flowing into the A&D space, as geopolitical tensions accelerate defense budgets and the quest for space supremacy. That said, newly public space companies are having a rough go of it, liquidity is drying up, and the cost of capital is climbing. Consolidation and business closures will continue until morale improves.

At the end of the day, the data suggests that despite the shakeouts, space is still open for business.