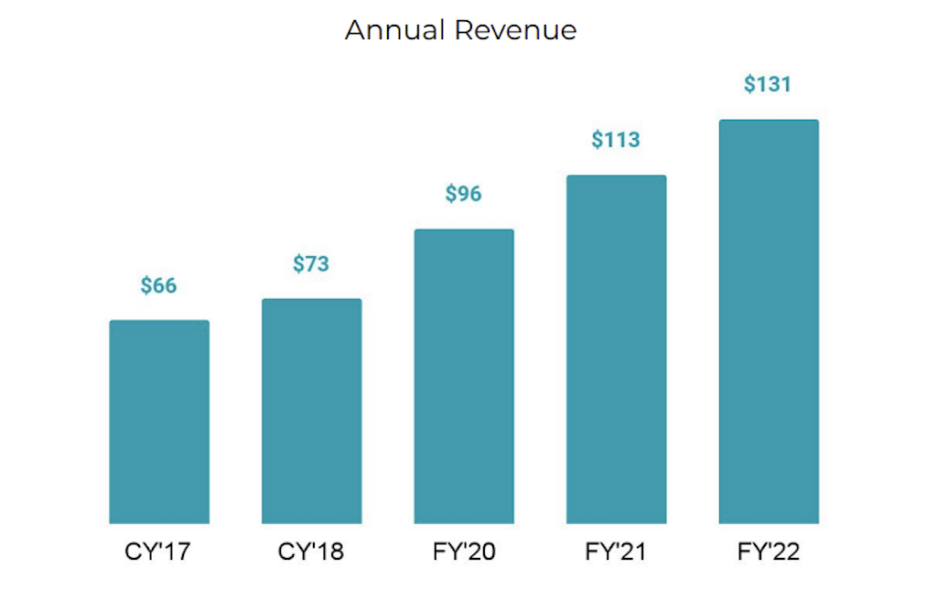

On Thursday, Planet released Q4 and full-year (for the fiscal year ended January 31, 2022) financial results.

Planet booked $131.2M in revenue last year, the company said yesterday in Q4 & FY 21 financial results. The planet-scanning company is growing at a healthy clip: 2021’s results represent a 16% jump over 2020.

- Q4 was Planet’s strongest quarter of the year, with $37.1M in revenue (up 23% YoY).

- Planet grew its customer base by 25% YoY to 770, including a 38% growth in customers with $1M+ contracts..

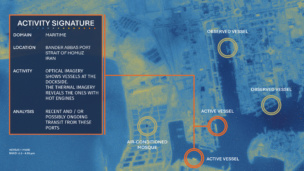

- Half of Planet’s customers are based in North America. And just over 50% of the company’s business is with government and military users.

- Gross margins grew to 37% (up from 23%)..

- Planet ended 2021 with $491M cash on the balance sheet.

All grown up: Hatched in 2012 by a trio of former NASA scientists, Planet set itself apart by leveraging new compact satellite form factors, software-first design principles, and “agile development.” Now, as a public company, Planet pitches itself as the “bloomberg terminal” for all types of Earth data. The company has received (we’d guess) an unprecedented boom in interest and exposure, due to its role as a provider of imagery of Ukraine.

Looking forward: Planet de-SPAC’d in late December, and as a public company, it now wants to command software valuation multiples. The company breaks out metrics like ARR, ACV, and net dollar retention rate, and will continue pitching itself as a “one to many data platform.”

For 2022, Planet predicts a 30-45% jump in revenue and a 43-50% non-GAAP gross margin. They plan to continue expansion activities like hiring amongst commercial and software teams, expanding data products, and continuing M&A activity after this year’s acquisition of Vandersat.