Image: Planet

On Tuesday, Planet released its Q1 2023 earnings for the period ending April 30th 2022. Planet’s stock traded down 10% after hours despite record Q1 revenue, likely due to a spike in net loss and a downward adjustment on full-year revenue guidance.

The numbers: Planet booked $40M in revenue in the first quarter of their fiscal year, up ~26% YoY, due the acceleration of its data subscription service, the company said yesterday. Planet also expects the revenue growth rate to more than double YoY for FY ’23.

- Adj. EBITDA: -$16.3M, up 340% YoY from -$3.7M

- Cash on hand: $484.5M

- Net Loss: $44.3M vs. $3.7M YoY

- Customer base: 43% commercial, 30% defense and intelligence, 27% civil government

- Adjusted FY revenue guidance to $177M – $187M from $170M – $190M

✨New✨…Over half of Planet’s customers are now based in North America. The company also split out RoW (rest of world) for the first time: APAC (22%), EMEA (17%), and LATAM (4%)

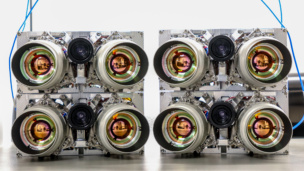

Lots of updates since Q4. Since the last earnings release, Planet received a landmark EOCL Award from the NRO, the company’s largest contract to date. It surpassed 800 customers and announced Pelican, its new generation of satellites intended to upgrade the 21 SkySats currently in orbit. Planet also launched its Planetary Variables product.

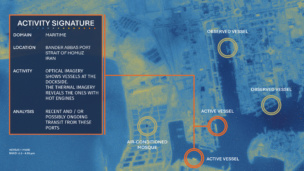

EO changes conflict. Planet imagery, along with other EO providers, has played a vital role in increasing transparency around the war in Ukraine, showing active damage of critical infrastructure, real-time insight into the battle for Snake Island, evidence of mass graves, and more.

Looking ahead: Growth-stage EO players may take solace in the relative stability afforded by public sector contracts. While that may help them weather the current storm better than their terrestrial tech peers, satellite operators have pitched themselves as software companies. That can cut both ways: software valuations were high when the going was good, but multiples have now compressed significantly and fallen back down to Earth.