Private space companies raised $17.9B last year—a 25% reduction from 2022 and the lowest in ten years, according to a report released today by venture fund Space Capital.

Bigger picture: Overall venture investment fell 38% from 2022 to 2023. Rising interest rates, a spate of bank failures, and bad returns from publicly-traded space firms made private investors leery of throwing cash at capital-intensive start-ups.

The biggest losers were firms utilizing space data, particularly location-based services. One major exception: Metropolis, a company that uses machine learning and GPS data to manage parking facilities, saw the largest single deal of the previous quarter, raising more than $1B. Moving forward, Space Capital predicts using AI to boost the value of data collected in space will be a top theme for 2024.

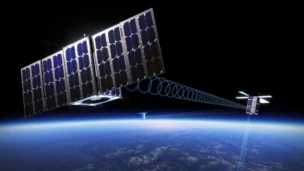

Bright spots: Investment in emerging industries—companies with novel business models such as building commercial space stations, in-space manufacturing and servicing, and space traffic management—rose 250%, to $2B.

More importantly, investment in companies developing space infrastructure—hardware and software to build, launch, and operate space assets—increased 30% this year, driven by government spending, and investments in mature companies like Advent International’s $6.4B purchase of Maxar, and Jeff Bezos putting $2B into Blue Origin.

These investments could help prime the pump for firms further down the tech stack to succeed. Space Capital’s analysts have high hopes for the unprecedented payload capacity of SpaceX’s Starship to enable new business models, but it’s doubtful we’ll see those effects until the vehicle is flying regularly.

Consolidation ahead: Space Capital reports 39 acquisitions of space companies in 2023, a decade high. If central banks begin to cut rates next year as many economists expect, Space Capital expects more M&A activity and (though this is hard to believe) renewed interest in IPOs.