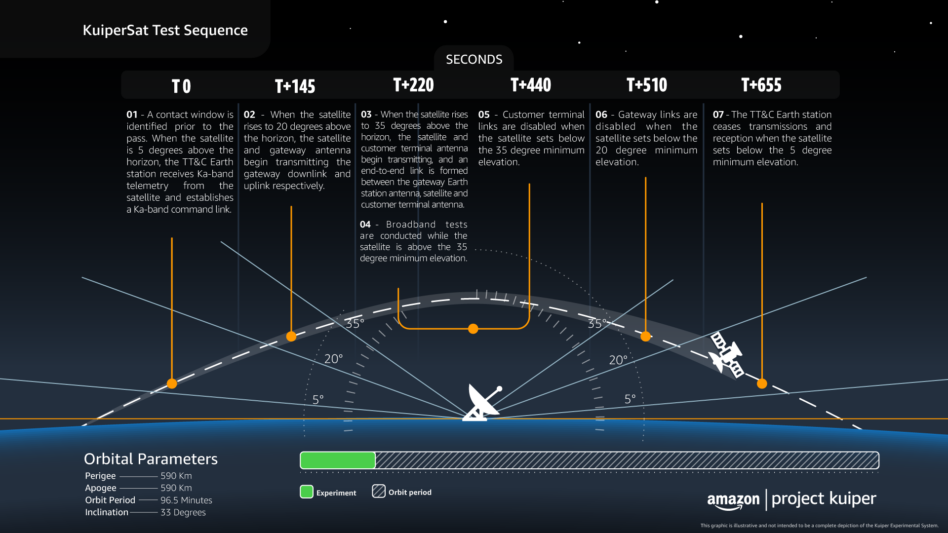

Yesterday, Amazon subsidiary Kuiper Systems asked the US for approval to launch two demonstration satellites, KuiperSat-1 and KuiperSat-2. See the FCC filing here.

Amazon says the prototypes will include “much of the technology and subsystems” that will be in Kuiper production satellites. Over the course of two years, Kuiper will validate the satellites’ tech stack on-orbit…and test links with customer terminals and ground stations in South America, Asia, and Texas.

Assuming its application is accepted, KuiperSat-1 and -2 will launch on separate ABL Space Systems RS1 rockets by Q4 2022.

ABL is aiming for a RS1 orbital launch before the end of this year. Though RS1 has yet to reach space, its builder has received votes of confidence from investors and customers. Last week, El Segundo, CA-based ABL announced a $200M raise at a $2.4B valuation. The small launcher has raised $420M since its 2017 inception.

- ABL plans to charge $12M per launch. The company says it has active contracts with 14 customers, totaling 75+ launches.

- Lockheed, an ABL backer, purchased a block of up to 58 launches from the company through 2029.

Launch strategy: Amazon isn’t putting all of its eggs in one rocket basket. In April, the company purchased nine Atlas V flights from United Launch Alliance (ULA). Kuiper is also in talks with other launchers, including low-Earth orbit (LEO) rival SpaceX, Amazon VP Rajeev Badyal told the NYT.

SpaceX, by contrast, can (and has) put its Starlink eggs in one basket. The Falcon rocket family has hoisted 1,700+ internet satellites into orbit, giving Starlink quite a headstart over competing constellations. For reference, SpaceX launched Microsat-2a and Microsat-2b, a pair of test Starlink satellites, in Feb. 2018.