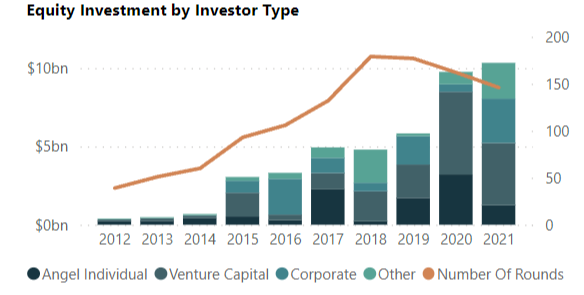

Space Capital has published its quarterly report tracking private investment in the space sector. Investors put roughly $8.7 billion to work in Q3 2021, backing a total of 112 space companies.

In Q3, while the lion’s share of money went to growth- and late-stage companies, smaller startups pulled in $1.5 billion and represented 59% of all deals closed.

NB: Space Capital’s methodology includes “applications,” a category enabled by space assets but not necessarily space-first itself. Delivery service GoPuff, for example, falls into this category.

Notable highlight: Space infrastructure, defined as “hardware and software to build, launch, and operate space-based assets,” has received $10.3 billion in investment YTD. Space infrastructure had its largest quarter on record in Q3, with $3.9 billion in new investment. Launch companies received $700 million, while satellite players pulled in $2.8 billion (these figures include SPAC deals and associated PIPE investments).

Here’s Space Capital’s data on private investment in space infrastructure, dating back to 2012: