It’s been a five-coffee-a-day week for analysts tracking the “primes” and publicly traded contractors that make up the US defense and aerospace (A&D) industrial base and sell fighter jets, weapons systems, and advanced spacecraft to the Pentagon.

Of the US’ prime contractors, Lockheed posted Q2 earnings last week, with Northrop Grumman, Raytheon, General Dynamics, and Boeing reporting over the past few days. ICYMI, here’s our Boeing and Airbus recaps.

The outlook? Quite the mixed bag–let’s dive in.

Looking back to last Tuesday with $LMT…

Lockheed missed on top- and bottom-line expectations, with revenue falling 9% year-over-year (YoY) to $15.4B (vs. ~$16B est) and earnings per share (EPS) of $1.16 (vs. $1.88 est).

- The company also lowered guidance for the full year on both revenue and EPS, attributing the adjustment to supply chain disruptions and sluggish F-35 sales.

- The stock showed support, however, after Lockheed reported reaching a “handshake” agreement with the Pentagon on a three-year, $30B deal to build ~375 F-35s.

LM Space: Q2 revenue decreased 11% YoY to $2.8B, with operating profit dropping 20% YoY to $268M. Management cited the timing and mix of ULA launches, of which Lockheed owns $50%, along with lower profit rate adjustments.

Notably Lockheed does not expect the recent increase in DoD budgets or European defense spending to have much impact on its 2023 outlook (due to the long-cycle nature of defense).

Rolling right along to $RTX

Raytheon was a mixed bag with revenue of $16.3B, missing expectations ($16.7B est) but beating on earnings ($1.16 actual vs. $1.12 est). Raytheon reiterated full-year guidance of $67.8B–$68.8B in annual revenue. It also bought back $1B worth of RTX shares in Q2, and plans to purchase $2.5B over the course of 2022.

Under the hood, earnings expectations for Raytheon’s Intelligence & Space (I&S) division ($348M actual vs $468M est) were down. Management attributed the dip to lower I&S “net program efficiencies” (in other words, execution issues).

- I&S sales dropped 6% YoY to ~$3.6B

- Operating profit margin was 8.8%, down 210bps YoY.

Raytheon closed out Q2 with a backlog of $161B, of which $96B was from its commercial aerospace order book.

Now, on to $NOC

Northrop Grumman’s Q2 was also a mixed bag, with a top-line miss ($8.8B in actual revenue vs. $9.1B est) and bottom-line miss, with EPS of $6.06 (vs. $6.10 est). A bright spot in the Q2 results was Northrop’s Space Systems division, which reported $3.8B of revenue (vs. $2.9B est).

+ While we’re here: Investors are keeping a close eye on the new antitrust review of the Orbital ATK acquisition. Politico reported last week that the FTC is weighing legal action against Northrop for supposed violations of a 2018 settlement that allowed the company to acquire Orbital ATK, the dominant supplier of large solid rocket motors.

- The commission could seek to toughen the terms of the settlement deal or sue to overturn it entirely, per Politico.

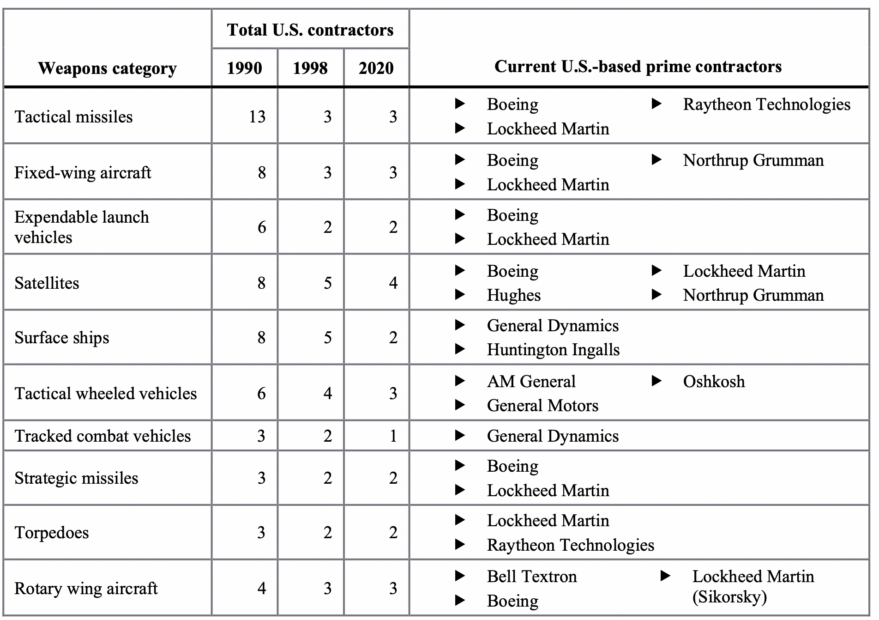

In one of the most watershed A&D consolidation plays in recent memory, Northrop acquired Orbital ATK back in June 2018. Orbital ATK is one of the two key solid rocket motor manufacturers in the country (the other being Aerojet Rocketdyne).

The FTC says Northrop violated settlement terms by slow-rolling negotiations with Boeing on a recent rocket motor deal, after promising fair treatment of its competitors. Northrop CEO Kathy Warden said this week she doesn’t believe the scrutiny will adversely affect Northrop’s underlying business.

Got time for $GD?

General Dynamics’ revenues of $9.2B (vs. $9.4B est) missed forecasts, with management citing the supply chain issues that have been plaguing the entire industry. But EPS of $2.75 (vs. $2.72 est) beat expectations, driven primarily by strong sales from the firm’s Aerospace unit and deliveries of its flagship Gulfstream plane.

- Aerospace revenue jumped 15% YoY to $1.87B.

- Investors were particularly keen on hearing about whether the FAA would lift the G500/G600 landing restriction by the end of September and management discussed a possible removal by as early as mid-month.

“Demand in the quarter was very strong in Aerospace, with margins showing steady improvement year over year.” CEO Phebe Novakovic said.

Sizing it all up

If you had “inflation,” “supply chain,” and “labor issues” on your buzzword bingo card for this week’s A&D calls, please come forward to collect your winnings.

Here at Payload, we’ve commented on A&D’s outperformance over other industries and indices, and prognosticated that it may stay that way for a while. But A&D players are feeling the heat, ranging from broader macro headwinds to rising interest rates to a tougher stance on consolidation from the Pentagon and the White House.

Now, it’s almost time to turn our attention toward the space SPACs and their financial results…Anyone making money yet?