MDA ($MDA) has been a longtime customer of SatixFy ($SATX). Now, it’s getting a piece of the company.

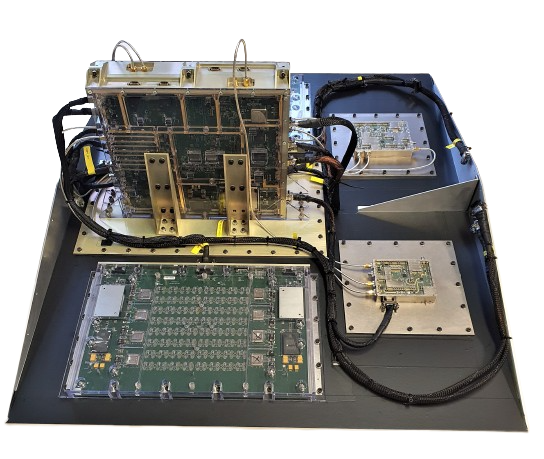

SatixFy, a satellite communications company that is driven by its in-house chipsets, announced on Thursday it will sell its payload division to the Canadian space tech company for $60M.

MDA will pay $40M to buy SatixFy Space Systems, which develops the payload platforms for satellites. The company will also contribute an additional $20M in advanced payments to utilize SatixFy’s flagship chipsets in satellites and ground systems like digital beam-forming antennas and communications networks.

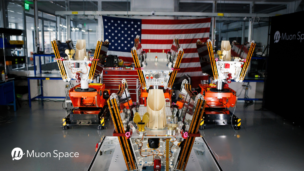

“This acquisition is a natural next step in solidifying and strengthening our market position and addressing customer demand as we continue to capitalize on the growth in the Low Earth Orbit satellite communication market,” MDA CEO Mike Greenley said.

Diving in: SatixFy is offloading its digital satellite payloads division to allow it to go all-in on developing chipsets for payload design companies. The company will work closely with MDA to make chipsets for its payload devices, as well as expand its customer base and scale up its chipset manufacturing.

“We recently took the strategic decision to focus our satellite business on our core competencies of development of groundbreaking chipsets supporting multi-beam digital antennas and on-board processing for the space industry and advanced ground terminals,” Nir Barkan, CEO of SatixFy, said in a statement. “Today’s announcement is an integral part of that strategy and brings SatixFy’s cutting-edge space chipsets into MDA’s digital payloads, representing a strong step forward in the commercialization of our technology.”

The big picture: The global chipset shortage has debilitated industries beyond just space—several promising electric vehicle companies reported low earnings and had to scale back manufacturing as a result of the backlog.

SatixFy’s new strategy could be a sign that the space industry is looking to get ahead of the problem. The company’s decision to say goodbye to its digital payloads department will open the door for it to tap into MDA as a long-term revenue stream while MDA continues to order chips.