A five-year-old agency within the Pentagon founded with a mandate to move quickly is stimulating investments that make the entire small sat industrial base more resilient and scalable, according to half a dozen top industry execs.

While the Pentagon is known for delayed timelines and changing requirements, officials told Payload that the Space Development Agency is setting a new standard for how the government does business—and that the satellite industry is flourishing with the support of a consistent demand schedule and a predictable schedule of contract awards.

“From 2015, where there was basically no existence of true mass production in the industry whatsoever, to now, where you have probably three or four different companies who have made significant investments in production and who can produce at large scales, feed the entire industrial base, and help the government meet goals,” said Dirk Wallinger, the CEO and president of York Space Systems.

Payload spoke with officials at companies working on SDA contracts, including Rocket Lab, Sierra Space, York, Lockheed Martin, Terran Orbital, and L3Harris.

The SDA model: Founded in 2019 with a mission to disrupt the typically slow and cumbersome DoD acquisition process, the office is building a proliferated constellation in LEO to help with comms and missile warning through an iterative series of contracts.

SDA offers a few benefits for industry, including:

- Predictable acquisition cycles with new contracts issued every two years that help companies from primes to suppliers prepare.

- Flexible contract methods, including Other Transaction Authority, that allow the office to better absorb the effects of budgetary anomalies, such as continuing resolutions.

- Set requirements that do not change while working on the program.

“It is absolutely shaping the entire industry,” Paul Wloszek, the general manager of missile defense at L3Harris, told Payload.

The steady stream of contracts also ensures lots of companies have opportunities to win, and frequent chances to compete, unlike more traditional, exquisite space capabilities, which are really seen as “boom or bust” for the space industry, Rocket Lab CEO Peter Beck said. “Everyone tries to survive until the next program.”

Skeptics and true believers: Industry wasn’t always on board with the SDA’s new way of doing business.

“There was some skepticism—not from us—but in the industry about being able to hold the pace,” Wallinger said. “It was absolutely unheard of.”

SDA chief Derek Tournear said he recognized the skepticism, but has seen industry jump on board after a series of contracts followed the agency’s original timeline.

“Most people assumed that we would be the same as what they had seen in a lot of government programs, and that those dates would slip significantly to the right and change drastically from what we originally came out with, but we held that,” he said. “Since we did that, we saw in Tranche 1, people were prepared because they knew what we said we were going to do in Tranche 0, and we went through with it.”

Supply and demand: It’s impossible for the supply chain to ramp up quickly, and officials all acknowledge there have been problems as suppliers were not prepared to meet SDA’s demand for quickly-build sats.

“Most of Tranche 1 is going pretty smoothly, we did see some marketplace immaturity in the Tier 3 providers,” Tourner said, referencing suppliers who make parts for components that are delivered to primes. “I believe now in Tranche 2, we should see all of that stabilized.”

Execs from multiple companies said there are still struggles in the lower tiers of suppliers, but some also noted that they’re seeing improvement, including having multiple vendor options where before they had a single point of failure in their supply chain.

“SDA’s diversified approach for the supply chain…builds resilience across the whole industrial base and really provides capacity for the government,” Beck told Payload. “A healthy, strong industrial base lifts the tide for all government programs and all commercial programs.”

Building up: Several companies are investing their own money to make sure they are competitive for SDA awards and can jump right into production on day one if they win because of the tight delivery timelines required by the agency.

- Sierra Space opened a new dedicated production center for orbital missions.

- York grew from one facility five years ago to four facilities.

- Terran Orbital has invested $300M in its production facilities, including using robotics to automate assembling modules.

- Lockheed opened its new small satellite production center SmallSat Processing Delivery Center last year, dubbed the “speed center,” which will be able to assemble 180 satellites a year at full capacity.

“We really did this to meet the emerging needs for mass production of small satellite networks,” said Adrián Cuadra, the director of the SDA transport layer program at Lockheed.

Though these are examples of investments by specific companies, officials said the entire industry’s ability to ramp up quickly has been bolstered.

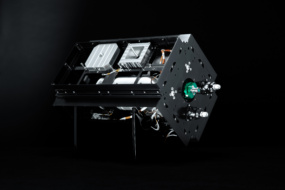

Commercial market: Investments companies are making to meet the DoD demand signal are trickling over to boost commercial prospects as well. Sierra Space unveiled its Eclipse satellite bus line last month—a product line that was made possible at least in part by investments the company made to meet the requirements of SDA, which are shared with plenty of time for industry to prepare, Erik Daehler, Sierra Space’s VP of orbital systems and services, told Payload.

“The timeline is very precise,” Daehler said. “It allows us to plan the pipeline years in advance, and put investments in the right place to plan and prep for them.”

New kids on the block: The new way of doing business is also drawing in new partners. Though major aerospace primes such as Lockheed Martin are competing for and winning SDA contracts, some in the industry predict small, more agile companies will be the winners of the government’s shift to small sats acquired on a more rapid timeline.

“The big primes can’t do it at the price point SDA wants it at,” said Marc Bell, CEO of Terran Orbital. “SDA is really changing how the DoD does business and can stretch taxpayer dollars further.”

On its earnings call last month, RTX COO Chris Calio said the company is planning to shift its space business away from being a prime to become a component supplier. It’s also something Lockheed Space President Robert Lightfoot spoke about at Space Symposium, telling reporters that he’s comfortable with the aerospace giant being a supplier on programs where that role best suits its strengths.

“You’ve seen the traditional primes step up and the emerging new primes and the new way of doing business…stepping in, so it’s almost a role reversal of traditionally how DoD would buy these programs,” Beck said. “I think ultimately, there will be a few primes that bubble to the top that really execute, and I would say my money would be on those primes not being the ones that you would traditionally see.”