Sierra Space raked in a $290M Series B funding round at a $5.3B valuation, the company announced yesterday.

That brings the company’s total fundraise to $1.7B across two funding rounds.

Japanese investors MUFG Bank, Kanematsu, and Tokio Marine led the round, highlighting the company’s growing relationship with Japan. Sierra Space is also considering selecting Japan’s Oita Airport as a landing site option for its spaceplane.

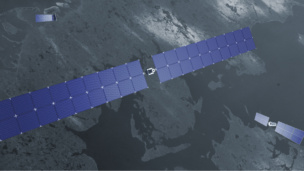

Chasing a launch date: After years of development, the Broomfield, CO-based company is preparing to launch its Dream Chaser spaceplane aboard the second flight for ULA’s Vulcan rocket, which is slated for Q1 of next year.

The spaceplane will initially resupply the ISS, but Sierra hopes to expand to transporting crew and national security payloads to orbit.

- The Dream Chaser, which resembles a baby space shuttle, is 30 ft long and can transport ~5,500 kg to the ISS.

- While the spacecraft will launch vertically atop a rocket, it will touch down back on Earth in a low-g horizontal runway landing.

With Dream Chaser R&D largely complete, the company will use the funding to accelerate its other product lines, including space systems products and building a commercial space station.

Space station: Sierra performed a burst test on its inflatable space LIFE habitat last week. The habitat, crafted with a specialized fabric weave, is engineered for easy transportation to space. Once in orbit, it can be inflated to provide multiple floors of living and working spaces.

- The company has partnered with Blue Origin to deploy the inflatable habitat in the joint construction of Orbital Reef, a commercial LEO space station.

Payload’s take: Sierra’s funding announcement, coupled with Axiom’s $350M Series C last month, is a good sign for the space ecosystem as it indicates that the largest space enterprises maintain access to institutional money—albeit at a lower dollar amount.

The investment inflow comes as the space capital markets have undergone a mini recalibration period after the easy money and SPAC-bonanza financial environment of a couple years ago.