The company building the next American space plane is preparing to go public, despite recently-listed space firms facing rough waters.

Sierra Space Corporation CEO Tom Vice told Bloomberg that the pure-play space company is waiting for better market conditions to move forward with its bullish plan for an initial public offering.

Background: Sierra Space has raised $1.7B in new capital since being spun out of privately-held Sierra Nevada Corp., in 2021, armed with a new executive team led by 30-year Northrop Grumman veteran Vice.

- Sierra’s investors value it at more than $5B, but whether retail investors will agree is anyone’s guess.

- Vice also suggested the company might seek to acquire other firms to round out its offerings.

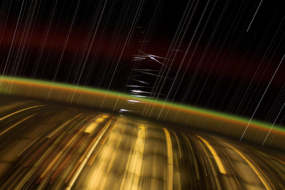

NASA is paying Sierra $1.1B to build and fly Dream Chaser, a spaceplane similar to the space shuttle, on cargo flights to the ISS and back to Earth. The vehicle is expected to make its first trip to orbit on the second launch of ULA’s Vulcan rocket this year before flying back through the atmosphere to land on a runway.

After its six flights for NASA, it’s not clear what destination it will service when the ISS retires, but the company says it will adapt the vehicle for crewed research missions.

The company is also building inflatable space habitats for Blue Origin’s Orbital Reef space station project, despite rumors of discord last year, and won a $740M contract from the Space Development Agency to design and build a network of missile defense satellites.

Pub Trivia: The company that originated Sierra’s commercial space business, SpaceDev, built the engines for SpaceShipOne, the privately built rocketplane that won the X Prize and catalyzed the “new space” era. After being acquired by Sierra Nevada in 2008, the company built the first edition of Dream Chaser to compete for NASA’s initial commercial cargo contracts, but lost out to SpaceX’s Dragon and Northrop’s Cygnus.