TV…Did Not Kill the Radio Star?

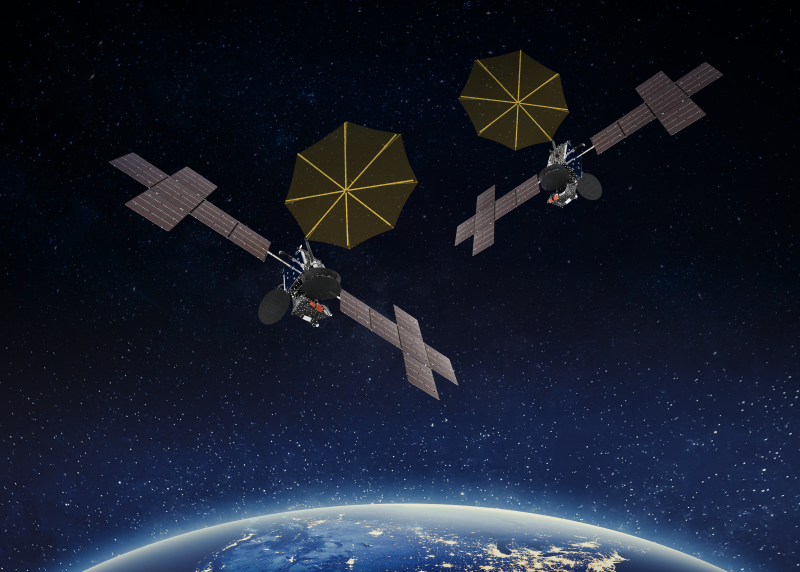

SiriusXM ($SIRI) announced Tuesday that it has commissioned Maxar ($MAXR) to build SXM-11 and SXM-12, two new geostationary satellites.

The deal doubles the number of SiriusXM satellites in the pipeline. Last year, the American broadcaster ordered SXM-9 and -10 from Maxar. As a matter of fact, these two go way back…Maxar has been building SiriusXM’s satellites for two-plus decades.

- SXM-11 and -12 will be the 12th and 13th satellites that Maxar builds for SiriusXM.

- The twin spacecraft will be “high-powered digital audio” radio satellites, built on Maxar’s 1300-class bus in Palo Alto and San Jose.

That’s a lot of TAM

In a press release, SiriusXM noted that 150M+ cars on the road are equipped to receive its satellite-delivered audio entertainment services. But compatibility ≠ paying customers. SiriusXM has ~34M subscribers.

SiriusXM offers blended distribution, in that it serves customers both through 1) GEO satellites and 2) streaming rails (SiriusXM owns Pandora). While #1 is more expensive, it’s also the primary business. Last year, SiriusXM made up 76% of the company’s revenue (with Pandora kicking in the rest).

Writing on the wall…

In a Q3 call with analysts, $SIRI CFO Sean Sullivan braced investors for a capex ramp to buy SXM-11 and -12. The company reported $2.28B in Q3 revenue.

Payload takeaway: GEO satellites are complex, costly, and time-consuming endeavors, which in part is driving a migration to LEO. But they’re still effective for use cases like broadcasting. SiriusXM clearly sees value in GEO—after all, it’s the reason Americans can get radio nationwide in their cars.