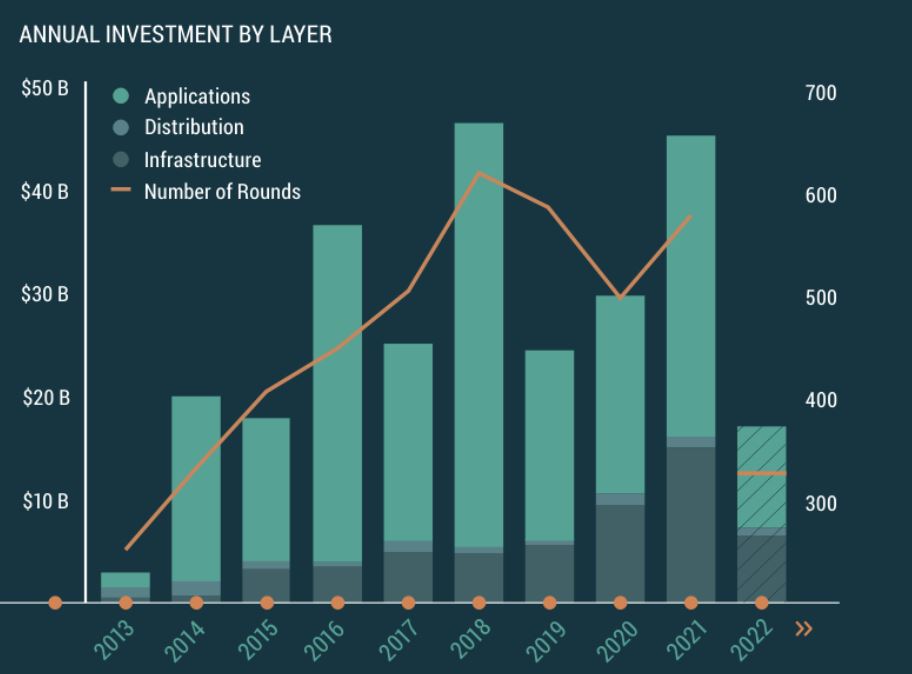

Space Capital has released its quarterly report on investment in the space industry. In the third quarter of 2022, investors injected $3.4B into 79 individual space companies, broadly defined across infrastructure, distribution, and applications.

Infrastructure

It comes as no surprise that SpaceX takes the cake in capital raised over Q3 with its $1.9B Series R. Over the past decade, the industry leader in launch has accounted for 38% of investment into launch.

In total, investors put $2.5B into space infrastructure companies last quarter, a significant decrease from the wild highs in 2021 investment.

Emerging industries: Though the launch sector represented far and away the largest piece of the pie last quarter, the analysts made a point to highlight the smaller players in the game. This subset excludes the launch and satellite industries, and has represented $3.1B of $54.8B of total investment into infrastructure since 2013. Most of this has been concentrated in stations, logistics, and lunar infrastructure.

2021 saw a spike in emerging industry investment at $1.4B (45% of the total amount ever invested in the sector), but the trend didn’t continue in 2022. So far this year, emerging industries investment is essentially on par with 2020 numbers.

Distribution

The distribution investment area covers “hardware and software to connect, manage, and process data from space-based assets.” Of the three areas, it’s seen the least investment since 2013 at $8.3B. In Q3, investors dedicated $44M across five rounds.

ATLAS Space Operations’ $26M Series B accounted for 59% of the dollars flowing into distribution last quarter. Sofant Technologies’ $2M seed and Fixposition’s $1M round joined ATLAS at the top of the list.

Applications

The third area of space investment is far and away the largest, as it covers the broadest swath of companies—namely, any startup building a hardware or software product utilizing space data. Since 2013, investors have funneled $204.5B into companies building space applications. This quarter, though, it saw a serious decline in investor dollars, down 74% QoQ at ~850M invested across 43 rounds.

53% of Q3 investment into the space sector overall flowed into position, navigation, and timing (PNT) services. Since 2013, companies in the PNT sector have accounted for 74% of the applications funding rounds.

An opportunity emerges: EO. Though the sector accounted for far less of the investing share last quarter than PNT, the discrepancy only points to a higher level of opportunity. As the analysts wrote, “Earth Observation has the largest difference in rounds vs. capital (24% vs. 4%), indicating early-stage activity and strong potential for innovation.”

The upshot: The macro environment continued to disproportionately affect the space investing landscape in Q3, and Space Capital expects that to continue. Investment in space overall dropped 44% last quarter, compared to the overall market decrease of 31%.

Still, the space industry is resilient due the counter-cyclical nature of government programs (and aerospace’s close association with defense). Plus, Space Capital highlighted, a number of high-profile household names (AT&T and Apple) have their sights set on adopting space technology.