(Ed. note: This is Payload Research analysis. You can sign up for our Research newsletter here.)

With Starliner slated to transport crew to the ISS for the first time next week, we’re digging into all the money spent to get here—from NASA’s contributions and seat pricing to the total development expenditures.

A quick trip down history lane: Following the shuttle’s retirement in 2011, NASA found itself solely reliant on Russian Soyuz capsules to transport astronauts to the ISS. Instead of the agency designing another crewed vehicle to replace the shuttle and then hiring aerospace contractors to build it, NASA decided to hand over most of the reins to the commercial sector under a new Commercial Crew Program.

Contract History

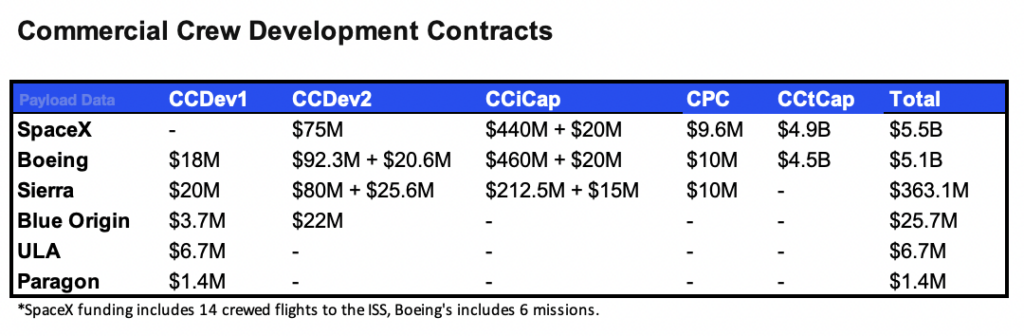

Funding: Over nearly 15 years, NASA has awarded over $11B in contracts to commercial crew development initiatives over five funding rounds.

- Over the years, Boeing’s Starliner and SpaceX’s Crew Dragon pulled ahead of other commercial crew contenders, securing the lion’s share of those dollars to finish development on a crew-certified spacecraft.

- Boeing is the only company to be awarded funding from all five CCP funding rounds.

The CCP contracts are awarded on a fixed price basis, resulting in significant savings for NASA compared to the traditional cost-plus contracts of earlier space programs.

Commercial Crew Transportation Capability (CCtCap): The majority of the program’s funding came from a large CCtCap contract, which NASA awarded in 2014 to finance the final development of the spacecraft and six crewed flights.

- Boeing initially received $4.2B

- SpaceX initially received $2.6B

At that time, officials generally viewed Boeing’s proposal as the more dependable option and regarded SpaceX’s method as experimental.

Dragon vs. Starliner: The CCtCap contract required each company to fly two test flights to the ISS—one uncrewed and one crewed—to verify the fully integrated spacecraft and rocket system, plus all its operating systems.

At the time the CCtCap contract was awarded in 2014, Starliner and Dragon were both expected to be certified as soon as 2017—but both programs faced technological and operational challenges that delayed their first launch and increased development costs.

Dragon takes the lead: Up until 2019, SpaceX and Boeing were developing their spacecraft at a similar rate. Then in December 2019, Starliner faced a major setback when its uncrewed flight test failed due to a critical software error.

- This failure required a second uncrewed flight to be performed in May 2022, causing a multi-year delay to the program.

- Valve issues, flammable tape, and parachutes further pushed the crewed flight test back.

SpaceX ended up completing its first crewed flight test three years late in 2020 and has since completed eight missions. Starliner, on the other hand, plans to launch its first crewed flight test next week, seven years after the initial plan.

+ CCtCap increases: Boeing’s CCtCap contract increased slightly to $4.5B in 2019. SpaceX’s CCtCap contract increased more significantly to $4.9B in 2022, thanks to two contract extensions that added an extra eight crewed flight missions.

R&D Costs

- Starliner: $4.8B

- NASA contributed $3.3B to the development (per 2021 inflation-adjusted Planetary Society calc).

- Boeing paid $1.5B of out-of-pocket expenses due to cost overruns.

- Crew Dragon: $3B+

- NASA contributed $2.6B to the development (per 2021 inflation-adjusted Planetary Society calc).

- SpaceX invested hundreds of millions of dollars of its own money to build Cargo Dragon and Crew Dragon. While exact figures were not disclosed, the out-of-pocket expenses are likely north of $500M.

Compared to Orion: Although Starliner’s development cost was higher than Crew Dragon’s, relatively speaking, the project was still completed at a very low cost. Both Starliner and Crew Dragon’s development costs were sub-$5B, which compares favorably to historical crew-rated spacecraft costs and to Orion, the only other operational crewed spacecraft in the US.

Orion—which is larger than Dragon and Starliner and is deep space rated—had a development cost of $23B.

Per Seat Cost

In the 2010s, NASA relied heavily on Russia’s Soyuz to send astronauts to the ISS. In recent years, the cost per seat on Soyuz has risen to as high as $86M.

Dragon and Starliner seat cost: In 2019, NASA’s inspector general pegged Crew Dragon’s cost per seat at $55M and Starliner’s cost per seat at $90M.

Crew Dragon’s cost per seat has risen with its two contract extensions.

- The cost per seat for SpaceX’s Crew-7 through Crew-9 contract extension increased to $65M.

- For SpaceX’s Crew-10 through Crew-14 extension, the cost per seat increased once again to $72M.

The hikes can be attributed to inflation and the company’s increased leverage.

What’s next for Starliner? Outgoing Boeing CEO Dave Calhoun asserts the company remains committed to the Starliner program, although there is no defined plan for the spacecraft after its six flight NASA contract obligation. With the Atlas V (Starliner’s launch vehicle) retiring and Boeing laser-focused on resolving safety and cost overruns in its other business lines, the long-term future of Starliner is up in the air. But in the short-term, Starliner brings needed capacity and competition to NASA’s crewed spaceflight program.

(Argyris Kriezis contributed research to the article).