India is on the verge of approving SpaceX’s Starlink service, paving the way for the launch—or, dare we say, broadband—giant to bring satellite internet to a nation of 1.4B people.

Officials are set to meet as early as this month to approve Starlink’s satellite license for use in India, according to two reports from the Times of India and Financial Express. If approved, Starlink would join OneWeb and Jio Satellite in beaming down internet to India.

Starlink & India: SpaceX began selling pre-orders of Dishy McFlatface Starlink terminals in late 2021, quickly reaching 5,000 sign-ups before the Indian government scolded the company for doing business in the country pre-license. SpaceX conceded, issued refunds, and submitted a formal license proposal in late 2022.

A year later, India is set to approve Starlink, setting up a win-win for SpaceX and the nation’s large, underserved community.

40% without internet: Despite rapid growth, India remains a developing country, with a staggering ~40% of its population without internet access, often due to poor fiber broadband coverage. Even those who do have internet access are subject to shutdowns—sometimes imposed by the Indian government for political reasons, such as to prevent people from criticizing the government or organizing protests.

Payload Insights:

With 500M+ people lacking accessible internet, India represents a massive opportunity for SpaceX. Sanjay Bhargava, a former Starlink executive, said in 2021 that the company was aiming to sell 200,000 terminals in India within its first nine months of operations.

ICRA credit rating firm estimates India’s overall satellite internet user base could hit 2M (.1% of the population) users by 2025, representing a billion-dollar market. But Starlink’s high cost poses a headwind. While exact monthly pricing is unknown, SpaceX often sells Starlink subscriptions to developing countries (such as the Philippines or Malaysia) for ~$45 a month. At that level, the price point is high for a nation that pays ~$10/mo for fiber broadband.

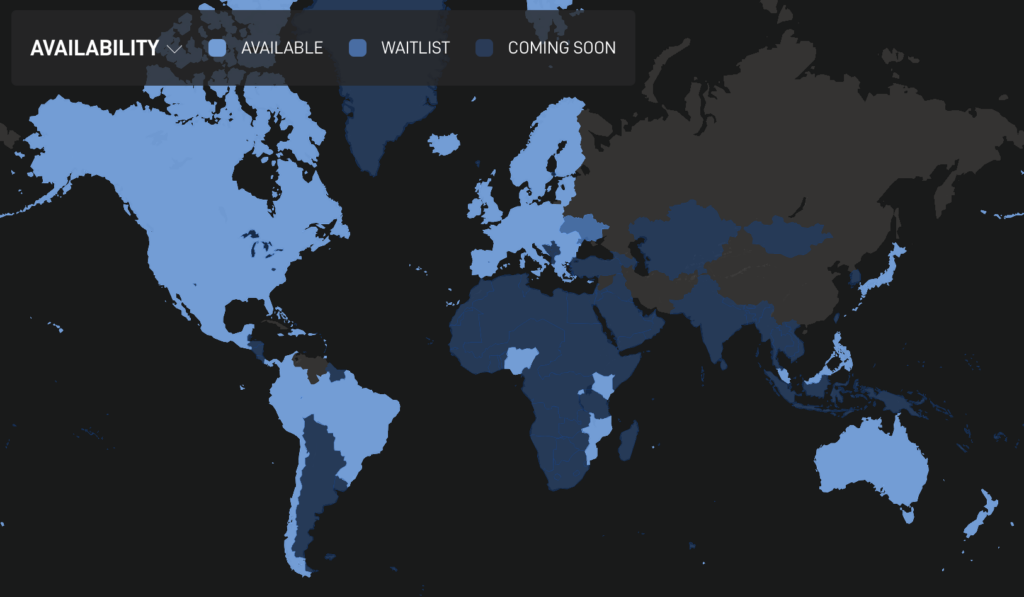

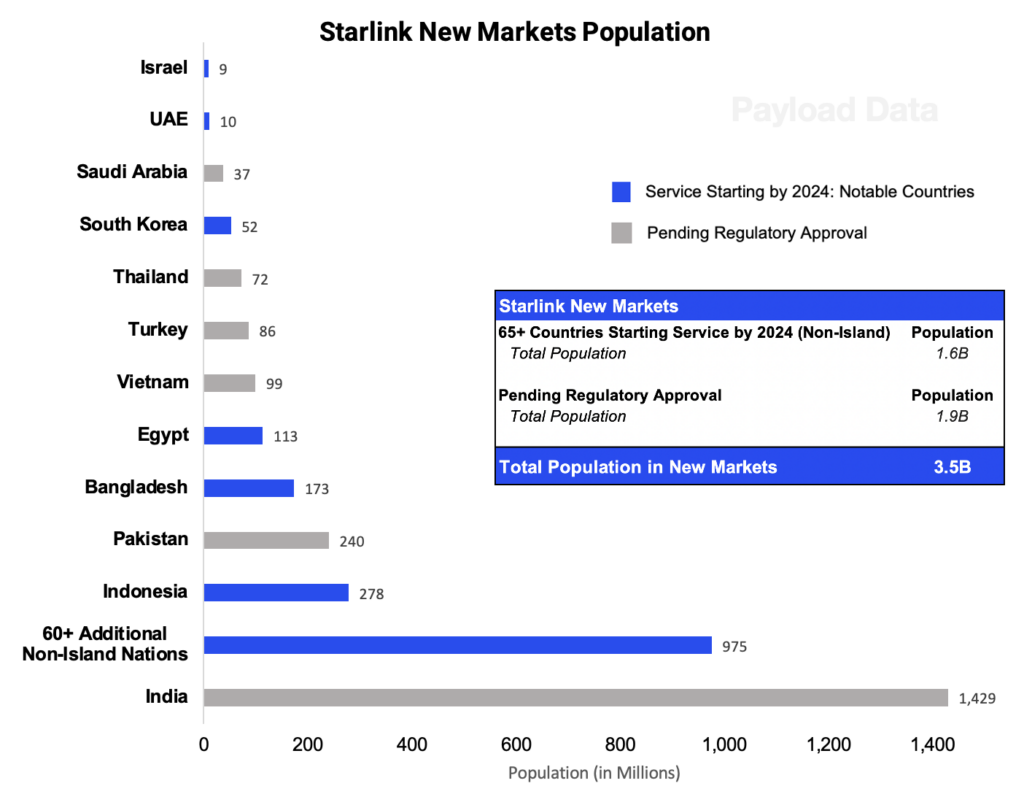

New market opportunity: In the next couple of years, the service is set to expand availability to an additional 3.5B people.

- The service is approved and expected to go live in 60+ additional countries by the end of 2024—covering 1.6B people

- Including India, SpaceX has pending regulatory approval in six nations—a population totaling 1.9B.

The opportunity in front of Starlink is huge. Albeit, these new markets are largely developing countries, where affordability may limit market penetration.

Cash-cow: The SpaceX/Starlink business model is as follows:

- SpaceX launches customer payloads, generating profits

- Those profits are then used to pay for Starlink-dedicated SpaceX launches

- SpaceX generates recurring revenue through Starlink subscriptions

Starlink hit 2M subs in September, doubling its base in the last nine months. In January, Payload estimated Starlink would hit 2.5M users and $5B+ revenue this year. SpaceX’s high revenue generating internet service—which started just a few years ago—is poised to surpass launch in revenue.

Tapping into new markets with a combined population of 3.5B, coupled with riding the wave of continued adoption trends, will provide key support for Starlink’s growth trajectory in 2024 and beyond.